- Analytics

- News and Tools

- Market News

- AUD/JPY Price Analysis: Struggles at 95.00, dives inside the Kumo, further downside expected

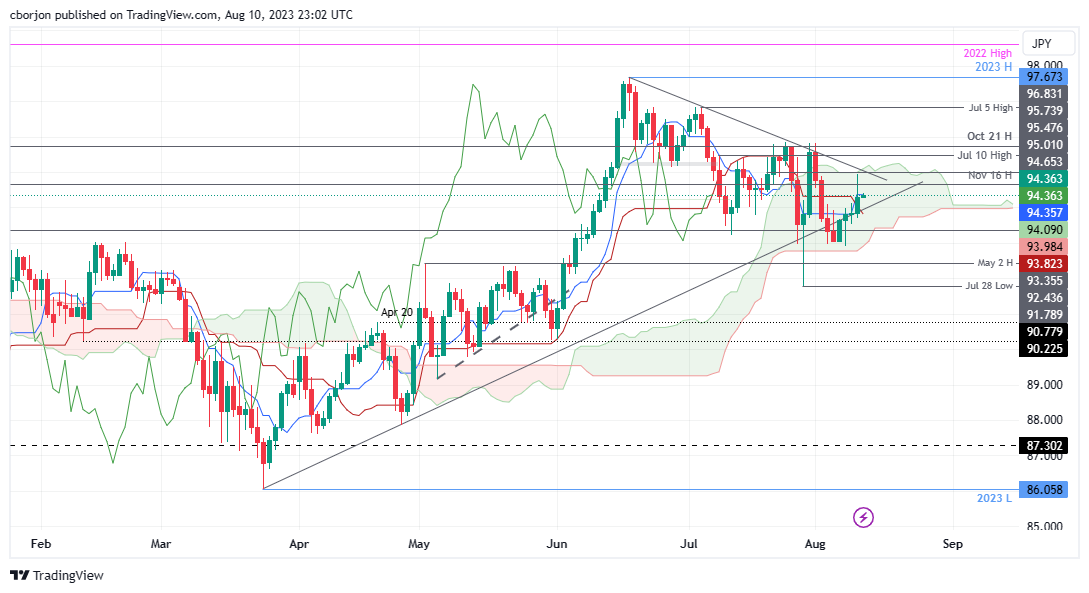

AUD/JPY Price Analysis: Struggles at 95.00, dives inside the Kumo, further downside expected

- AUD/JPY briefly touched one-week highs at 94.93, influenced by US inflation data which reduced chances for a Fed rate hike in September.

- Ichimoku Cloud (Kumo) dynamics indicate the AUD/JPY may weaken, especially if it slides below the Tenkan-Sen at 94.35.

- A breach above 95.00 could propel the pair to target the 95.75/85 resistance zone.

AUD/JPY climbs modestly as the Asian session begins, following Thursday’s session greatly influenced by the release of inflation data in the United States (US), cemented the case for the US Federal Reserve (Fed) to skip a rate hike in September. Although the AUD/JPY refreshed one-week highs at 94.93, it reversed its course and printed gains of 0.51%. The AUD/JPY exchanges hands at 94.38.

AUD/JPY Price Analysis: Technical outlook

After struggling to break above 95.00 in Thursday’s session, the AUD/JPY is subject to weaken further, with sellers eyeing the lows of the Ichimoku Cloud (Kumo). Also, price action sliding below the Tenkan-Sen at 94.35 would likely keep the AUD/JPY trading within a familiar range inside the Kumo.

The AUD/JPY would resume bullish, with a decisive break of the 95.00 figure, which would lift prices above the Kumo, followed by a supply area within the 95.75/85 area.

Conversely, if AUD/JPY breaks below the Kijun-Sen, the first demand zone at 93.82, that would pave the way to test the August daily low of 92.89, followed by the bottom of the Kumo at 92.77.

AUD/JPY Price Action – Daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.