- Analytics

- News and Tools

- Market News

- USD Index gathers some balance around 102.40 ahead of Fedspeak

USD Index gathers some balance around 102.40 ahead of Fedspeak

- The index attempts a mild rebound to the 102.40 region.

- Investors continue to digest Friday’s Nonfarm Payrolls figures.

- Fedspeak, Wholesale Inventories next on tap in the US docket.

The greenback, in terms of the USD Index (DXY), regains some composure following Friday’s post-NFP sharp sell-off and revisits the 102.40 zone at the beginning of the week.

USD Index now looks at Fedspeak, CPI

The index picks up some buying interest following two consecutive daily pullbacks on Monday as investors continue to adjust to Friday’s release of the June Payrolls (+209K jobs), while expectations for a 25 bps rate hike remain largely unchanged for the time being.

On the latter, CME Group’s FedWatch Tool sees the probability of such a scenario at around 92% against the backdrop of the ongoing resilience of the US economy and the still tight labour market.

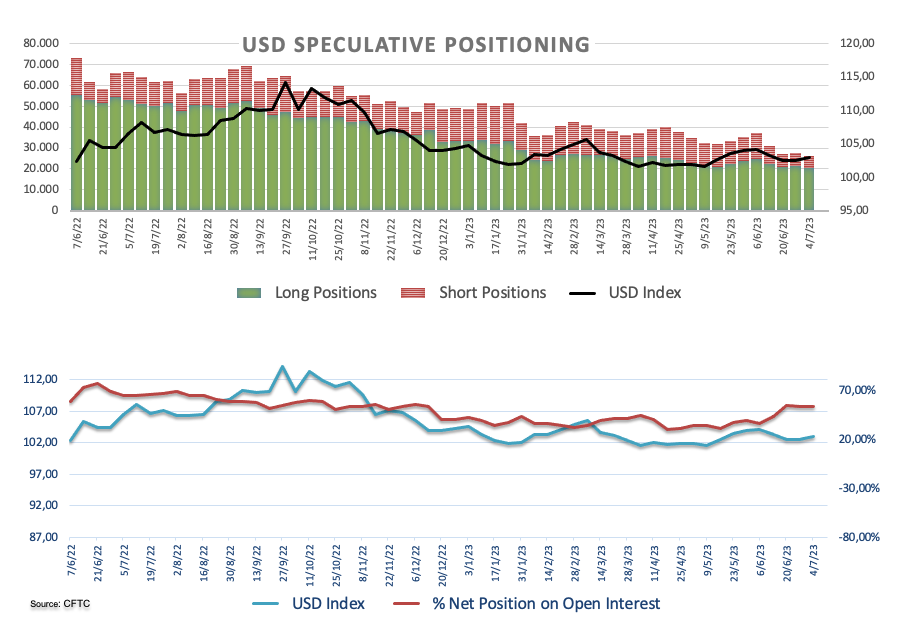

On the speculative front, net longs in the USD receded to 3-week lows in the week ended on July 3, a period where the index entered some consolidative range prior to the release of the crucial jobs report.

Later in the NA session, Wholesale Inventories will be the sole release along with a slew of Fed speakers: M. Barr (permanent voter, centrist), San Francisco Fed M. Daly (2024 voter, hawk), Cleveland Fed L. Mester (2024 voter, hawk), and Atlanta Fed R. Bostic (2024 voter, hawk).

What to look for around USD

The index hovers around the 102.40 region following Friday’s Nonfarm Payrolls, while prudence is seen increasing ahead of the publication of key US inflation figures on July 12.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high, supported by the continued strength of key US fundamentals such as employment and prices.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: Wholesale Inventories, Consumer Credit Change (Monday) – MBA Mortgage Applications, Inflation Rate, Fed’s Beige Book (Wednesday) – Producer Prices, Initial Jobless Claims (Thursday) – Advanced Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.15% at 102.42 and the breakout of 103.54 (weekly high June 30) would open the door to 104.60 (200-day SMA) and then 104.69 (monthly high May 31). On the downside, the next support aligns at 101.92 (monthly low June 16) followed by 100.78 (2023 low April 14) and finally 100.00 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.