- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD firms at a three-month low, awaits more US data

Gold Price Forecast: XAU/USD firms at a three-month low, awaits more US data

- Gold price is under pressure as the Fed outlook remains hawkish.

- US data this week has been supportive to the Greenback, so far.

Gold price was lower on Wednesday losing ground to a fresh low at $1,902.87 from a high of $1,917.28, weighed down by a rising US Dollar even as US Treasury yields fell. Gold price was trading at its lowest in three months as the outlook of tighter monetary policy lifted the Greenback and raised the opportunity cost of holding precious metals.

Signs of economic resilience to higher borrowing costs wiped out the recent support from safety demand while the US Dollar makes traction as US data remain strong.

Data this week has been an improvement n last and the latest data showed that US Consumer Confidence jumped to a nearly 1-1/2-year high in June, while business spending, durable goods orders and home sales held up in May.

Consequently, markets are starting to price in that second Fed hike this year as analysts at Brown Brothers Harriman noted: ''WIRP suggests a 25 bp hike is nearly priced in for September, with odds of a second 25 bp hike topping out near 10% for November. PCE data Friday may help solidify those odds, with headline expected at 3.8% YoY vs. 4.4% in April and core expected to remain steady at 4.7% YoY.''

However treasury yields were lower on the day, and that would have been expected to be bullish for Gold price because it pays no interest. The US two-year note was last seen paying 4.716%, down 17.1 basis points, while the yield on the 10-year note was down 5.1 basis points to 3.716%. In the meantime, Federal Reserve Chair Powell said that two additional rate hikes are not off the table during the European Central Bank’s annual forum on central banking, repeating what he said during the Summary of Economic Projections, on the quest to bring down inflation. Gold price is therefore on the back foot as the Federal Reserve is suggesting it will add further 50-basis points of rate hikes before the end of the year, keeping the carrying cost of owning gold, which pays no interest, high.

Gold technical analysis

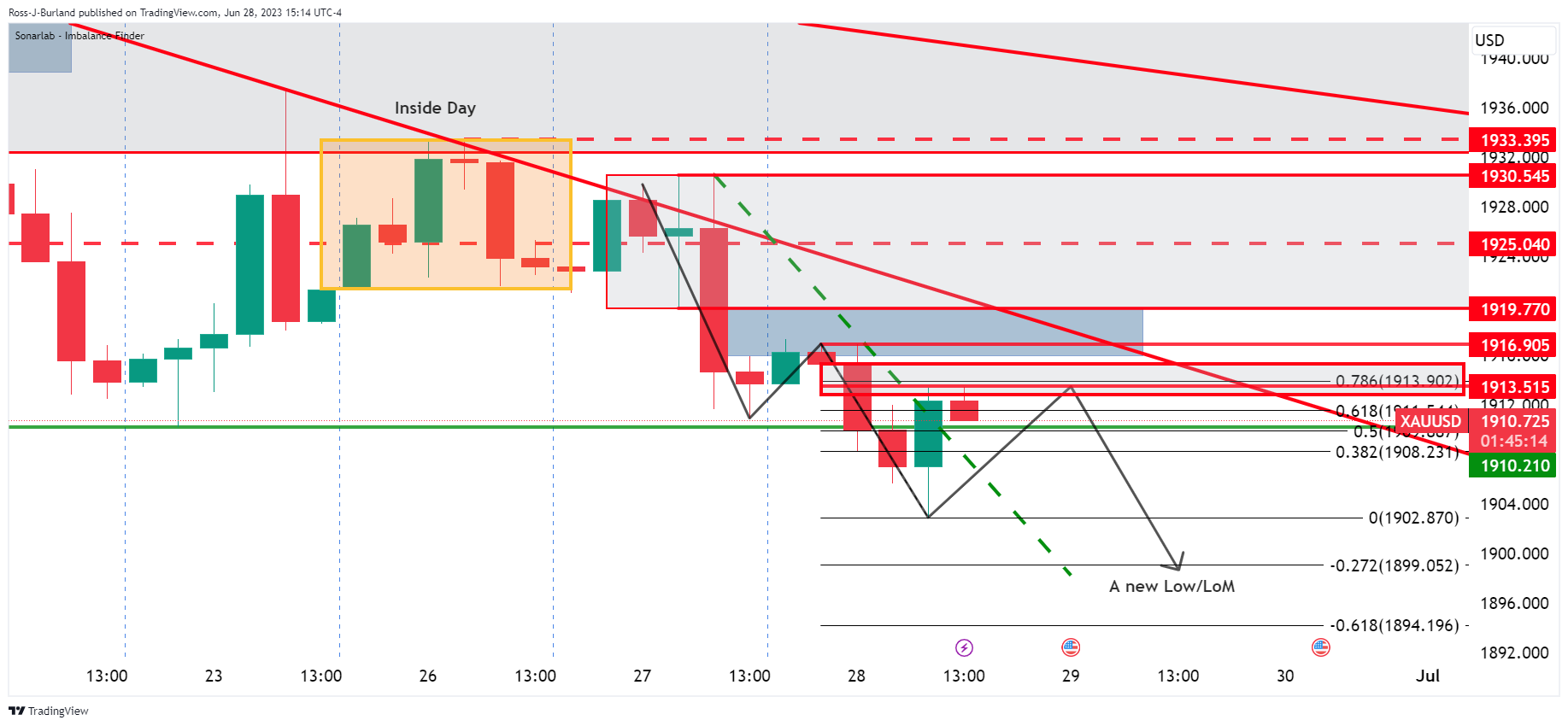

The Gold price is in the bear's lair, pressured below trendline resistance and on the backside of the prior bullish trendline.

The price fell out of the inside day's range and sank into longs to then print a new low of the week and month. Therefore, a short squeeze could be on the cards as follows:

Gold price H4 charts

On the 4-hour chart, the bulls are moving in and eye the imbalance as per the greyed area on the chart that will either act as resistance or give way to a run towards the trendline resistance. A break of the resistance will open risk to the range between $1,919 and $1,930.

On the other hand, if the resistance plays its role, then the bears will be on the hunt for a fresh low:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.