- Analytics

- News and Tools

- Market News

- USD/TRY challenges weekly peaks past 23.60 on CBRT hike

USD/TRY challenges weekly peaks past 23.60 on CBRT hike

- USD/TRY resumes the upside north of 23.600.

- The CBRT hiked rates for the first time since August 2021.

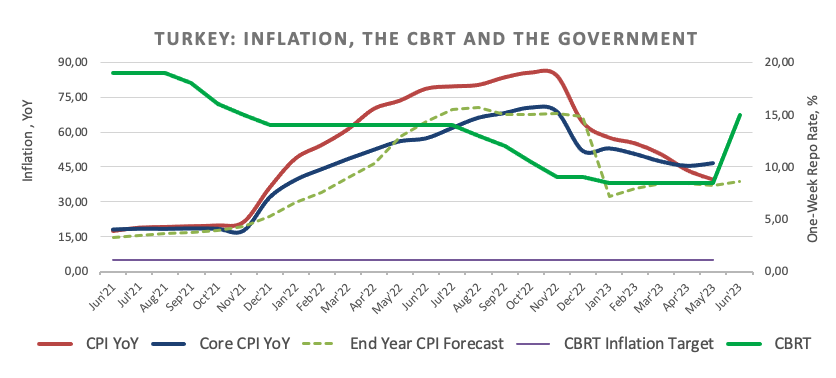

- The central bank raised rates by 650 bps to 15.00%.

The Turkish lira gives away part of the gains seen earlier in the week and lifts USD/TRY back to the area beyond the 23.6000 level on Thursday.

USD/TRY stronger post-CBRT

After two consecutive daily declines, the USD/TRY currency pair has rebounded and continued its upward trend past the 23.6000 level. This occurred despite investor disappointment following the Turkish central bank's decision to raise the One-Week Repo Rate by 650 basis points during its event on Thursday.

The central bank's move was intended to kick-start the monetary tightening process, establish a disinflation course, anchor inflation expectations, and control pricing behavior.

The CBRT reiterated its commitment to the 5% inflation target and did not rule out additional monetary tightening measures to achieve this target.

What to look for around TRY

USD/TRY now seems to have embarked on a consolidative phase in the upper end of the recent range.

In the meantime, investors are expected to closely monitor upcoming decisions on monetary policy. By appointing Mehmet Simsek and Hafize Gaye Erkan, both former Wall Street bankers, to oversee the country's finances, President R. T. Erdogan seems to suggest a possible move away from heavy state intervention in favor of letting the market dictate the fair value of the currency.

Although it remains uncertain whether Mr. Erdogan's preference for combating inflation through lower interest rates will allow Simsek and Erkan's orthodox approach to monetary policy to thrive, the news of their appointment has been so far cautiously welcomed by market participants.

In a broader sense, price action around the Turkish currency is expected to continue to revolve around the performance of energy and commodity prices, which are directly tied to developments from the Ukraine conflict, broad risk appetite trends, and dollar dynamics.

Key events in Türkiye this week: Consumer Confidence (Monday) – Capacity Utilization, Manufacturing Confidence (Wednesday) – CBRT Interest Rate Decision (Thursday) – Economic Confidence Index, Trade Balance (Friday).

Eminent issues on the back boiler: Persistent skepticism over the CBRT credibility/independence. Absence of structural reforms. Bouts of geopolitical concerns.

USD/TRY key levels

So far, the pair is gaining 0.61% at 23.6595 and faces the next hurdle at 23.6804 (all-time high June 12) followed by 24.00 (round level). On the downside, a break below 20.5294 (55-day SMA) would expose 19.8125 (100-day SMA) and finally 19.2064 (200-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.