- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: Further downside past 0.6100 appears more impulsive

NZD/USD Price Analysis: Further downside past 0.6100 appears more impulsive

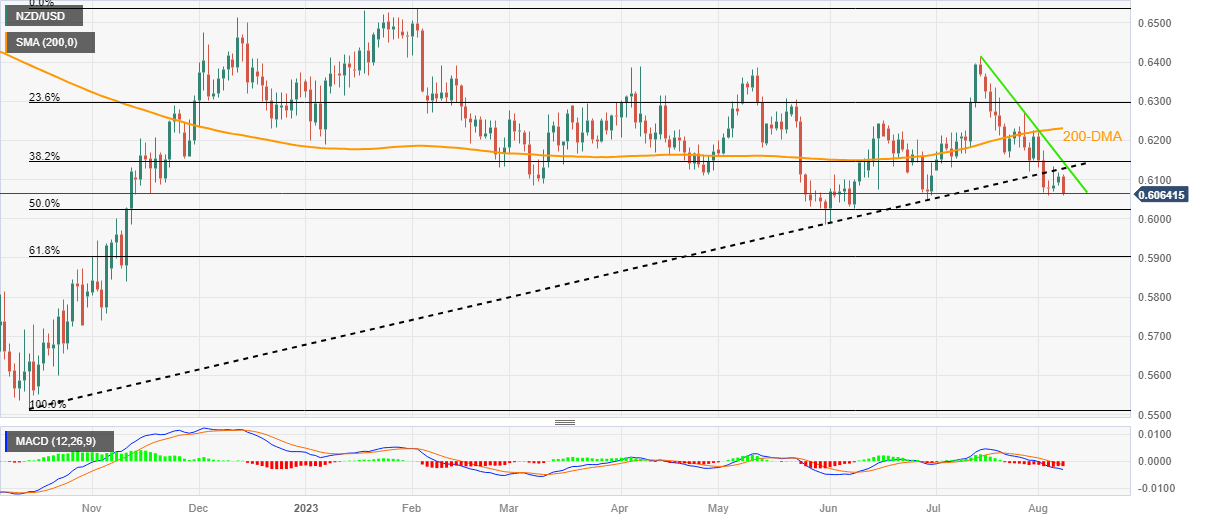

- NZD/USD extends pullback from 10-month-old previous support amid bearish MACD signals.

- Three-week-old descending resistance line, 200-DMA act as additional upside filters.

- Kiwi bears approach 50% Fibonacci retracement, June’s low amid further downside.

- Risk catalysts eyed for clear directions, sellers are likely to keep the reins amid slightly offbeat sentiment.

NZD/USD stands on slippery ground as it renews its intraday low near 0.6060 heading into Tuesday’s European session, printing the biggest daily loss, so far, in a week.

In doing so, the Kiwi pair justifies late previous week’s inability of the bulls to retake control after breaking an upward-sloping support line from October on August 02.

Not only the sustained reversal from the multi-month-old support-turned-resistance but the quote’s sustained trading below the three-week-old descending resistance line and the 200-DMA, respectively near 0.6145 and 0.6230, also challenge the NZD/USD buyers.

It’s worth noting that the Kiwi pair’s recovery beyond 0.6230 appears elusive unless crossing July’s peak of around 0.6415.

On the flip side, a 50% Fibonacci retracement of October 2022 to February 2023 upside, near 0.6025, can restrict the short-term downside of the NZD/USD price.

Following that, June’s low of 0.5985 and the 61.8% Fibonacci retracement level surrounding 0.5900 will lure the Kiwi bears.

To sum up, NZD/USD remains on the bear’s radar and appears set to challenge the yearly low marked in June surrounding 0.5985 as the US Dollar extends the week-start recovery amid sour sentiment.

Also read: NZD/USD keeps the red below 0.6100 on stronger USD, reacts little to Chinese trade data

NZD/USD: Daily chart

Trend: Further downside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.