- Analytics

- News and Tools

- Market News

- WTI bulls move in to a key resistance area, correction eyed

WTI bulls move in to a key resistance area, correction eyed

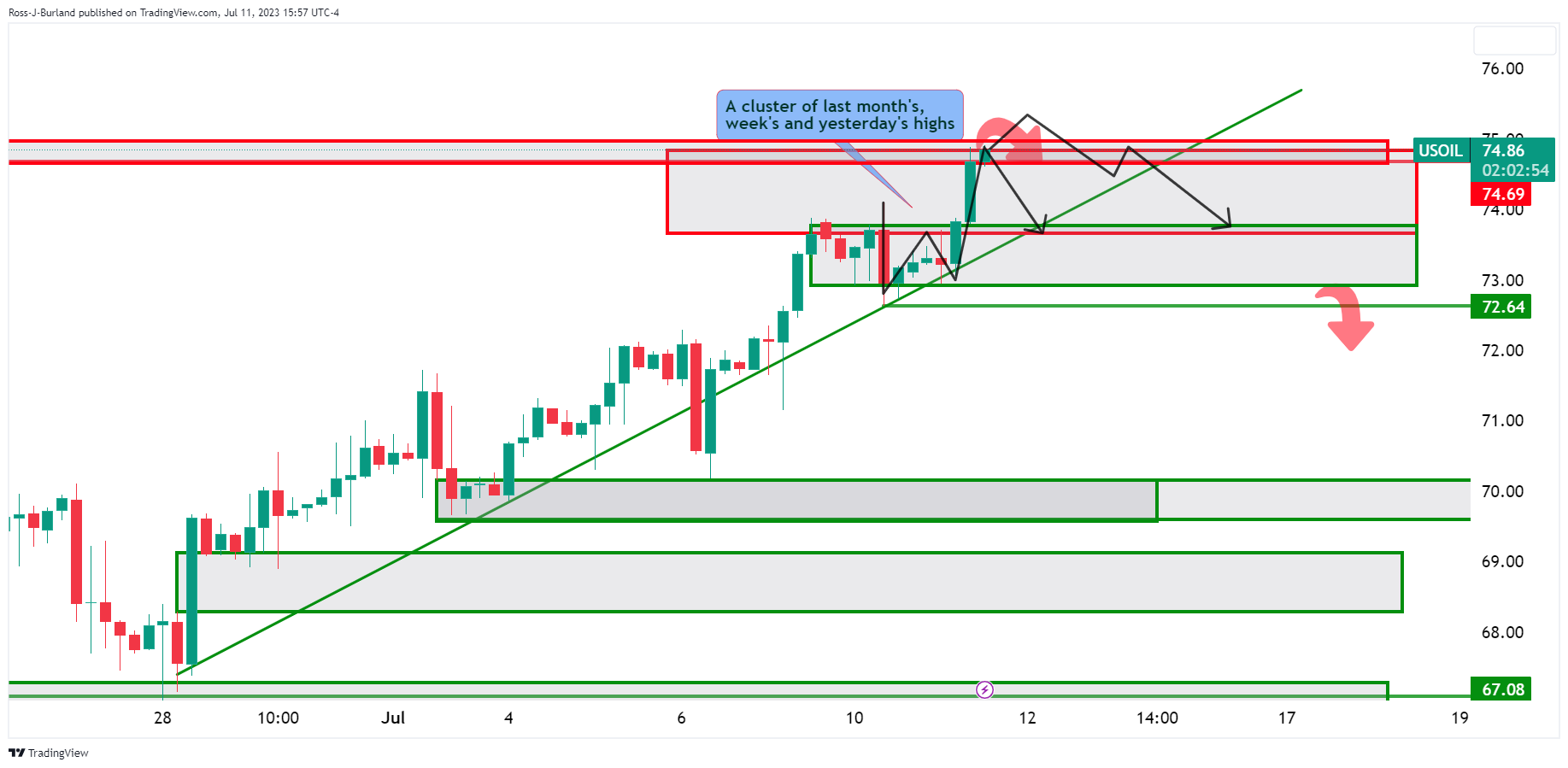

- WTI is up on the day on China sentiment and testing a key resistance area.

- Bears are lurking and the dynamoic trendline support is eyed.

WTI is higher by some 2.25% at $74.82 after moving withina range of $73.03 and $74.92. Crude prices rallied Tuesday after China took steps to support the property market by extending loan relief for developers. However, there remains concern about weaker Chinese energy demand. China's National Petroleum Corp (CNPC), China's largest oil and gas producer, cut its 2023 China crude oil demand forecast on June 20 to +3.5% to 740 MMT from a March forecast of +5.1% to 756 MMT.

Elsewhere, energy supply risks are offering support to the market once more as Saudi Arabia rolled over its voluntary production cuts while Russia's decision to curtail exports, as opposed to production, helps alleviate some concern about the nation's undercompliance with the OPEC+ deal, as analysts at TD Secureities explained.

''However, the sharp deterioration in our broad commodity demand indicator, along with market expectations of continued hawkish central bank policy, dented sentiment and maintain a bearish tilt in the market psyche.''

''In this sense WTI crude and Brent crude are still prone to CTA selling below $71.15/bbl and $75.20/bbl respectively,''the analysts stated, ''whereas the bar remains higher to see supportive algorithmic flow.''

WTI techncial analysis

Zoomning in on the 4-hour time frame, there are prospects of a correction from the resistance area to test trendlie support.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.