- Analytics

- News and Tools

- Market News

- USD Index regains composure near 104.30 ahead of data

USD Index regains composure near 104.30 ahead of data

- The index resumes the upside and revisits 104.30.

- US markets return to the activity following Monday holiday.

- Factory Orders will be in the limelight later in the NA session.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main rival currencies, manages to pick up some pace and reclaim the 104.30 region on Tuesday.

USD Index retargets the 104.50 zone

The index leaves behind Monday’s small pullback and flirts with the 104.30 region on turnaround Tuesday amidst a mild improvement in the risk-off sentiment.

As US markets return to the normal activity following Monday’s Labor Day holiday, investors continue to assess the increasing likelihood that the Federal Reserve might start cutting rates around Q2 2024.

This view seems to be behind the drop in US yields across different maturities sparked in the latter part of August.

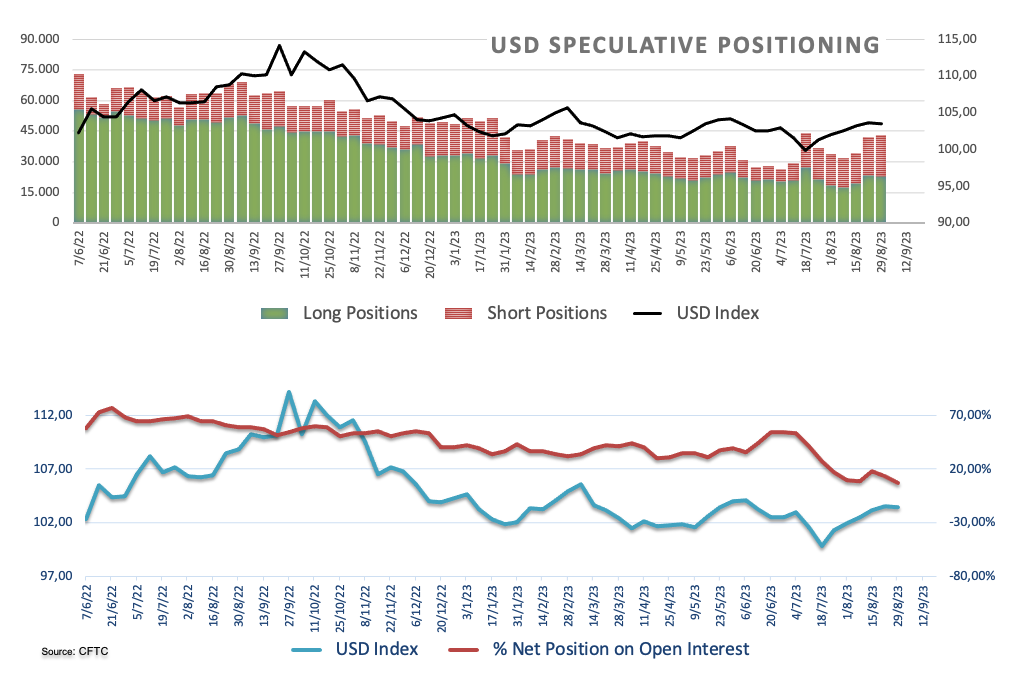

In addition, from the speculative community, net longs in USD dropped to three-week lows during the week ended on August 29 according to CFTC. During that period, the index climbed to fresh multi-week tops near 104.50 on the back of further evidence of the resilience surrounding the US economy.

Data-wise in the US docket, Factory Orders will be the only scheduled release on Tuesday.

What to look for around USD

The recent strong recovery in the index seems to have met some initial up barrier near the 104.50 region so far.

In the meantime, support for the dollar keeps coming from the good health of the US economy, which seems to have reignited the narrative around the tighter-for-longer stance from the Federal Reserve.

Running on the opposite side of the road, the idea that the dollar could face headwinds in response to the data-dependent stance from the Fed against the current backdrop of persistent disinflation and cooling of the labour market appears to have regained some traction as of late.

Key events in the US this week: Factory Orders (Tuesday) – MBA Mortgage Applications, Balance of Trade, Final S&P Global Services PMI, ISM Services PMI, Fed Beige Book (Wednesday) – Initial Jobless Claims (Thursday) – Wholesale Inventories, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Persistent debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in H1 2024. Geopolitical effervescence vs. Russia and China.

USD Index relevant levels

Now, the index is gaining 0.29% at 104.40 and the next hurdle comes at 104.44 (monthly high August 25) ahead of 104.69 (monthly high May 31) and finally 105.88 (2023 high March 8). On the flip side, the breach of 103.03 (200-day SMA) would open the door to 102.93 (weekly low August 30) and then 102.46 (55-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.