- Analytics

- News and Tools

- Market News

- EUR/JPY Price Analysis: Eyes downtrend amid overbought RSI’s, ECB hawks hold back fall

EUR/JPY Price Analysis: Eyes downtrend amid overbought RSI’s, ECB hawks hold back fall

- EUR/JPY faces a neutral downward trend in the short term.

- Key support at Tenkan-Sen, Senkou Span B lines, though the EUR/JPY trades inside the Ichimouku cloud.

- Resistance awaits at 154.61 daily pivots, ahead of breaching the 155.00 figure.

The EUR/JPY drops as the Asian session commences, following a bearish session on Tuesday that witnessed a fall of 0.40%. However, expectations for further tightening by the European Central Bank (ECB) capped the cross’s fall. At the time of writing, the EUR/JPY exchanges hand at 154.37, down 0.02%.

EUR/JPY Price Analysis: Technical outlook

The daily chart portrays the pair in a strong uptrend, though price action is overextended, as the Relative Strength Index (RSI) exists from overbought conditions. That triggered the EUR/JPY downward correction toward the current week’s low of 154.04, but the pair recovered some traction since then.

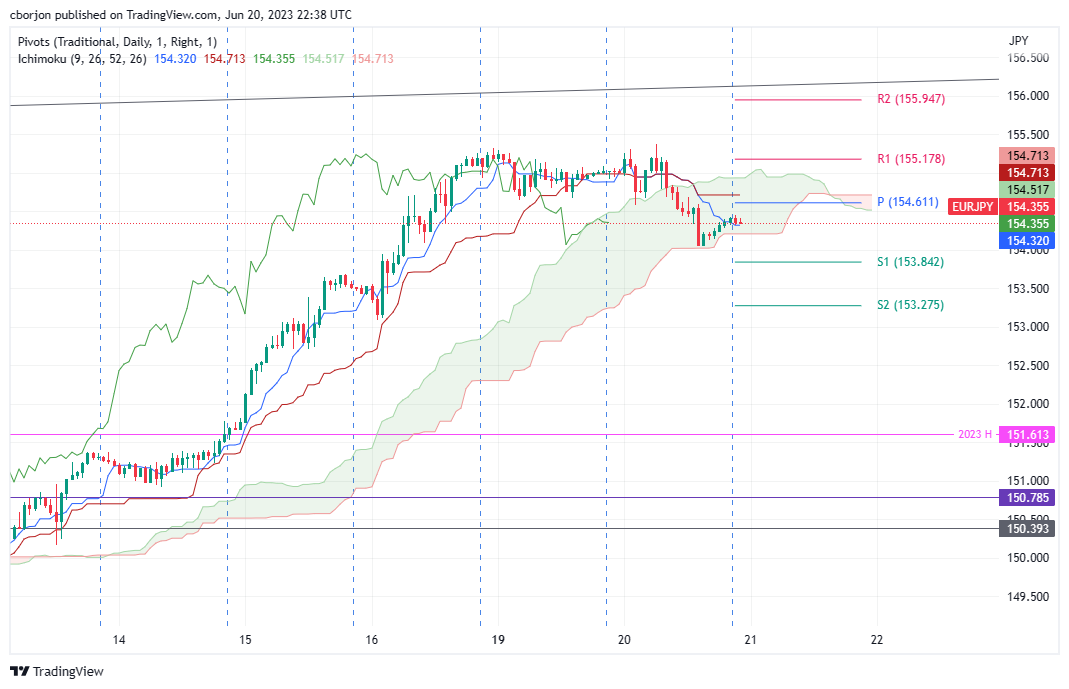

In the short term, the EUR/JPY 1-hour chart portrays the pair as neutral downwards. Traders must be aware the EUR/JPY is trading inside the Ichimoku cloud; therefore, price action would remain capped withint the Span A and B lines, each at 154.94/154.20.

If EUR/JPY breaks below the Tenkan-Sen line and the Senkou Span B line at around 154.32/20, the EUR/JPY would accelerate its downtrend. The next support would be the 154.00 figure, followed by the S1 daily pivot at 153.84. A decisive break will expose the 153.50, followed by the S2 pivot point at 153.27.

Conversely, the EUR/JPY first resistance would be the daily pivot at 154.61. Once cleared, the Kijun-Sen line is up for grabs at 154.71, followed by the Senkou Span A at 154.94, before cracking the 155.00 figure.

EUR/JPY Price Action – Hourly chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.