- Analytics

- News and Tools

- Market News

- EUR/GBP catches a bid to 0.8585, but UK data, ECB loom ahead

EUR/GBP catches a bid to 0.8585, but UK data, ECB loom ahead

- The EUR/GBP sees recovery from early Monday’s slide, but progress remains limited.

- UK wages, unemployment data to pluck away at the GBP for the early week.

- ECB rate call on the cards will cap the week off with volatility if comments or actions surprise.

The EUR/GBP pairing continues to look for a foothold on the charts, but this week brings key United Kingdom (UK) data and a critical rate call from the European Central Bank (ECB). Showings for both currencies threaten to keep the EUR/GBP pair hamstrung as sentiment drifts back and forth between the two.

UK data coming into view, ECB rate call ahead

The UK faces wage growth, unemployment, and industrial activity figures for the first half of the trading week. Wage figures, while slowly declining, remain elevated. The UK’s Chancellor of the Exchequer Jeremy Hunt noted over the weekend that the Bank of England (BoE) is facing stickier inflation than they previously forecast.

Stubborn inflation issues are partly driven by elevated wage growth, and if figures remain too high for too long it could mire the BoE, making an outright dovish or hawkish stance difficult to maintain.

On the Euro side of the data calendar, the ECB is slated to publish its latest rate call during Thursday’s market session. Market participants are increasingly convinced that the rate hike cycle has peaked in Europe, despite hawkish jawboning from ECB officials recently.

Market forecasts broadly anticipate the ECB to stand pat on rates for September’s meeting, though any nasty surprises from the ECB could throw markets for a loop.

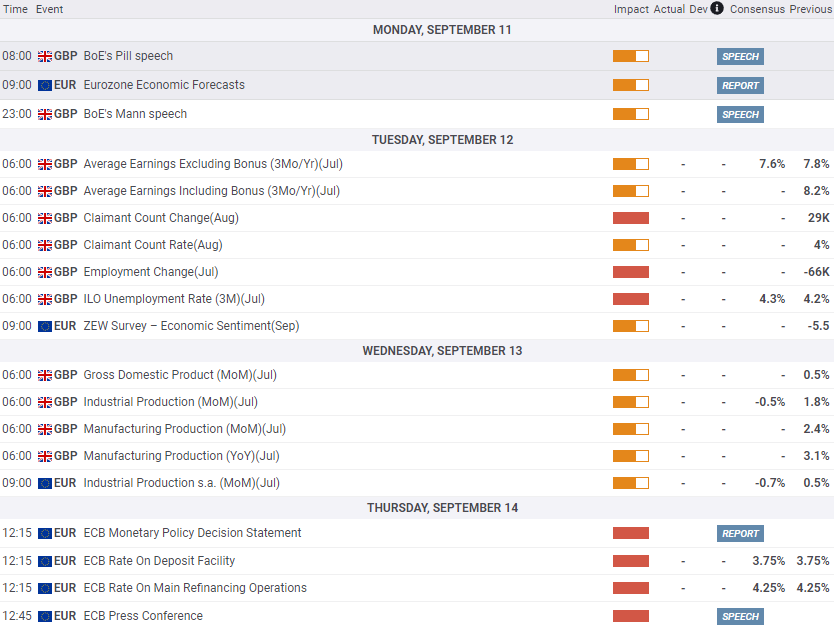

UK-EU economic calendar, Monday through Thursday. All times GMT.

EUR/GBP technical outlook

The Euro (EUR) is looking for a leg up against the Pound Sterling (GBP) in the markets today, trading into a session high of 0.8587. The pair started the trading week on a decidedly softer tone, with the Euro declining to 0.8558 before facing a rally on the back of a waffling GBP.

Longer-term, the pair is looking decidedly constrained, with the EUR/GBP trading into familiar territory for the past three months. The pair refuses to decline any further, marking its territory above the 0.8500 handle, but resistance from a declining 50-day EMA at 0.8585 is capping upside momentum.

EUR/GBP daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.