- Analytics

- News and Tools

- Market News

- GBP/USD rebounds amid USD weakness, BoE hike spurs recession woes

GBP/USD rebounds amid USD weakness, BoE hike spurs recession woes

- GBP/USD surpasses 1.2700 mark amidst broad USD weakness and risk aversion.

- Despite BoE’s recent rate hike, market fears of a potential UK recession persist.

- Investors expect a further 50 bps rate hike by BoE in late 2023 amidst stubborn inflation.

GBP/USD climbs after dropping to a last week’s low of 1.2685, surpassing the 1.2700 figure amidst a risk-off impulse and broad US Dollar (USD) weakness across the board. The previous week’s Bank of England (BoE) 50 bps rate hike weakened the Pound Sterling (GBP) on fears that higher rates could spur a recession in the UK. Nevertheless, the GBP/USD clings to its 0.03% gains, trading at 1.2718.

Pound regains ground despite fearful market sentiment; rate hike expectations taper off

The GBP/USD is clinging to its gains as the greenback weakens on risk aversion. A light economic calendar in the United States (US) left traders adrift to last week’s data and Fed speakers hitting the wires during the weekend. The New York Fed President John Williams noted that “restoring price stability is of paramount importance because it is the foundation of sustained economic and financial stability. Price stability is not an either/or, it’s a must have.”

In the early morning, the Dallas Fed Manufacturing Index for June came at -23.2, exceeding forecasts yet still in recessionary territory, portraying a US economic slowdown. Even though it contracted, it improved the most in the last three months.

Market participants mainly ignored the data, as the GBP/USD reaction was muted. Speculators slashed their bets for a Federal Reserve (Fed) rate cut in 2023; they expect a 25 bps rate hike through the remainder of 2023, according to CME FedWatch Tool data. Policymakers revised the Federal Funds Rate (FFR) above 5.50%, but investors do not believe the Fed would surpass 5.50%, as shown by the swaps market.

The US Dollar Index (DXY), which measures the performance of six currencies vs. the American Dollar (USD), slides 0.17%, down to 102.696, undermined by falling US Treasury bond yields.

Across the pond, the UK economic calendar was absent, though a Reuters poll showed investors expect the Bank of England (BoE) to increase borrowing costs by 50 basis points towards the end of 2023. The latest week’s inflation data in the UK opened the door for a surprising 50 bps rate hike by the BoE while increasing the odds for further tightening amidst stubbornly high inflation.

Even though a rate hike will usually appreciate the currency of a country that raised borrowing costs, in the UK happened, the opposite as the economy continues to deteriorate and mortgage rates rose. That spurred fears the UK’s economy would be tipped into a recession. Therefore, speculators piled in a sold the GBP/USD.

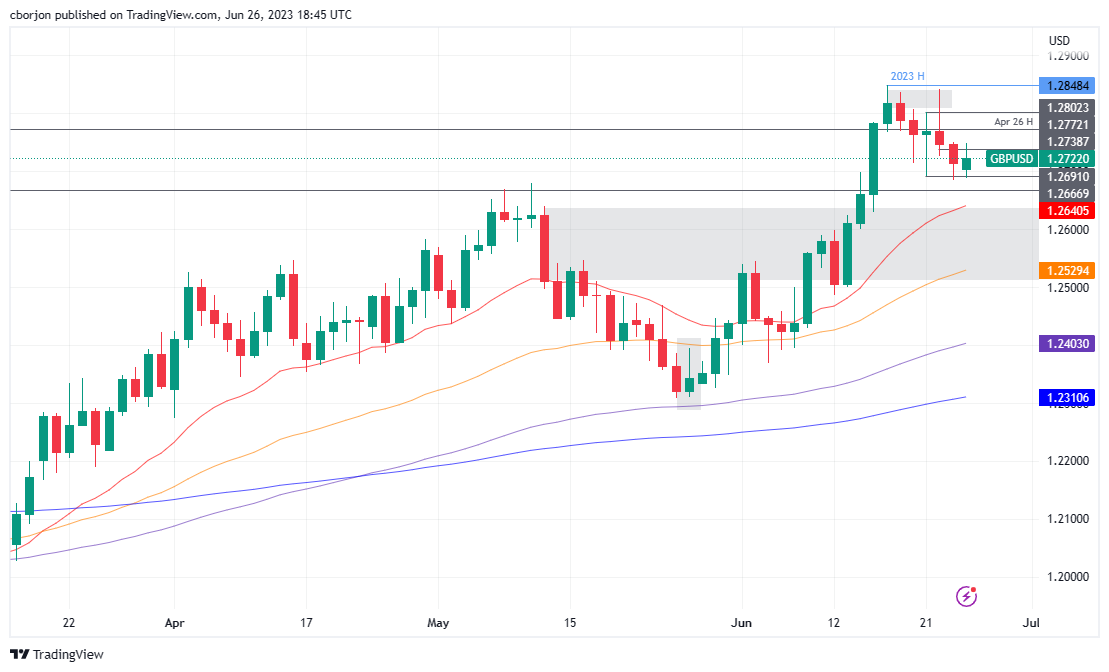

GBP/USD Price Analysis: Technical outlook

From a technical perspective, the GBP/USD remains upward biased, but to continue its uptrend, buyers must achieve a daily close above the June 23 high of 1.2749. In that outcome, the GBP/USD could extend its gains past 1.2800 and re-test the year-to-date (YTD) high of 1.2748. Conversely, that will exacerbate the GBP/USD fall toward the 1.2600 handle, exposing the 20-day Exponential Moving Average (EMA) at 1.2641 as the first resistance. Breach or the latter will expose the psychological 1.2600 figure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.