- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: Bulls testing bearish commitments at key levels, ripening for a fading opportunity

NZD/USD Price Analysis: Bulls testing bearish commitments at key levels, ripening for a fading opportunity

- NZD/USD bulls are in the market but a fading opportunity could be on the cards.

- Friday is the end of the three-day cycle that could prove fruitful for the bears.

The New Zealand dollar strengthened for the second straight session as the US dollar continues to slide. An eight-week high was made on fresh selling of the Greenback as further data pointed to disinflation in the US economy signaling the Federal Reserve will need to adopt a less hawkish stance this year. meanwhile, although New Zealand's inflation rate slowed to 6.7% in the first quarter, it is still above the Reserve Bank of New Zealand's target range of 1-3% over the medium term.

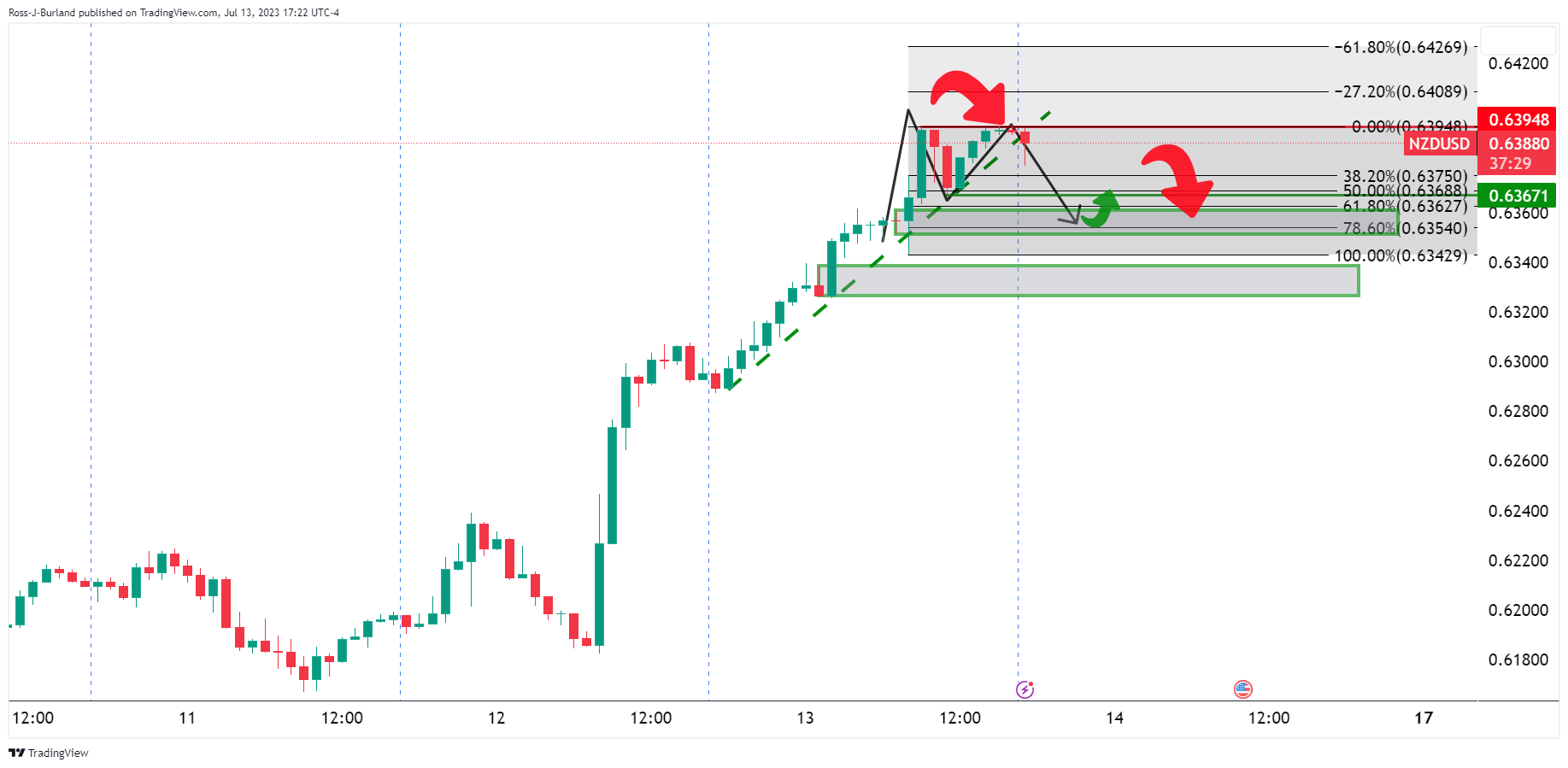

On the technical front, we have a topping pattern in play as follows:

NZD/USD H1 chart

It's the end of the week and a three-day cycle that could see the price deteriorate into longs that have been built up since Wednesday's rally. The M-formation is a topping pattern that could offer an opportunity before the week is out as traders take profits into the weekend.

NZD/USD M15 charts

We are seeing signs of deceleration, but there will need to be a break of the 0.6370s to confirm that bearish bias. even still, there are prospects of a move higher to test 0.6400/20:

NZD/USD daily chart

The daily chart is offering prospects of a continuation...traders can look for a fade if the market offers the set up to end the week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.