- Analytics

- News and Tools

- Market News

- USD Index comes under pressure around 103.30, attention remains on Jackson Hole

USD Index comes under pressure around 103.30, attention remains on Jackson Hole

- The index extends the corrective move to 103.30.

- US yields kicks off the week in a positive tone.

- Markets’ attention will be on the Jackson Hole event.

The greenback extends the bearish note into the beginning of the new trading week and drags the USD Index (DXY) to the 103.30 zone.

USD Index focused on Jackson Hole, Powell

The index continues to correct lower following last week’s fresh monthly peaks near 103.70 (August 18) amidst the generalized improvement in the risk-associated universe.

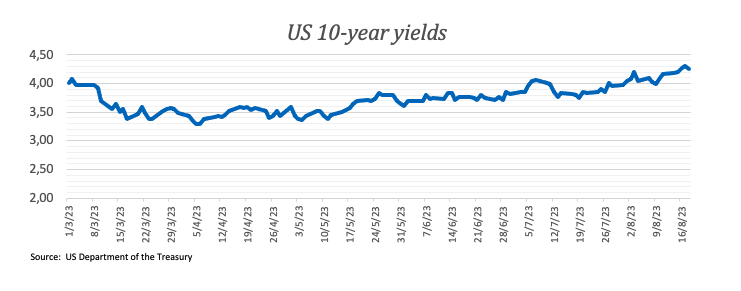

The dollar, in the meantime, seems to have met an initial decent resistance near 103.70 against the backdrop of the relentless march north in US yields across the curve as well as increasing speculation that the Federal Reserve might keep the tighter-for-longer stance for an extended period.

There will be no data releases in the US docket on Monday, while market participants are expected to remain focused on the Jackson Hole Symposium as well as Chief Powell comments due in the second half of the week.

What to look for around USD

The index appears to have entered in a consolidative phase below recent multi-week highs around 103.70.

Extra support for the dollar also comes from the good health of the US economy, which seems to have reignited the narrative around the tighter-for-longer stance from the Federal Reserve.

Furthermore, the idea that the dollar could face headwinds in response to the data-dependent stance from the Fed against the current backdrop of persistent disinflation and cooling of the labour market appears to be losing traction as of late.

Key events in the US this week: Existing Home Sales (Tuesday) – MBA Mortgage Applications, Flash Manufacturing/Services PMIs, New Home Sales (Wednesday) – Jackson Hole Symposium, Durable Goods Orders, Chicago Fed National Activity Index, Initial Jobless Claims (Thursday) - Jackson Hole Symposium, Final Michigan Consumer Sentiment, Chief Powell (Friday).

Eminent issues on the back boiler: Persistent debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in early 2024. Geopolitical effervescence vs. Russia and China.

USD Index relevant levels

Now, the index is down 0.10% at 103.32 and faces initial support at 102.32 (55-day SMA) followed by 101.74 (monthly low August 4) and then 100.55 (weekly low July 27). On the other hand, the breakout of 103.68 (monthly high August 18) would open the door to 104.69 (monthly high May 31) and finally 105.88 (2023 high March 8).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.