- Analytics

- News and Tools

- Market News

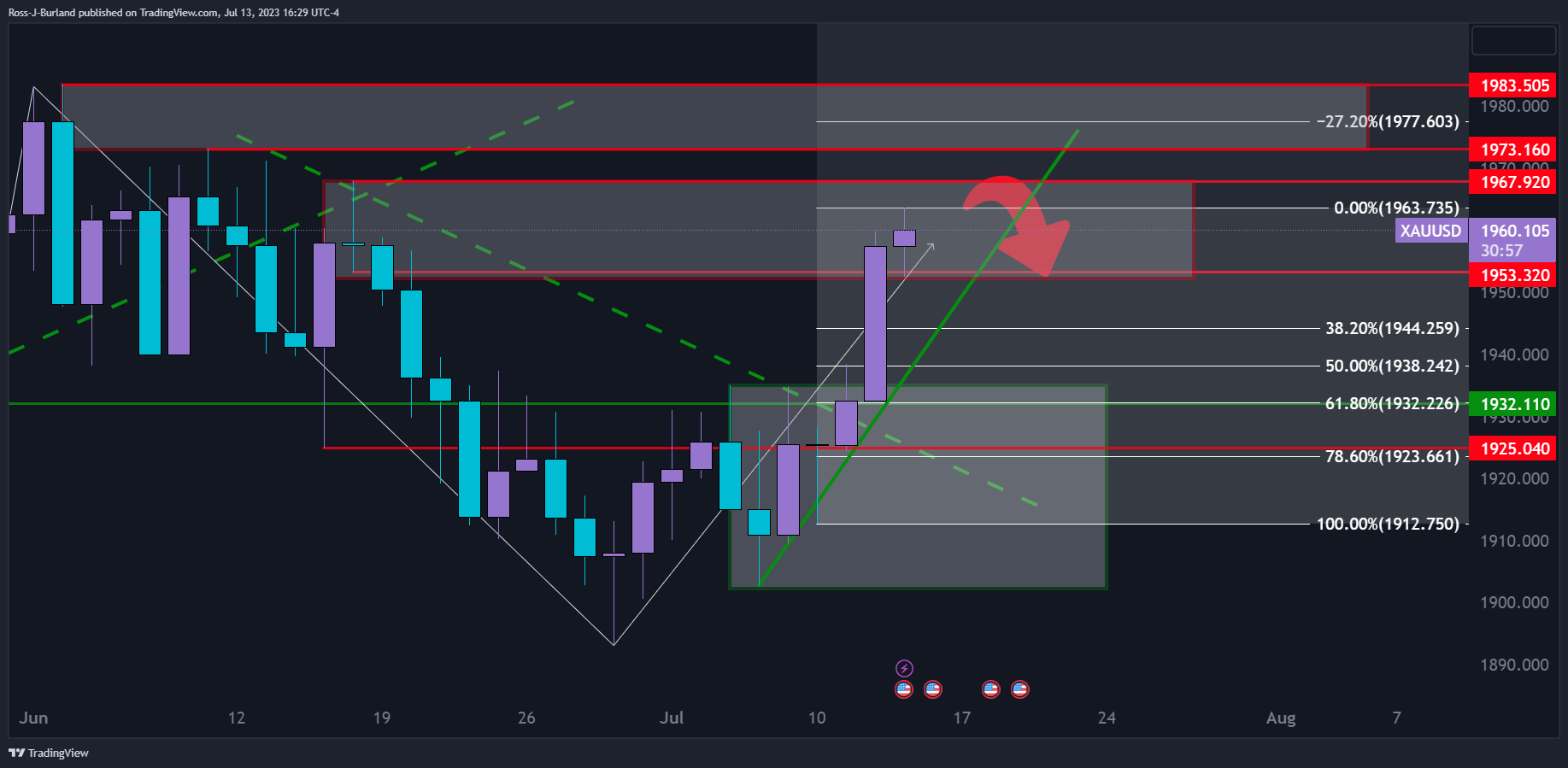

- Gold Price Forecast: XAU/USD bears eye a move to a 61.8% Fibo, but bulls test key resistance

Gold Price Forecast: XAU/USD bears eye a move to a 61.8% Fibo, but bulls test key resistance

- Gold price could be on the verge of a correction as per resistance, but the bulks are still in control.

- A move through the current resistance of the $1,970s opens risk for a test of the $1,983 highs.

- Gold price bears eye the 61.8% ratio to the downside in line with $1,932 support.

Gold prices edged higher on Thursday while the Greenback continued lower as data continue to dictate the market's sentiment. US Treasury yields were the driver on yet another report that showed slowing US price pressures, pushing investors to add risk.

This benefitted the Gold price that was already glowing on the United States reported inflation report that showed that the Consumer Price Index rose by just 3% annualized in June, which was down from a 4% rate in May. On Thursday, the price pressures were shown to have eased in June, with the Producer Price index rising 0.1% annualized from 1.1% in May.

The DXY is already down for the sixth straight day and traded at its lowest since April 2021 near 99.97. A close below 100.00 will open risk for a test of the late March 2022 low near 97.685. Looking to US Treasury yields, the 2-year traded as low as 4.622% today and has fallen nearly half a percentage point from last week’s peak near 5.12%.

Gold technical analysis

The daily charts show that the price is now in a resistance area and could be on the verge of a correction. The 61.8% Fibonacci retracement area is eyed as support to $1,932.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.