- Analytics

- News and Tools

- Market News

- AUD/USD rebounds ahead of RBA’s decision, as Wall Street pauses on Labor Day

AUD/USD rebounds ahead of RBA’s decision, as Wall Street pauses on Labor Day

- AUD/USD pair recovers to 0.6460s, up 0.26%, as investors anticipate the Reserve Bank of Australia’s upcoming monetary policy decision.

- Mixed US jobs data and a closed Wall Street for Labor Day contribute to a softer US Dollar, with Fed rate hike probabilities for September holding at 92%.

- Positive news from China’s property market and hawkish remarks from Cleveland’s Fed President Loretta Mester add complexity to the currency landscape.

The Australian Dollar (AUD) pared some of its last Friday’s losses against the US Dollar (USD) ahead of the upcoming Reserve Bank of Australia’s (RBA) monetary policy decision amid a risk-on impulse. The pair reversed its course after reaching a daily low of 0.6440 and is trading at around 0.6460s, above its opening price by 0.26%.

Risk-on sentiment and mixedUS jobs data fuel Aussie Dollar’s recovery; eyes on upcoming RBA monetary policy

Wall Street remains closed in the observance of the Labor Day. Last week’s jobs data from the United States (US) was mixed with Nonfarm Payrolls coming at 187K above estimates of 177K in August, which failed to underpin the Greenback, as the Unemployment Rate ticked higher as estimates. Later, the Institute for Supply Management (ISM) revealed that business activity in the US, as shown by the manufacturing PMI, came at 47.6 figures versus analysts’ estimation of 47.0 versus 46.4 previous readings.

Consequently, investors slashed their bets about the US Federal Reserve continuing to tighten monetary policy. Interest rate probabilities for the September meeting remain at 92%, with the first-rate cut seen on May 1. On that date, traders foresee rates at around 5.14%, 19 basis points below the effective Federal Funds Rate (FFR) of 5.33%.

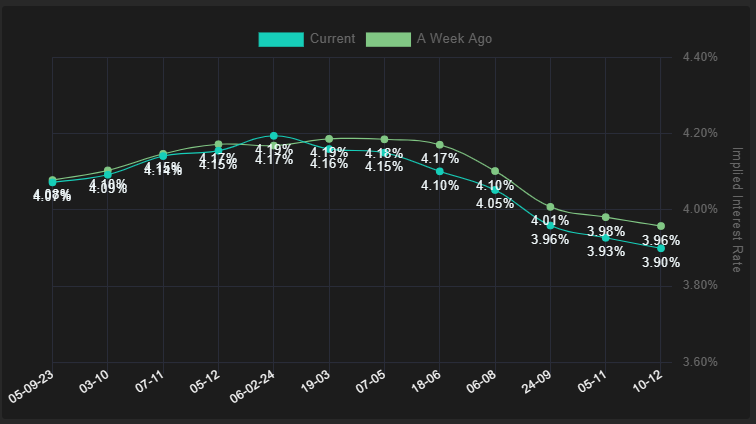

In the meantime, the Australian Dollar was bolstered ahead of the RBA’s decision, with the cash rate expected to stay unchanged at 4.10%. Yet, traders are not foreseeing any additional hikes until early February 2024, though with a slim chance for a nine-bps rate hike, as shown in the bottom picture.

RBA’s Interest Rates Expectations

Source: Financialsource

In addition, news from China improved investors’ sentiment as the country established measures to boost its property market, which is at the brisk of a crisis. As the Government easied measures, home sales rose, as reported by Bloomberg.

In the central bank action, Cleveland’s Fed President Loretta Mester states that the Unemployment Rate remains low, and she still sees the jobs market as quite strong. However, the policymaker remains hawkish and has seen higher rates for longer.

AUD/USD Price Analysis: Technical outlook

The AUD/USD remains downward biased, yet so far, unable to extend its losses below the August 17 daily low at 0.6364, the current year’s low, which would warrant further losses. Intermediate support levels emerge at November 22 and October 21 lows, each at 0.6272 and 0.6210, before the pair challenges a much more important support level at the October 13 swing low at 0.6169. Conversely, upside risks emerge if the pair cracks the 0.6500 mark.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.