- Analytics

- News and Tools

- Market News

- USD/JPY Price Analysis: Bears are chipping away at daily dynamic support

USD/JPY Price Analysis: Bears are chipping away at daily dynamic support

- USD/JPY bears are staring to lick their lips.

- The price is breaking daily dynamic support.

USD/JPY is up some 0.3% on the day trading at around 144.70 having travelled up from a low of 143.98 to a high of 144.91 so far. at this juncture, the Yen that's under intervention watch after the Japanese finance minister warned last week of excessive moves in the currency market.

Data on the day in the US from the Institute for Supply Management (ISM) showed that manufacturing PMI dropped to 46.0 from 46.9 in May, the lowest reading since May 2020. It marked the eighth straight month that the PMI has been below the 50 threshold indicating contraction. Consequently, USD/JPY's current bullish trend could continue to decelerate as we have seen over the last few days.

The following illustrates the prospects of a correction in a top-down analysis:

USD/JPY monthly charts

The W-formation is a reversion pattern that could play out to the downside in time.

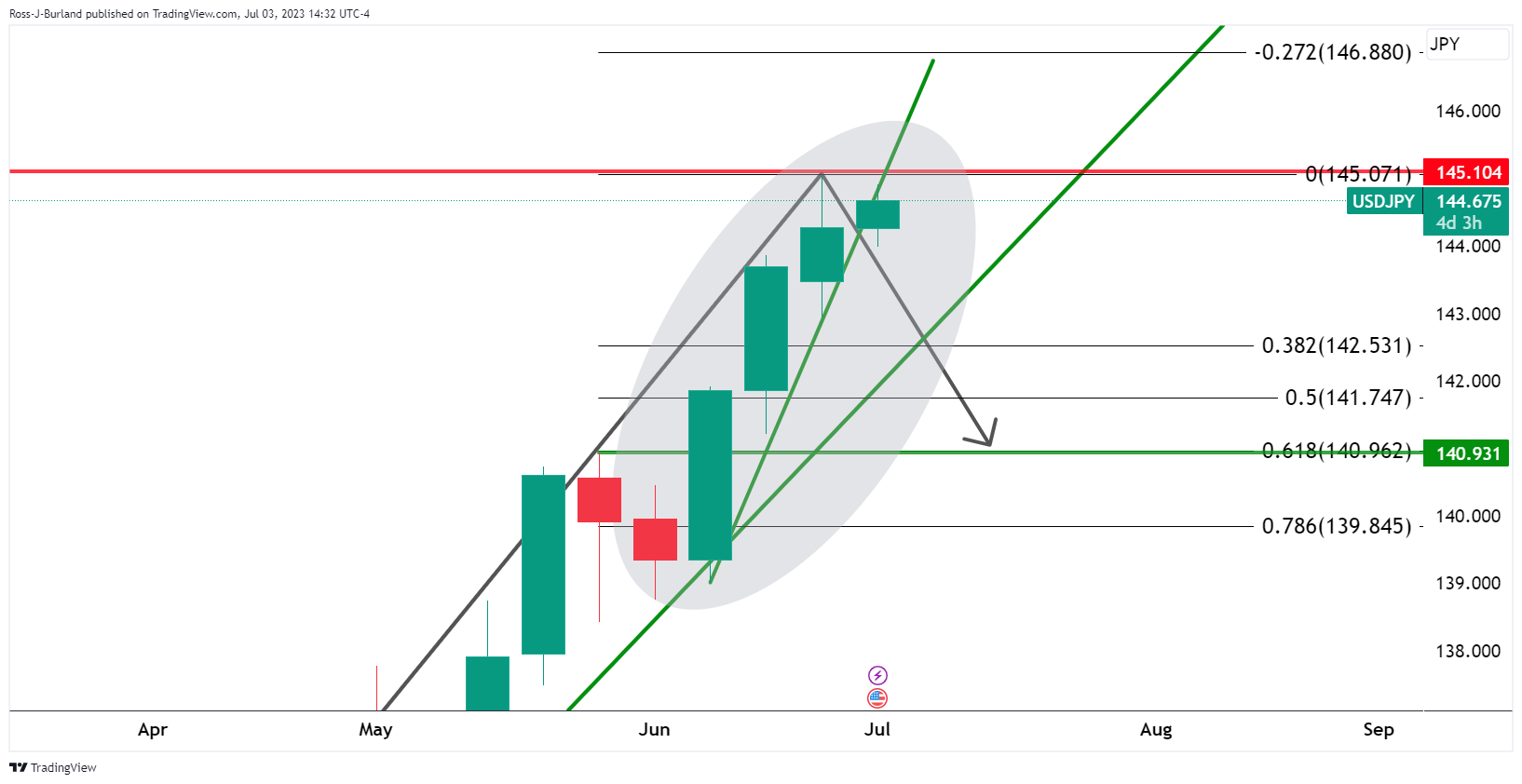

USD/JPY weekly

The current weekly highs could be the highest pot we will see for some time and as correction back to old highs neat 140.90 could be on the cards. The 61.8% Fibonacci aligns with those as well.

USD/JPY daily chart

\

\

Nearer term, the daily chart is breaking the trendline support and a target of 142.00 aligns with old highs and a 78.6% Fibonacci level.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.