- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears test $1,930 key support on hawkish Fed bets – Confluence Detector

Gold Price Forecast: XAU/USD bears test $1,930 key support on hawkish Fed bets – Confluence Detector

- Gold Price prods crucial support confluence as US Dollar, yields cheer hawkish Fed bias.

- FOMC met expectations of holding rates unchanged but dot plot, Powell’s Speech weighs on XAU/USD price.

- Downbeat China data adds strength to bearish bias but $1,930, US data holds the key to further Gold Price weakness.

Gold Price (XAU/USD) drops to a three-month low as market players seek solace in the Fed’s hawkish hold, as well as downbeat China data, during the bumper week. That said, the US central bank kept the benchmark interest rate unchanged at 5.0-5.25%, matching market expectations of pausing the multi-month-old hawkish cycle after 10 consecutive rate increases. However, the upbeat FOMC Economic Projections and Federal Reserve (Fed) Chairman Jerome Powell’s speech renewed the hawkish Fed bias surrounding the July meeting and weighed on the XAU/USD afterward.

Elsewhere, downbeat prints of China Retail Sales and Industrial Production join firmer US Treasury bond yields to also keep the Gold bears hopeful. However, the People’s Bank of China’s (PBoC) rate cut and the Fed’s emphasis on incoming data for decision-making keeps the XAU/USD sellers skeptical.

Hence, today’s Retail Sales for May and other mid-tier activity data, as well as the weekly Jobless Claims, will be important to watch. Additionally, the European Central Bank’s (ECB) monetary policy meeting results will be eyed too as it can be directly linked to the US Dollar and the Gold Price.

Also read: Gold Price Forecast: Fed’s hawkish pause powers XAU/USD bears, $1,918 and ECB next in sight

Gold Price: Key levels to watch

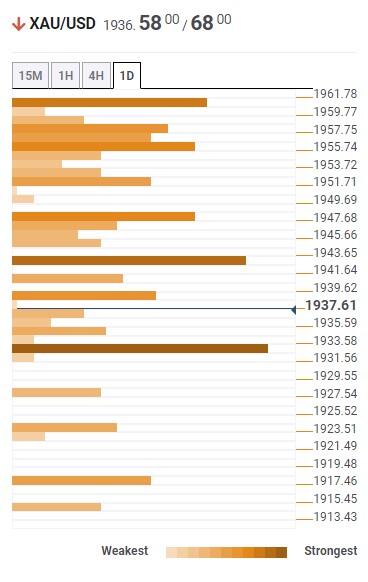

Our Technical Confluence Indicator signals that the Gold Price knocks on the door of bears after a long run to defend itself from bulls. That said, the XAU/USD is near the $1,932 key support comprising lows marked on hourly, four-hour and one-month timeframes, as well as the lower band of the Bollinger on the 15-minute chart.

Following that, the Fibonacci 161.8% on the weekly play, close to $1,917, may offer a small hiccup to the Gold bears on their way toward the $1,900 round figure.

Meanwhile, the 100-DMA joins the Pivot Point one-week S1 to highlight $1,943 as the short-term key upside hurdle for the XAU/USD buyers to cross.

Even if the Gold Price rises past $1,943, the Fibonacci 38.2% on Daily chart may prod the bulls near $1,948 ahead of highlighting the $1,950 upside hurdle.

It’s worth noting that the Gold Price run-up beyond $1,950 is still not a free road for the bulls as the previous daily high and Fibonacci 38.2% on one-week, near $1,960, can also check the XAU/USD buyers.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.