- Analytics

- News and Tools

- Market News

- USD/JPY continues to climb amid falling US bond yields, awaiting US CPI

USD/JPY continues to climb amid falling US bond yields, awaiting US CPI

- USD/JPY climbs to 143.53 despite weakening US Dollar across FX and declining US Treasury bond yields.

- Inflation anticipation: Wall Street is on standby for July’s CPI, expected to remain steady at 0.2% MoM.

- Mixed Fed signals stir the market, with officials hinting at tightening and others suggesting a steady rate path.

USD/JPY advances for three straight days, climbing 0.11%, despite falling US Treasury bond yields and overall US Dollar (USD) weakness across the FX board, ahead of inflation data release from the United States (US). At the time of writing, the USD/JPY exchanges hands at 143.53 after hitting a low of 142.98.

Uncertainty over the Federal Reserve’s stance and Japanese monetary policy dynamics to dictate USD/JPY direction

Wall Street trades with minuscule losses amidst a light US economic docket as traders brace for July’s inflation data. The Consumer Price Index (CPI) is expected to remain unchanged compared to June’s 0.2% MoM, while market analysts foresee a dip to 3% from 3.3% YoY. Core CPI is estimated to print 0.2% MoM as the prior month’s release, and YoY is projected to stay at 4.8% as June’s.

Aside from this, the shrinkage of the trade deficit slightly boosted the greenback, but mixed messages from US Federal Reserve (Fed) officials, keep investors uncertain about the Fed’s forward path. Even though Fed Governor Michelle Bowman stressed the need for additional tightening, more policymakers are taking a more cautious or neutral approach, as Philadelphia Fed President Patrick Harker. He commented the Fed is at a stage where it could leave rates unchanged, barring an abrupt change in the direction of recent economic data.

Monetary policy expectations on the Fed show money market traders expect no change to the Federal Funds Rate (FFR), with odds at 86.5%, as shown by the CME FedWatch Tool.

The US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, is losing some traction, down by 0.11%, at 102.430, undermined by falling UST bond yields. The US 10-year benchmark note rate is 4.00%, down two basis points.

The lack of economic data in Japan would keep traders leaning toward US Dollar dynamics, as well as recent data from the Bank of Japan (BoJ), as most members of the BoJ expressed an opinion about the Yield Curve Control (YCC). Even though there was some chatter about normalizing monetary policy, most BoJ’s members remain on the dovish side of the spectrum.

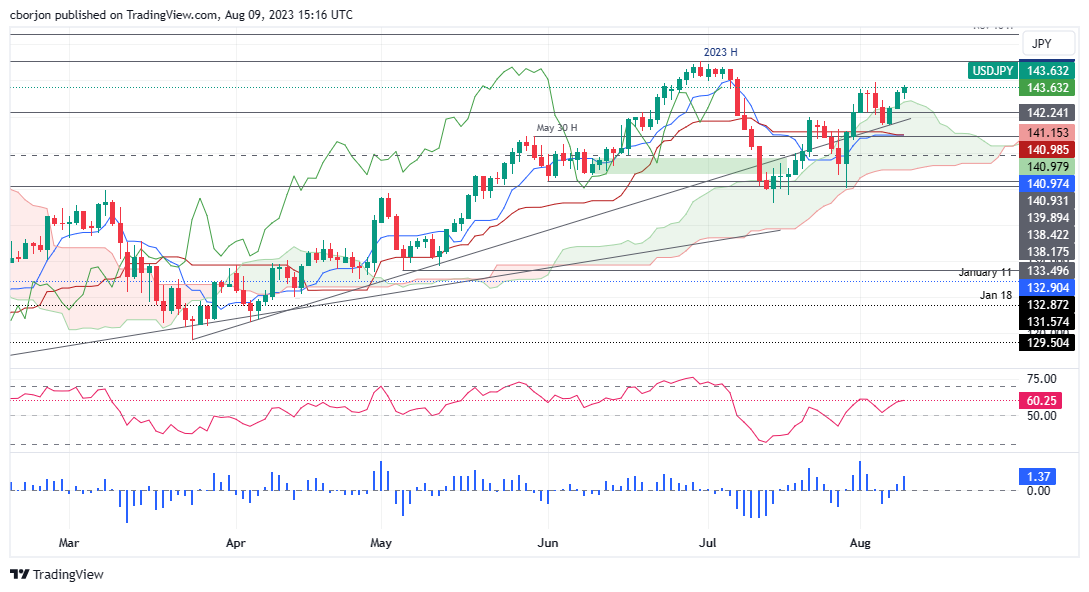

USD/JPY Price Analysis: Technical outlook

The USD/JPY found support around the top of the Ichimoku Cloud (Kumo), briefly pierced on Monday. However, a ‘tweezers bottom and harami’ pattern exacerbated a recovery toward current exchange rates. In addition, the Tenkan-Sen is about to cross above the Kijun-Sen line, seen as a bullish signal, while the Chikou Span is still below the price action. That said, the USD/JPY is bullishly biased, and it might test the year-to-date (YTD) high at 145.07, but firstly it would need to surpass key resistance levels, like the psychological 144.00 figure. Conversely, if the major drops inside the Kumo, it could test the current week’s low of 141.50.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.