- Analytics

- News and Tools

- Market News

- EUR/USD volatile amid US inflation data release, as US bond yields surged

EUR/USD volatile amid US inflation data release, as US bond yields surged

- EUR/USD surged to a weekly high of 1.1065 after the release of the US inflation data.

- US CPI came softer than expected, spurring traders to slash their bets on further Fed tightening.

- EUR/USD traders focus on the US PPI release and the University of Michigan Consumer Sentiment poll.

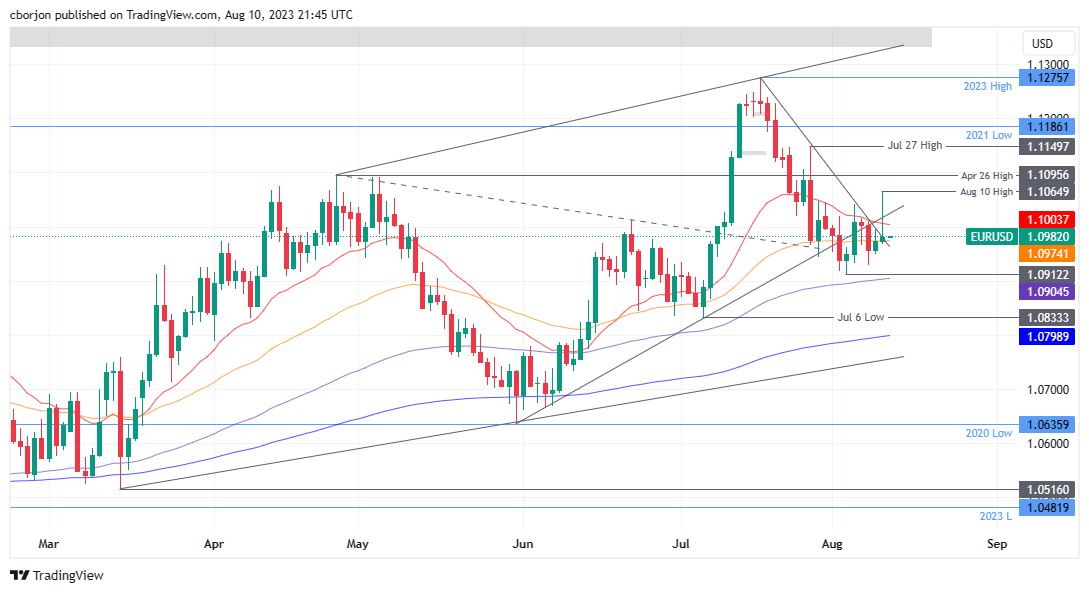

The EUR/USD finished Thursday’s session with minuscule gains of 0.06% after printing a weekly high of 1.1065 following the release of inflation data in the United States (US). Nevertheless, it made a U-turn, as high US bond yields underpinned the Greenback; hence the EUR/USD trimmed its earlier gains. As the Asian session begins, the EUR/USD trades at 1.0978, down 0.02%.

EUR/USD reaches a week’s high but retraces gains amidst rising US bond yields

Thursday’s session was characterized by the release of the much-awaited inflation report, which came below estimates with headline inflation, known as the Consumer Price Index (CPI) at 3.2% YoY, less than forecasts of 3.3% above June’s 3%. Regarding core CPI for July, the data came as foreseen at 4.7% YoY and below the previous month’s 4.8%.

After the headline crossed traders’ screens, the EUR/USD shoot through the roof, but traders faded the rally, as the pair tumbled 80-pips from its high towards its closing price. The Greenback recovered some ground toward the end of the session, as the US Dollar Index (DXY), which finished at 102.625, gained 0.14%.

Another reason behind the EUR/USD’s move was US Treasury bond yields, which skyrocketed after a 30-year bond auction, with the 10-year benchmark note rate finishing at 4.107%, gaining ten and a half basis points, even though traders pared their bets the US Federal Reserve (Fed) wouldn’t continue to increase borrowing costs.

Mary Daly from the San Francisco Fed remained hawkish in the day, commenting that she’s data dependent and supported July’s 25 bps hike. She added that July’s inflation report was good for people and business though she refrained from saying that rates are at their peak and took off-the-table rate cuts when asked, as she stated there’s a “long way from a conversation about rate cuts.”

After the data, expectations for further tightening by the Fed plunged, as the September meeting expectations for an increase lie at 9.5% odds, while for November, remain at 26.5%., from 33.8%, a month ago.

Further data revealed that the labor market gave another sign of easing, though it should be viewed cautiously, as the latest figures have not been consistent. Initial Jobless Claims for the week ending July 29 exceeded forecasts of 230K, advanced 248K.

Given the backdrop, the EUR/USD could extend its losses amid a light economic agenda in the Eurozone (EU), while the US would reveal the Producer Price Index (PPI), as well as the University of Michigan Consumer Sentiment. A higher inflation reading could pave the way for EUR/USD’s downside; otherwise, a test of 1.1000 is on the cards.

EUR/USD Price Analysis: Technical outlook

From a technical standpoint, the EUR/USD is neutral to slightly downward biased after buyers struggled to keep the spot price above the 1.1000, exacerbating a pullback toward the high 1.09s, with sellers eyeing a decisive break below the 50-day Exponential Moving Average (EMA) at 1.0974. Once cleared, key support levels emerge at the August 8 daily low at 1.0928, providing intermediate support, followed by the month-to-date (MTD) ow of 1.0912, before dropping to 1.09. On the other hand, if EUR/USD reclaims 1.1000, the 20-day EMA would be tested at 1.1003, followed by the current week’s high of 1.1065.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.