- Analytics

- News and Tools

- Market News

- GBP/JPY Price Analysis: Retreats from around 186.00, on risk-off, Japanese authorities intervention

GBP/JPY Price Analysis: Retreats from around 186.00, on risk-off, Japanese authorities intervention

- GBP/JPY trades lower at 184.70, down 0.56%, amid a risk-off environment and potential intervention threats from Japanese authorities.

- The pair shows signs of sideways trading on the daily chart, with a critical support level of 183.35.

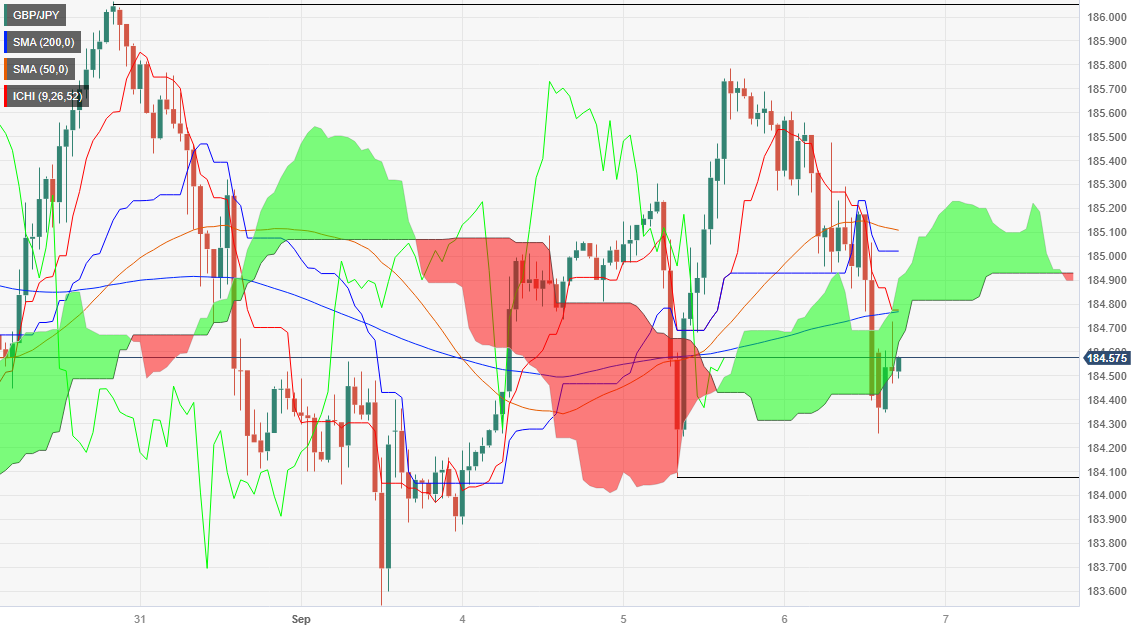

- Intraday technicals suggest bearish momentum, as the pair has broken below the Ichimoku Cloud (Kumo).

The Pound Sterling (GBP) losses steam against the Japanese Yen (JPY) after threats of a possible intervention by Japanese authorities. Also, a report from yesterday portraying a global economic slowdown triggered a risk-off impulse, favoring the Yen’s safe-haven status. The GBP/JPY is trading at 184.70, down 0.56%, after hitting a daily high of 185.62.

GBP/JPY Price Analysis: Technical outlook

The daily chart depicts the cross as upward biased, but of late, the GBP/JPY has printed a successive series of lower highs but failed to print lower lows. Hence, the pair is trading sideways, at the brisk of breaking support formed during the last three weeks at around 183.35. If buyers reclaim last week’s high of 186.06, expect a retest of the year-to-date (YTD) high of 186.76. Conversely, a drop towards the top of the Ichimoku Cloud (Kumo), at around 179.96, is possible.

On an intraday basis, the GBP/JPY has broken below the Kumo, turning bearish, but its fall was cushioned by the S1 daily pivot point at 184.48. Once cleared, the next support would be the September 5 daily low of 184.07, followed by the September 1 swing low of 183.53. Conversely, if the pair breaks above the Tenkan-Sen at 184.76 and climbs above the Kumo, that could expose the daily pivot at 185.15.

GBP/JPY Price Action – Hourly chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.