- Analytics

- News and Tools

- Market News

- USD/JPY sinks to two-month low amid softening US inflation, Fed rate hike speculations

USD/JPY sinks to two-month low amid softening US inflation, Fed rate hike speculations

- US inflation seems to be easing, with June’s Producer Price Index (PPI) missing estimates and the previous month’s data. The Core PPI, excluding volatile items, also showed signs of weakening.

- The Federal Funds Rate (FFR) is expected to peak at 5.25%-5.50% for the remainder of the year, according to money market futures, despite softening inflation data.

- Japanese households expect higher inflation levels, averaging 10.5% for next year, well above the BoJ’s 2% target.

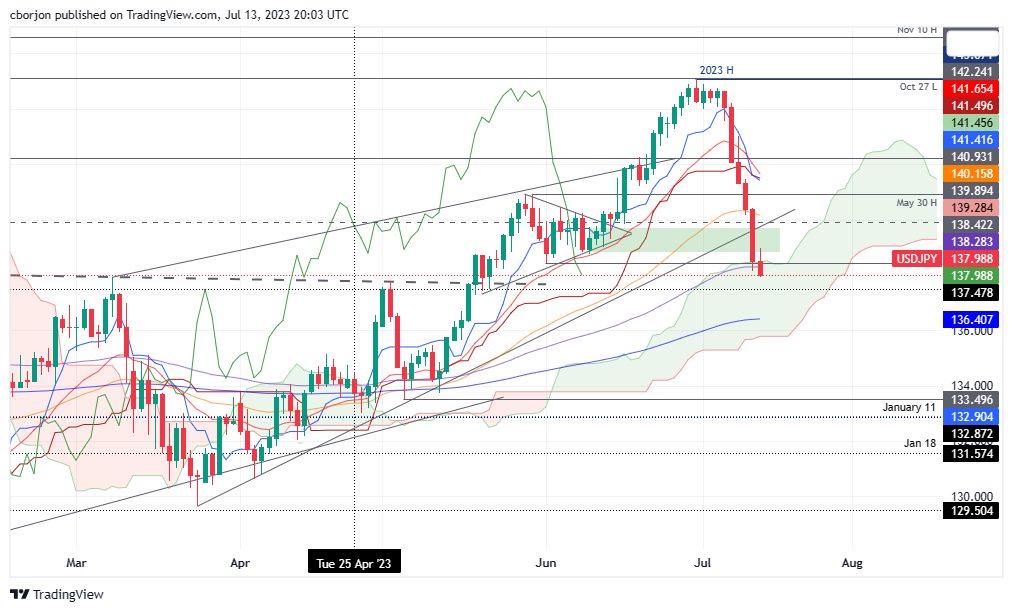

The USD/JPY extended its losses for the sixth consecutive trading session and broke to a new two-month low of 137.92 on speculations the US Federal Reserve would hike in July to reach its peak rates as inflation continued to ease. Hence, the USD/JPY is trading at 137.98, below the psychological 138.00 figure, after hitting a daily high of 138.95.

Yen strengthens as the USD softens, following disappointing US PPI data and low bond yields

Inflation in the United States (US) is edging lower after data revealed that the June Producer Price Index (PPI) missed estimates of the downside following Wednesday’s consumer inflation report. PPI expanded at a 0.1% YoY pace, beneath forecasts of 0.4%, and lower than May 1.1%, while Core PPI, which strips volatile items, showed signs of losing steam and expanded at a 2.4% YoY pace, below estimates of 2.6% and the previous month’s 2.8%.

Although the data would justify a pause on the Fed’s tightening cycle, money market futures think otherwise. According to the CME FedWatcth Tool, odds for a quarter of a percentage increase lie above 90%. Even though Fed Chair Jerome Powell and some of his colleagues expressed that “a couple” of increases are pending, investors pared those bets. That said, the Federal Funds Rate (FFR) is expected to peak at 5.25%-5.50% for the remainder of the year.

That would likely keep the greenback pressured, as shown by the US Dollar Index (DXY). The DXY, which tracks the buck’s performance against other currencies, tumbled to a new 15-month low of 99.741, losing 0.80%. Another factor weighed by lower inflation levels in the US is bond yields, with the US 10-year note rate sitting at 3.767%, down nine basis points.

Therefore, the USD/JPY has dropped 4% since July 6, mainly attributed to a soft US Dollar and lowes US bond yields.

On the Japanese front, households’ expectations for higher inflation levels put pressure on the Bank of Japan (BoJ). According to Reuters, “Households expect inflation to average 10.5% a year from now, the June survey showed, down from 11.1% in the previous survey but well above the BOJ’s 2% target.” That comes at the expense of BoJ Governor Kazuo Ueda’s stance to keep monetary policy loose until the BoJ sees clear evidence that inflation will persist at around 2%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY has tumbled below the 100-day Exponential Moving Average (EMA) of 138.79, extending its downward path past the top of the Ichimoku Cloud. With USD/JPY prices dropping inside the Cloud suggests the trend is still strong. The Tenkan-Sen crossing below the Kijun-Sen, while the Chikou Span standing below the price action, means the USD/JPY shifted bearish and could threaten to edge lower. First support emerges at the 137.00 mark, followed by the 200-day EMA at 136.40. Conversely, if USD/JPY buyers reclaim 138.00, that could pave the way to regain the 100-day EMA, followed by the 139.00 figure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.