- Analytics

- News and Tools

- Market News

- Euro extends the recovery north of 1.0900 on a weaker Dollar

Euro extends the recovery north of 1.0900 on a weaker Dollar

- Euro looks to consolidate the move past 1.0900 vs. the US Dollar.

- Stocks in Europe extend the positive start of the week.

- EUR/USD briefly climbs to four-day highs around 1.0930.

- The USD Index (DXY) puts the 103.00 region to the test.

- EMU Current Account surplus widens in June.

- Fedspeak and housing data will be next on tap in the US.

The Euro (EUR) adds to Monday’s decent rebound against the US Dollar (USD) and lifts EUR/USD to the area of multi-session peaks around 1.0930, a region also coincident with the temporary 100-day SMA on Tuesday.

The extra recovery in the pair comes pari passu with a further loss of momentum in the Greenback, which prompts the USD Index (DXY) to surrender further ground and opens the door to a potential visit to the 103.00 neighbourhood sooner rather than later.

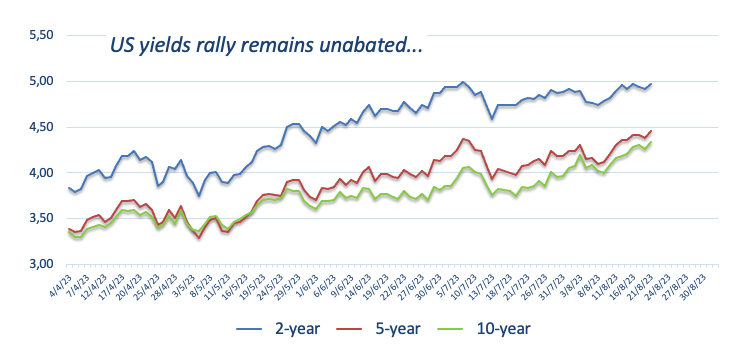

The Dollar’s pullback comes amidst the so far small correction in US yields across different maturities. On this, the short end of the curve continues to flirt with the 5.0% threshold, while the 10-year benchmark hovers around levels last seen in November 2007 past the 4.30% yardstick.

Taking a broader view of monetary policy, there has been a resurgence in the discussion surrounding the Federal Reserve's commitment to maintaining a more restrictive policy for an extended period. This renewed focus is a response to the US economy's resilience, even in the face of a slight easing in the labour market and lower inflation readings in recent months.

Within the European Central Bank (ECB), internal disagreements among its Council members regarding the continuation of tightening measures after the summer period have emerged. These disagreements are contributing to renewed weakness that is negatively impacting the Euro.

Looking ahead, market participants are anticipated to adopt a cautious stance in light of the upcoming Jackson Hole Symposium and the speech by Chairman Jerome Powell in the latter half of the week.

In the domestic calendar, the Current Account surplus in the broader euro area widened to a seasonally adjusted €35.84B in June.

In the US docket, July’s Existing Home Sales are due along with the regional manufacturing gauge by the Richmond Fed and speeches by Richmond Fed Thomas Barkin (2024 voter, centrist), FOMC Governor Michelle Bowman (permanent voter, centrist), and Chicago Fed Austan Goolsbee (voter, centrist).

Daily digest market movers: Euro surpasses 1.0900 to print new weekly highs

-

The EUR gathers steam vs. USD and trespasses 1.0900.

- The improvement in the risk appetite weighs on the US Dollar.

- US 10-year yields reach multi-year highs beyond 4.30%

- Markets’ attention remains on the Jackson Hole gathering.

- Fed’s tighter-for-longer narrative keeps hovering around investors.

- The Fed is likely to maintain rates unchanged until Q1 2024.

Technical Analysis: Euro now looks at 1.0960

EUR/USD extends Monday’s decent advance and reaches new multi-day peaks around 1.0930.

In case the recovery picks up a more serious impulse, EUR/USD is expected to meet an interim barrier at the 55-day SMA at 1.0961 prior to the psychological 1.1000 the figure and the August high at 1.1064 (August 10). Once the latter is cleared, spot could challenge the weekly top at 1.1149 (July 27). If the pair surpasses this region, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 (July 18). Further up comes the 2022 high at 1.1495 (February 10), which is closely followed by the round level of 1.1500.

In case bears regain the upper hand, the pair could retest the August low of 1.0844 (August 18) ahead of the July low of 1.0833 (July 6). The breakdown of the latter exposes the significant 200-day SMA at 1.0795 ahead of the May low of 1.0635 (May 31). Deeper down, there are additional support levels at the March low of 1.0516 (March 15) and the 2023 low at 1.0481 (January 6).

Furthermore, the positive outlook for EUR/USD remains valid as long as it remains above the important 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.