- Analytics

- News and Tools

- Market News

- EUR/GBP looking for a run above 0.8560 to close out Friday, UK data in the pipe for next week

EUR/GBP looking for a run above 0.8560 to close out Friday, UK data in the pipe for next week

- The EUR has moved higher on the week against the GBP as ther BoE turns dovish.

- Soft data for the Eurozone caps upside capacity.

- It's the Pound Sterling's ballgame to lose with data-heavy calendar due next week.

The EUR/GBP pair has moved higher for the week, with the Euro (EUR) gaining some ground against the Pound Sterling (GBP). A dovish Bank of England (BoE) has struck the GBP with bearish undertones, and despite beleaguered economic data for the broader European Union (EU) region, the Euro is the tug-of-war winner for this week.

The EUR started the week on the low end after Purchasing Manager Index (PMI) figures for the EU showed economic sentiment is declining for the continent. Later, Eurostat sales figures showed the retail space contracted by -1%, further capping upside potential for the Euro.

BoE hits dovish notes

On the United Kingdom (UK) side, the BoE’s Governor Andrew Bailey and members of the BoE’s Monetary Policy Committee (MPC) testified before the UK Parliament, speaking about inflation expectations and the overall economy.

Governor Bailey and his fellow MPC members struck a decidedly dovish tone, stating that the rate hike cycle for the BoE could very well be at the top, as well as expressing concerns that too much more action from the UK’s central bank could worsen the odds of achieving a “soft landing” for the domestic economy.

The softening stance from the BoE sent the GBP broadly lower for the week.

Next week: data-heavy UK

The economic calendar for the first half of next week is notably GBP-heavy, with very little meaningful releases from the EU side.

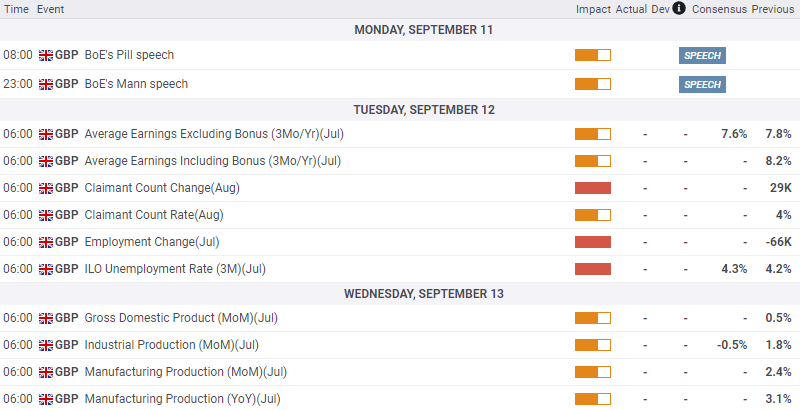

Monday sees appearances from the BoE’s chief economist Huw Pill and MPC member Catherine L. Mann. Tuesday brings UK unemployment figures and wages data, and Wednesday will bring UK manufacturing and Gross Domestic Product (GDP) data.

Wage growth, unemployment, and industrial data are all anticipated to slightly worsen.

UK economic calendar schedule, Monday - Wednesday. All times in GMT.

EUR/GBP technical outlook

The Euro-Pound pair has consolidated since June, cycling in a rough range between 0.8660 and 0.8520. A high-side resistance zone sits above, between 0.8740 and 0.8720, while any significant downside breaks could see the floor give way beneath the 0.8500 major handle.

A break below 0.8500 would see the Euro trading into 13-month lows against the Sterling.

EUR/GBP Daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.