- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD looks set to test $1,935 as US employment clues loom – Confluence Detector

Gold Price Forecast: XAU/USD looks set to test $1,935 as US employment clues loom – Confluence Detector

- Gold Price bounces off three week low but stays on bear’s radar on breaking key supports, now resistances.

- US credit rating cut prods US Dollar bulls, puts a floor under XAU/USD price.

- Fears of hawkish Fed moves, receding Gold demand from Asia weigh on bullion.

- Strong US employment data can bolster September Fed rate hike odds and exert downside pressure on XAU/USD.

Gold Price (XAU/USD) clings to mild gains as it bounces off the lowest levels in three weeks. However, the metal’s current position remains elusive to lure the XAU/USD buyers as it stays beneath the key supports as markets await the top-tier US employment data comprising the ADP Employment Change and the Nonfarm Payrolls.

Late on Tuesday, global credit rating agency Fitch Ratings downgraded the US credit rating from AAA to AA+. However, the recent market chatters, mainly from big bankers, suggest that such a rating cut is likely to have a minor negative impact on the US fundamentals and hence recently challenge the risk-off mood, as well as prod the Gold buyers.

Further, hawkish comments from Chicago Federal Reserve Bank President Austan Goolsbee and fears of Fed policy pivot, as cited by Atlanta Federal Reserve Bank President Raphael Bostic escalate the market’s anxiety ahead of the key data and prod the Gold buyers.

It should be noted that the latest World Gold Council (WGC) report suggests a 2.0% fall in the annual demand and anticipates a 10% fall in the gold demand from India, one of the major customers, to challenge the XAU/USD bulls. Additionally, downbeat China statistics and fears of easing economic growth in the key Gold customer also prod the precious metal price.

Also read: Gold Price Forecast: XAU/USD’s sustained reccovery hinges on weak US ADP jobs data

Gold Price: Key levels to watch

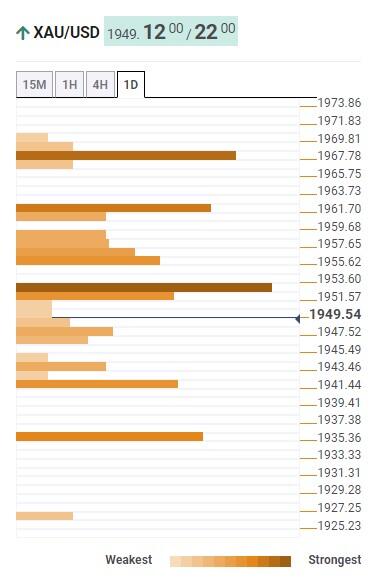

Our Technical Confluence indicator signals that the Gold Price remains well beneath the $1,950 and $1,970 trading range that previously restricted the XAU/USD moves as market players brace for the US employment and activity data scheduled for release this week.

That said, the previous day’s downside break of the $1,952 support confluence, now resistance serves as the immediate signal to favor the Gold bears despite the metal’s recent intraday gains. It should be noted that the Fibonacci 23.6% on one week highlights the importance of the said technical level.

With this, the Gold Price is likely to decline towards the lower band of the Bollinger on hourly play joins Pivot Point one-week S1 and 200-HMA, around $1,940.

Following that, a convergence of the Pivot Point one-day S1 and 61.8% Fibonacci retracement of one-month, can act as the final defense of the Gold buyers near $1,935 before directing them to the $1,900 round figure.

Alternatively, an upside clearance of the $1,952 hurdle can direct the Gold Price toward the 10-DMA resistance of around $1,962.

However, major attention will be given to the $1,969-70 resistance zone comprising the Fibonacci 61.8% on one week, 100-DMA and Fibonacci 23.6% on one-day and one-month.

Should the Gold buyers manage to cross the $1,970 hurdle, a multi-day-old horizontal resistance zone surrounding $1,985 may prod the XAU/USD bulls before directing them to the $2,000 psychological magnet.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.