- Analytics

- News and Tools

- Market News

- EUR/USD bears move closer to the edge of the abyss after FOMC minutes and ahead of a slew of key US data

EUR/USD bears move closer to the edge of the abyss after FOMC minutes and ahead of a slew of key US data

- EUR/USD is breaking down technically as we head into key US data events.

- FOMC minutes prop up the hawkish sentiment and the US Dollar.

EUR/USD fell by some 0.25% on Wednesday, weighed by a weaker-than-forecast eurozone PMI and PPI, risk-off tones surrounding China noise and by the Federal Open Market Committee minutes that have cemented the current hawkish sentiment.

The US Dollar has been climbing of late and jolted higher in late trade in New York ahead of more critical US data releases Thursday and Friday. Firstly, worries that trade frictions between China and the US could escalate kickstarted a move up in the Greenback this week. China made an abrupt announcement on Monday of controls from Aug. 1 on exports of some gallium and germanium products which has ramped up a trade war with the United States and could potentially cause more disruption to global supply chains. ''Analysts have described Monday's move as China's second - and bigger - countermeasure in the long-running US-China tech fight, coming after it banned some key domestic industries from purchasing from US memory chipmaker Micron (MU.O) in May,'' Reuters wrote on the matter.

Eurozone inflation expected to fall

Domestically, eurozone data disappointed and follows a mixed inflation report that was released at the end of June whereby the headline beat expectations, but while the data accelerated 5.5% in June it was lower than May’s 6.1% increase. The Core HICP inflation rose to 5.4% YoY in June, compared with May’s figure of 5.3%. But markets had forecasted a 5.5% clip. On Wednesday, the eurozone reported soft final June services and composite PMIs.:

Both headline services and composite PMIs fell four ticks from the preliminary to 52.0 and 49.9, respectively. ''This was the first sub-50 reading for the composite since December and confirms our view that the eurozone is slipping into recession,'' analysts at Brown Brothers Harriman explained.

''Looking at the country composite readings, Germany fell two ticks from the preliminary to 50.6 and France fell one tick to 47.2. Italy and Spain reported for the first time and their composites came in at 49.7 and 52.6, respectively. Both fell more than two full points from May. Italy has joined France below the key 50 boom-bust line and it’s only a matter of time before other nations do as well,'' the analysts added and explained that eurozone inflation expectations continue to fall:

''The monthly ECB survey showed inflation expectations for the next 12 months fell to 3.9% in May vs. 4.1% in April and 5.0% in March. For three years ahead, inflation expectations remained steady at 2.5% vs. 2.9% in March. The ECB will be happy to see the drop and should allow the doves to retain control of the narrative at the July 27 meeting''

Markets are expecting the ECB to hike 25bp two more times and World Interest Rate Probability, WIRP, suggests odds of a 25 bp hike are near 90% this month.

Hawkish FOMC minutes props up the US Dollar

Meanwhile, in the US, the Federal Open Market Committee (FOMC) released the minutes of its June meeting, triggering a rise in the Greenback. According to the document, some officials favoured a rate hike at the meeting but went along with a pause. The minutes showed a division among FOMC members. “Most participants observed that uncertainty about the outlook for the economy and inflation remained elevated and that additional information would be valuable for considering the appropriate stance of monetary policy”, the minutes noted.

More here: FOMC minutes: Some officials favoured a 25bps hike at the June meeting

Now, the focus is on the US jobs data where the nation will report on layoffs on Thursday, Jobless Claims, ISM Services and JOLTS ahead of Friday's Nonfarm Payrolls report. This slew of fresh data would be expected to overshadow today's FOMC minutes and offer clues as to the next move from the Fed where there is a possibility of two more hikes this year.

''US payrolls likely remained above-trend in June, but still representing slowing after ~300k expansions in Apr-May. We also look for the UE rate to drop a tenth to 3.6% and for wage growth to print 0.3% MoM,'' analysts at TD Securities said.

Other than this week's events, traders will then be looking ahead to next Wednesday's Consumer Price Index.

