- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls cheer $1,965 breakout ahead of US GDP, ECB – Confluence Detector

Gold Price Forecast: XAU/USD bulls cheer $1,965 breakout ahead of US GDP, ECB – Confluence Detector

- Gold Price renews weekly top during three-day uptrend.

- Fed fails to impress US Dollar buyers despite 0.25% rate hike, showing readiness for further tightening in September.

- China data, hopes of witnessing slower US GDP growth numbers propel XAU/USD ahead of eventful days.

- ECB needs to defend hawks to keep Gold buyers hopeful of crossing $1,985 key hurdle via softer USD.

Gold Price (XAU/USD) remains on the front foot for the third consecutive day as bulls cheer a fresh weekly top ahead of some more top-tier data/events, after marking a bullish reaction to the Federal Reserve (Fed) Interest Rate Decision.

In doing so, the XAU/USD fails to justify the Fed’s 0.25% interest rate hike, as well as readiness for an interest rate increase in September, amid fears of a sooner end to the tightening spell. Additionally favoring the Gold price could be the recent improvement in China's industrial profits and cautious optimism in the equity markets, mainly due to the upbeat earnings of global tech giants like Meta and Alphabet.

Furthermore, hopes of witnessing softer readings of the first readings of the US Gross Domestic Product (GDP) Annualized for the second quarter (Q2), as well as the ECB’s inability to convince hawks, also seem to propel the XAU/USD price. Also important to watch will be the US Durable Goods Orders and monetary policy meeting announcements of the Bank of Japan (BoJ).

Above all, the easing fears of higher rates can keep the Gold buyers hopeful but a clear upside break of the $1,985 resistance confluence becomes necessary to stretch the bull’s dominance.

Also read: Gold Price Forecast: Fed Powell’s patience powers XAU/USD toward $2,000, US GDP eyed

Gold Price: Key levels to watch

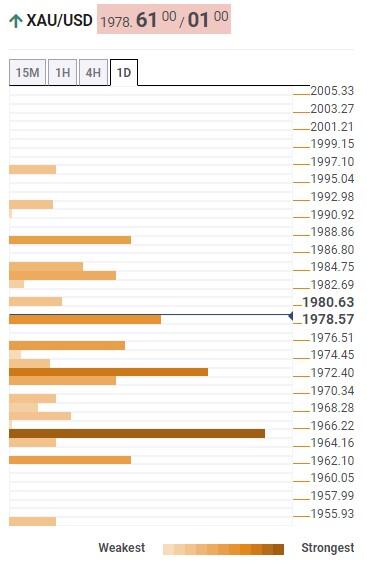

Our Technical Confluence indicator signals that the Gold Price remains on the front foot after crossing short-term key hurdles and has fewer challenges in extending the north run.

That said, the previous monthly high of around $1,985 prods immediate upside of the XAU/USD ahead of the $1,988 resistance confluence comprising the Pivot Point one-day R2 and previous weekly high.

Following that, there prevails an empty space unless the Gold Price hits the $2,000 psychological magnet.

On the contrary, Pivot Point One-month R1 joins the Fibonacci 38.2% on one-day and one-week to highlight $1,972 as immediate support to watch during the fresh Gold Price weakness.

However, major attention is given to the $1,965 support confluence comprising the 100-DMA and middle band of the Bollinger on the four-hour chart.

Overall, the Gold Price remains on the bull’s radar unless breaking $1,965 support.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.