- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Recovery prods 0.6500 after RBA Minutes, Australia/China statistics

AUD/USD Price Analysis: Recovery prods 0.6500 after RBA Minutes, Australia/China statistics

- AUD/USD picks up bids to refresh intraday high, reverses from YTD low.

- Mixed RBA Minutes, softer Aussie wage growth and downbeat China data prod Aussie bulls but US Dollar’s retreat favor recovery.

- Oversold RSI challenges Aussie bears beyond 0.6460-55 support zone.

- Multiple hurdles stand tall to test upside; 0.6600 appears the key resistance.

AUD/USD recaptures the 0.6500 round figure while extending the early Asian session rebound from the lowest level since November 2022 amid the Tuesday morning in Europe.

The Aussie pair dropped to the lowest levels in 2023 the previous day after broad risk aversion drowned the risk barometer.

However, the recently mixed headlines from the Reserve Bank of Australia’s (RBA) Minutes of its August monetary policy meeting and the top-tier data from Australia, as well as China, allowed the traders to print a corrective bounce from the 0.6460-55 support zone comprising lows marked in late May and the previous day.

Also read: AUD/USD remains below 0.6500 mark after softer Chinese macro data, seems vulnerable

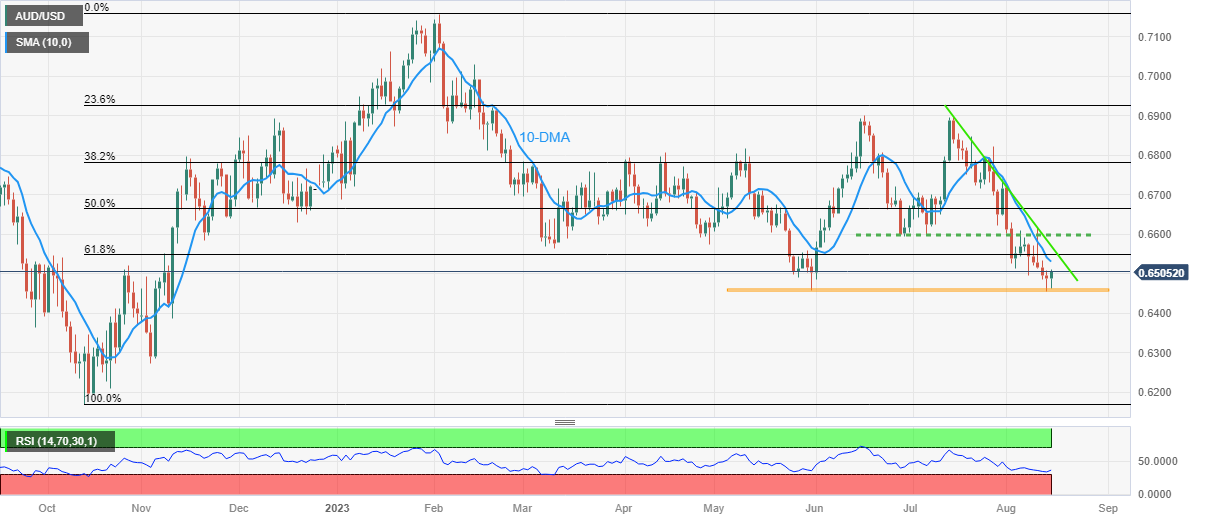

Technically, the failure to provide a daily closing beneath 0.6458 joined the nearly oversold RSI conditions to trigger the AUD/USD pair’s latest rebound.

That said, the 10-DMA level of 0.6530 precedes the 61.8% Fibonacci retracement of October 2022 to February 2023 upside, near 0.6550, to restrict a short-term recovery of the Aussie pair.

Following that, a one-month-old descending resistance line and lows marked in June, as well as early July, respectively near 0.6570 and 0.6600, will be crucial to watch for the AUD/USD buyers to retake control.

On the flip side, a daily closing beneath the 0.6460-55 support area could quickly drag the quote to a September 2022 low of near 0.6365 ahead of highlighting the late 2022 bottom of around 0.6170 for the AUD/USD bears.

AUD/USD: Daily chart

Trend: Limited recovery expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.