- Analytics

- News and Tools

- Market News

- GBP/JPY Price Analysis: Aims towards 183.00, as technicals suggest consolidation in the short term

GBP/JPY Price Analysis: Aims towards 183.00, as technicals suggest consolidation in the short term

- GBP/JPY experiences gains for the second consecutive day, peaking at a weekly high of 182.95.

- Chikou Span is on the verge of a bullish signal, while flat Tenkan-Sen and Kijun-Sen lines hint at potential subdued movement.

- The 183.00 mark remains pivotal; a breakthrough could lead to testing the YTD high of 184.01.

- Downside risks include supports at 181.37 (August 8 low) and the Ichimoku Cloud top around 180.50/60.

GBP/JPY advanced for the second consecutive day on Tuesday, registering gains of 0.36%, reaching a fresh weekly high of 182.95. Nevertheless, toward the close of the day, the GBP/JPY dipped, and as the Asian session began, the GBP/JPY exchanges hands at 182.65, down 0.03%.

GBP/JPY Price Analysis: Technical outlook

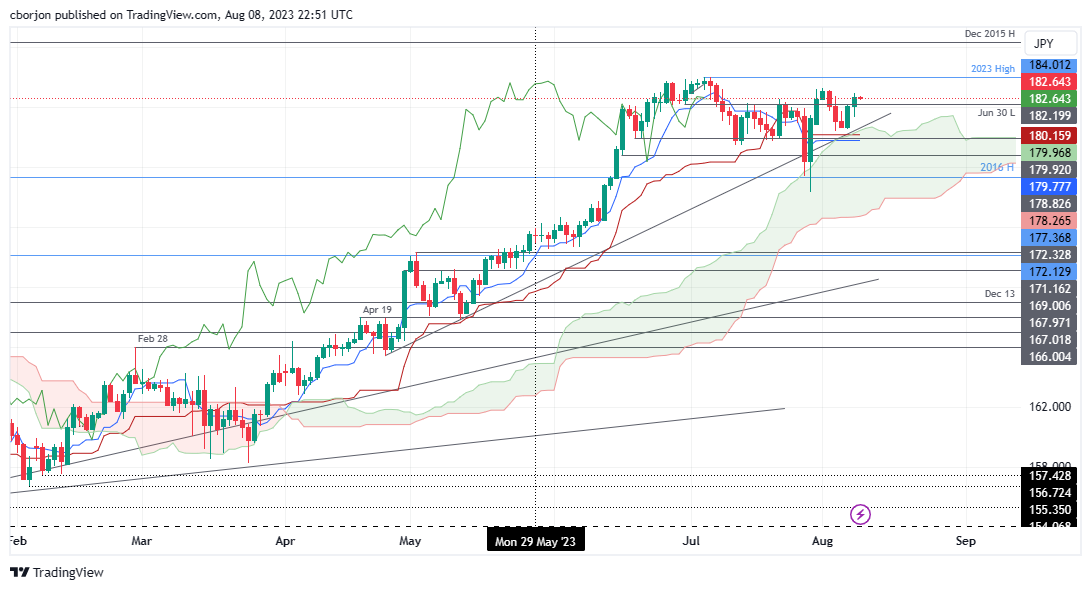

The GBP/JPY remains neutral to upward biased, poised to re-test the year-to-date (YTD) high of 184.01, even though it remains below 183.00. It should be said the Chikou Span is about to give a bullish signal, about to break above price action; however, the Tenkan-Sen remains below the Kijun-Sen, with both lines remaining flat, suggesting the GBP/JPY could remain subdued in the near term.

If GBP/JPY breaks to a new weekly high, the first resistance would be the 183.00 figure. A breach of the latter would expose the August 1 high of 183.24, followed by the YTD high of 184.01

Conversely, if GBP/JPY remains below 183.00, that could open the door for a pullback. First support will emerge at the August 8 daily low of 181.37. The following support would be the top of the Ichimoku Cloud (Kumo) at around 180.50/60, followed by the Kijun-Sen and Tenkan-Sen lines, each at around 180.16 and 179.77, respectively.

GBP/JPY Price Action – Daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.