- Analytics

- News and Tools

- Market News

- USD Index extends the rebound from lows near 102.00

USD Index extends the rebound from lows near 102.00

- The index adds to Thursday’s gains north of 102.00.

- US markets will be closed on the Monday.

- Investors started to assess the potential Fed’s move in July.

The USD Index (DXY) tracks the greenback, which starts the week on the positive foot and revisits the 102.40 region, marking an increase for the second session in a row so far.

USD Index looks at risk trends, Fed

The index rises for the second session in a row and attempts to put further distance from last week’s multi-week lows around the 102.00 neighbourhood (June 16), as the recent upbeat mood in the risk complex appears to take a breather at the beginning of the week.

In the meantime, investors continue to expect a 25 bps rate hike by the Federal Reserve at the July 26 gathering following June’s hawkish skip, according to CME Group’s FedWatch Tool.

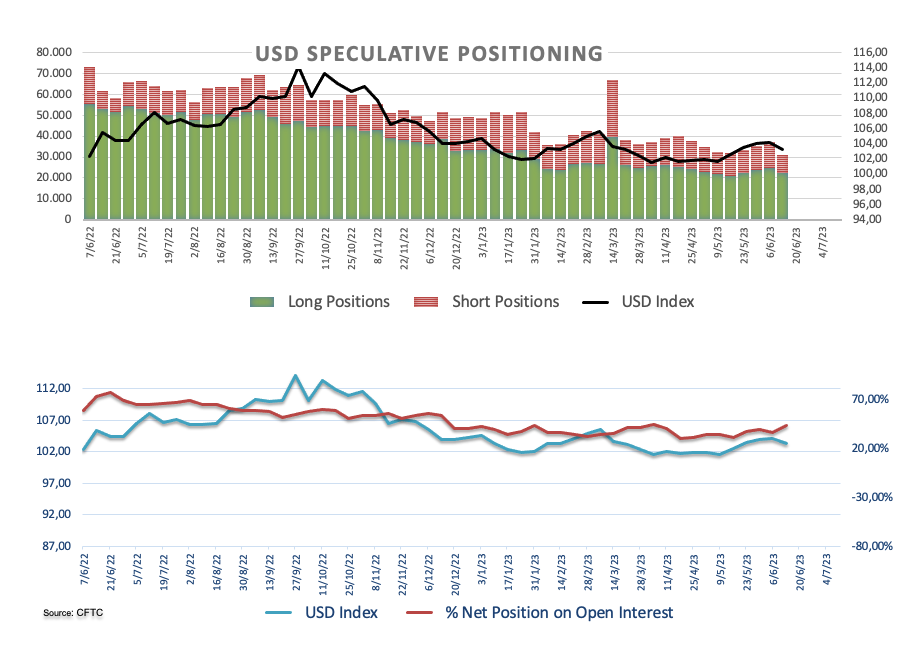

On another front, net longs in the greenback rose to the highest level since early April in the week ended on June 13, just ahead of the crucial FOMC event considering the latest CFTC report.

The only release of note in the US data space will be the NAHB Housing Market Index for the month of June amidst the inactivity in the domestic markets due to the Juneteenth holiday.

What to look for around USD

Despite a three-week negative streak, the index appears to have encountered significant contention around the 102.00 neighbourhood.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high, supported by the continued strength of key US fundamentals such as employment and prices.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: NAHB Housing Market Index (Monday) – Building Permits, Housing Starts (Tuesday) – MBA Mortgage Applications. Fed’s Powell Testimony (Wednesday) – Chicago Fed National Activity Index, Initial Jobless Claims, Fed’s Powell Testimony, Existing Home Sales (Thursday) – Advanced Manufacturing/Services PMIs (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.05% at 102.35 and the breakout of 103.04 (100-day SMA) would open the door to 104.69 (monthly high May 31) and then 105.25 (200-day SMA). On the downside, the next support emerges at 102.00 (monthly low June 16) followed by 100.78 (2023 low April 14) and finally 100.00 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.