- Analytics

- News and Tools

- Market News

- GBP/JPY gains ground on optimistic British Manufacturing PMI

GBP/JPY gains ground on optimistic British Manufacturing PMI

- The GBP/JPY cross jumps above the 183.60 area on Monday, its highest level since 2015.

- British Manufacturing PMI saw a contraction but one that was lower than expected, giving the Pound traction.

- Japanese Takan Index came in better than expected, still the BoJ may remain dovish.

At the start of the week, the GBP/JPY gained ground after the release of the Manufacturing PMI from the UK, which contracted but not as much as expected. In response, rising British yields gave traction to Sterling while the Yen remined vulnerable amid the Bank of Japan’s (BoJ) dovish stance. Despite Takan indexes improving in Q2, BoJ officials may need more evidence to pivot.

The UK reported a better-than-expected Manufacturing PMI

The S&P Global/CIPS Manufacturing PMI for the UK in June recorded a reading of 46.5, which was higher than the previous figure of 46.2. As a reaction, British yields saw more than 1% increases, with the 2,5, and 10-year rates jumping to 5.35%, 4.73% and 4.44%, respectively.

In Japan, the Tankan Large Manufacturing Index for Q2 exceeded expectations, reaching 5 compared to the consensus of 3 and the previous reading of 1. The Tankan Large Manufacturing Outlook for Q2 also showed a notable improvement, reaching 9 versus the consensus of 5 and the previous reading of 3. While these positive figures suggest a strengthening economy, the Bank of Japan (BoJ) may require further evidence of robust economic activity before considering a shift in its dovish monetary policy stance. Meanwhile, its likely that the Yen will continue to weaken agains most of its rivals.

GBP/JPY Levels to watch

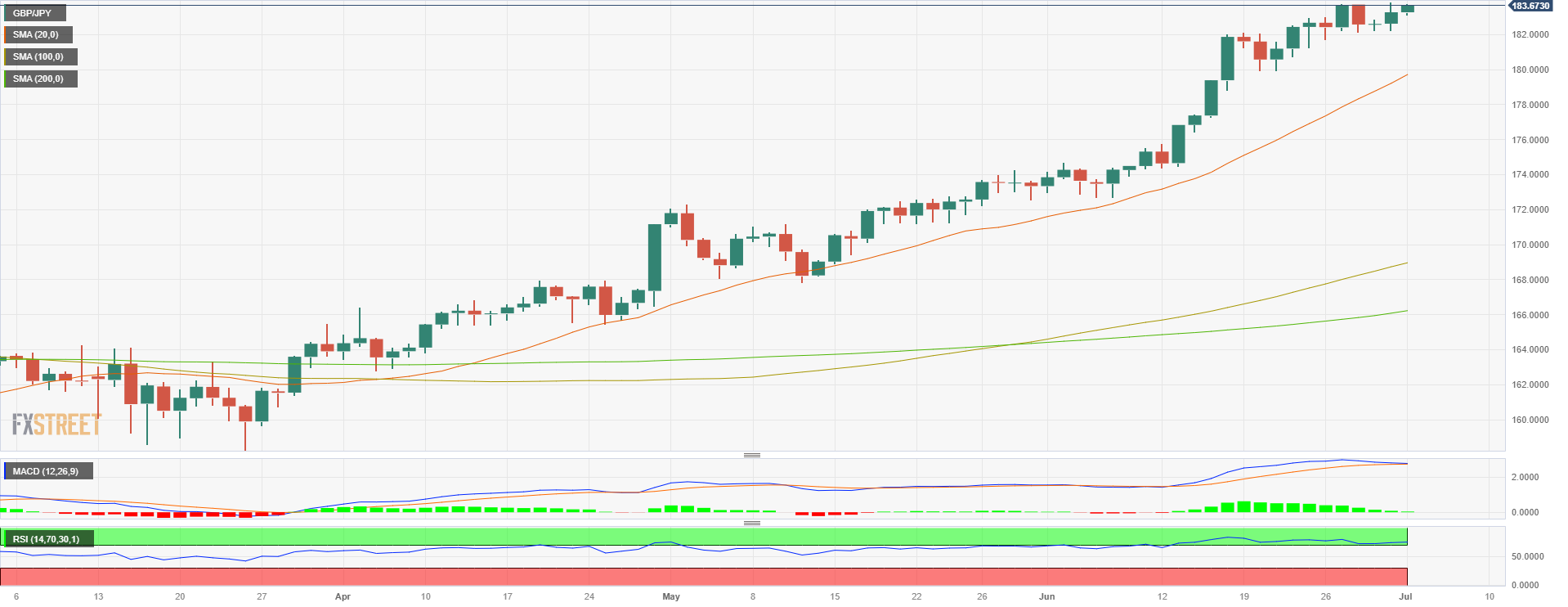

The daily chart suggests that the outlook is bullish for GBP/JPY even though the cross has shown overbought conditions since mid-June. In addition, the Moving Average Convergence Divergence (MACD) shows signs of exhaustion of the bullish momentum. Yet for a confirmed sell signal, the Relative Strength index would have to break back down below 70, and in the absence of such a break the outlook remains bullish.

On the upside, resistances levels to monitor line up at 183.70, 184.00 and 185.00.

In a downward correction, the next support levels are seen at 183.15, followed by 183.00 and 182.00.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.