EUR/USD and US Dollar charts

The DXY index, as illustrated above, has seen a move higher on the FOMC minutes into an area of potential resistance. The Euro bulls will want to see the 103.30s support and trendlines break to the downside in the coming sessions which could help prop the Single Currency around the US data events:

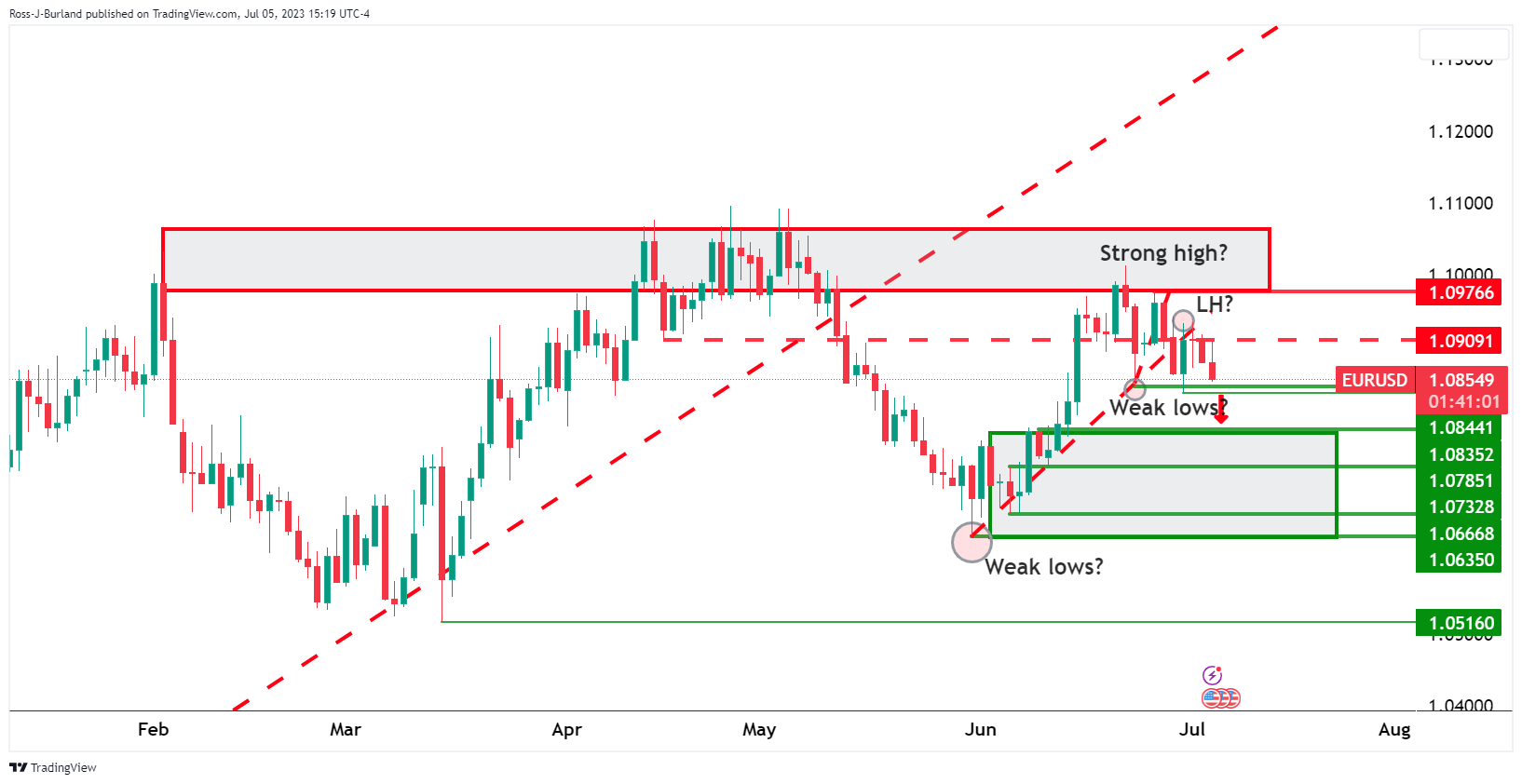

On the other hand, EUR/USD is headed to the edge of the abyss around what could prove to be daily weak lows that guard a move below 1.0850 in a broken-down market that leaves the 1.07 area vulnerable for the days ahead.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.