- Analytics

- News and Tools

- Market News

- NZD/USD faces headwinds amid Chinese deflation and upcoming US CPI data

NZD/USD faces headwinds amid Chinese deflation and upcoming US CPI data

- NZD/USD dips 0.24% following economic slowdown fears in China, trading cautiously at 0.6050 ahead of US inflation data.

- US CPI expectations: Forecasts suggest a MoM rate of 0.2% and a YoY decrease from 3.3% to 3%. Core CPI might slightly decline to 4.7% YoY.

- RBNZ anticipation: With no significant NZ data releases, the market focus shifts to the potential RBNZ stance, expected to maintain rates at 5.50%.

NZD/USD extended its losses for two straight days on Wednesday, losing 0.24% after hitting a daily high of 0.6094, but deflation in China spurred fears of an economic slowdown. That, alongside the release of inflation in the United States (US), would keep the NZD/USD trading within narrow ranges. The NZD/USD changes hands at 0.6050 as the Asian session commences.

Kiwi dollar on the defensive, as traders brace for US inflation report, anticipate next RBNZ’s move

The lack of economic news turned market sentiment sour, but the greenback, as shown by the US Dollar Index (DXY) failed to gain traction ahead of an important US inflation report. The Consumer Price Index (CPI) for July is estimated to dip to 0.2% on MoM, while annually based to dip to 3% from 3.3% in June. Regarding core CPI, which strips out volatile items, is estimated to remain at 0.2%, unchanged, while Year-over-year is estimated to slow from 4.8% to 4.7%.

Aside from data in the calendar, Federal Reserve officials remain focused on data, which has shown that monetary policy is lagging, but the deflationary process started. Additional policymakers are turning neutral, while Michelle Bowman commented that further tightening is needed.

The CME FedWatch Tool shows odds for a rate hike in September at 13.5%, as money market futures do not expect more borrowing costs to increase. Nonetheless, if Fed officials begin to pile into the dovish stance, any rate cut signals would weaken the greenback; hence further NZD/USD upside is expected.

An absent docket on the New Zealand (NZ) front will keep traders focused on US Dollar dynamics. ANZ analysts expect the Reserve Bank of New Zealand (RBNZ) to hold rates at 5.50% at its next monetary policy meeting next Wednesday. “The RBNZ is expected to reiterate their “watch, worry and wait” stance.

NZD/USD Price Analysis: Technical outlook

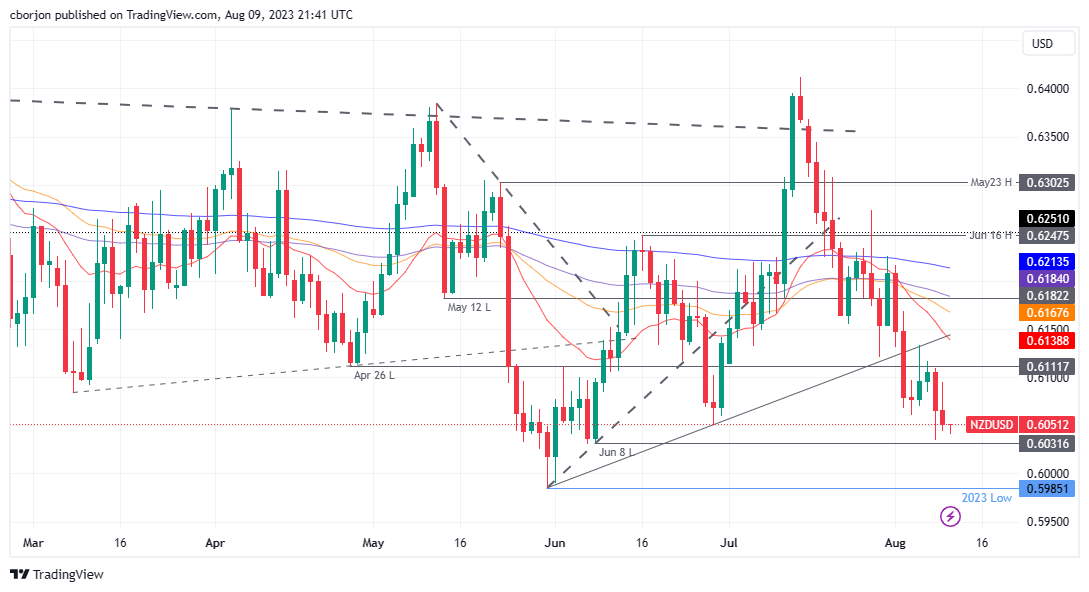

The NZD/USD downtrend remains intact after dropping below the daily Exponential Moving Averages (EMAs). Also, successive series of lower peaks and throughs open the door to test yearly lows. It the NZD/USD dives below the current week’s low of 0.6034, the next support would emerge at the July 8 low of 0.6031. Once cleared, the next demand area would be the 0.6000 mark, below testing the year-to-date (YTD) low of 0.5985.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.