- Analytics

- News and Tools

- Market News

- USD Index regains composure above 103.00 ahead of key data

USD Index regains composure above 103.00 ahead of key data

- The index trades with small gains above the 103.00 mark.

- US markets will be closed due to Independence Day on Tuesday.

- US ISM Manufacturing PMI takes centre stage later on Monday.

The greenback, in terms of the USD Index (DXY), starts the week on the positive foot and looks to reclaim the 103.00 hurdle in convincing fashion on Monday.

USD Index focused on US ISM

The index partially reverses Friday’s strong pullback and advances past the key 103.00 barrier on the back of some loss of momentum in the risk complex at the beginning of the week.

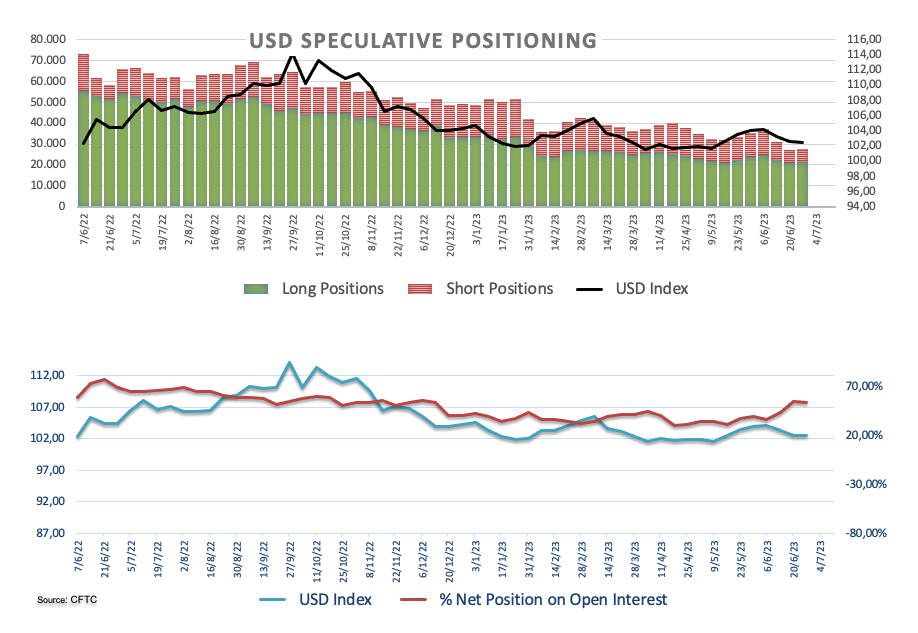

On the speculative front, net longs in the US Dollar increased to levels last seen in late March, around 15K contracts in the week ended June 27, according to the CFTC Positioning Report. The dollar’s strength during that period was once again underpinned by the Fed’s hawkish narrative amidst steady bets of a 25 bps rate hike at the July 26 meeting.

Moving forward, trading conditions are expected to shrink against the backdrop of an early close of US markets on July 3 and the Independence Day holiday on July 4.

In the US data space, the release of the ISM Manufacturing PMI for the month of June will take centre stage, seconded by the final S&P Global Manufacturing PMI and Construction Spending, both for the month of May.

What to look for around USD

The index regains the smile and advances north of the 103.00 hurdle at the beginning of the week.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high, supported by the continued strength of key US fundamentals such as employment and prices.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: Final Manufacturing PMI, ISM Manufacturing, Construction Spending (Monday) – Factory Orders, FOMC Minutes (Wednesday) – ADP Employment Change, Balance of Trade, Initial Jobless Claims, Final Services PMI, ISM Services PMI (Thursday) – Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.20% at 103.12 and the breakout of 103.54 (weekly high June 30) would open the door to 104.69 (monthly high May 31) and then 104.84 (200-day SMA). On the other hand, the next contention emerges at 101.92 (monthly low June 16) followed by 100.78 (2023 low April 14) and finally 100.00 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.