- Analytics

- News and Tools

- Market News

- Euro pushes higher and prints new tops near 1.1170 ahead of ECB, US data

Euro pushes higher and prints new tops near 1.1170 ahead of ECB, US data

- Euro climbs to 16-month tops vs. the US Dollar.

- Stocks in Europe extend the weekly recovery on Thursday.

- EUR/USD looks to consolidate the breakout of the 1.1100 hurdle.

- ECB Accounts, US Producer Prices dominate the calendar later in the session.

The Euro (EUR) accelerates its gains vs. the beleaguered US Dollar (USD) and lifts EUR/USD to the 1.1170 region on Thursday, an area last visited in late February 2022.

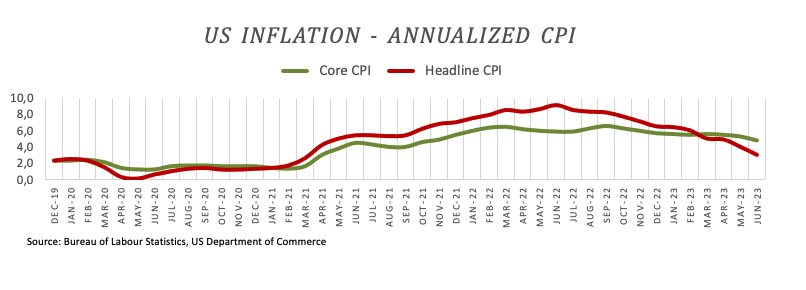

The strong upside impulse in the pair has been reinvigorated in response to lower-than-expected US inflation figures for the month of June, which, firstly, confirm that disinflationary forces remain well in place in the US economy and, secondly, underpin expectations that the Federal Reserve might end its ongoing hiking campaign sooner rather than later.

Back to US inflation: While it is inspiring that inflationary pressures are cooling off, it is unclear how much further prices can slow down in the current context of a still tight labour market and robust wage growth. This ongoing resilience in the domestic economy should still bolster another rate hike by the Fed at its July 26 gathering, although the intense disinflationary pressures could encourage market participants to think that the next hike will be the last of the tightening cycle.

The same can be said of the European Central Bank, where a 25 bps rate raise is largely anticipated at its meeting later in the month. However, the central bank is unlikely to halt its hiking bias in the near term, as highlighted by President Christine Lagarde and other Board members in past comments.

Looking at the broader picture, the potential future actions of the Fed and the ECB in normalizing their monetary policies continue to be a topic of discussion, especially with increasing concerns about an economic slowdown on both sides of the Atlantic.

Data-wise in the region, final June inflation figures in France saw the CPI gain 0.2% MoM and 4.5% YoY, while Industrial Production in the euro bloc expanded at a monthly 0.2% and contracted by 2.2% from a year earlier.

In the US, Producer Prices for the month of June will take centre stage, seconded by usual weekly Initial Jobless Claims for the week ended on July 8.

Daily digest market movers: Euro gathers fresh impulse beyond 1.1100

- The EUR surpasses the 1.1100 barrier vs. USD on Thursday.

- France’s final CPI rose 0.2% MoM in June and 4.5% YoY.

- Chinese trade balance figures came in short of expectations in June.

- Initial focus of attention will be on the ECB Accounts of the June meeting.

- Producer Prices will keep the focus on US inflation.

- The IEA said global demand for oil will reach record levels in 2023.

Technical Analysis: Euro faces the next hurdle at 1.1184

The ongoing price action in EUR/USD hints at the idea that further gains might be in store in the short-term horizon. However, the current pair’s overbought condition opens the door to some near-term corrective move.

The continuation of the uptrend now targets the 2023 high of 1.1169 (July 13). Further up comes the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1181, just before another round level at 1.1200.

On the downside, the weekly low at 1.0833 (July 6) appears reinforced by the proximity of the interim 100-day SMA. The breakdown of this region should meet the next contention area not before the May low of 1.0635 (May 31), which also looks underpinned by the crucial 200-day SMA (1.0643). South from here emerges the March low of 1.0516 (March 15) prior to the 2023 low of 1.0481 (January 6).

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.