- Analytics

- News and Tools

- Market News

- WTI bears taking control and eye 4-hour support targets

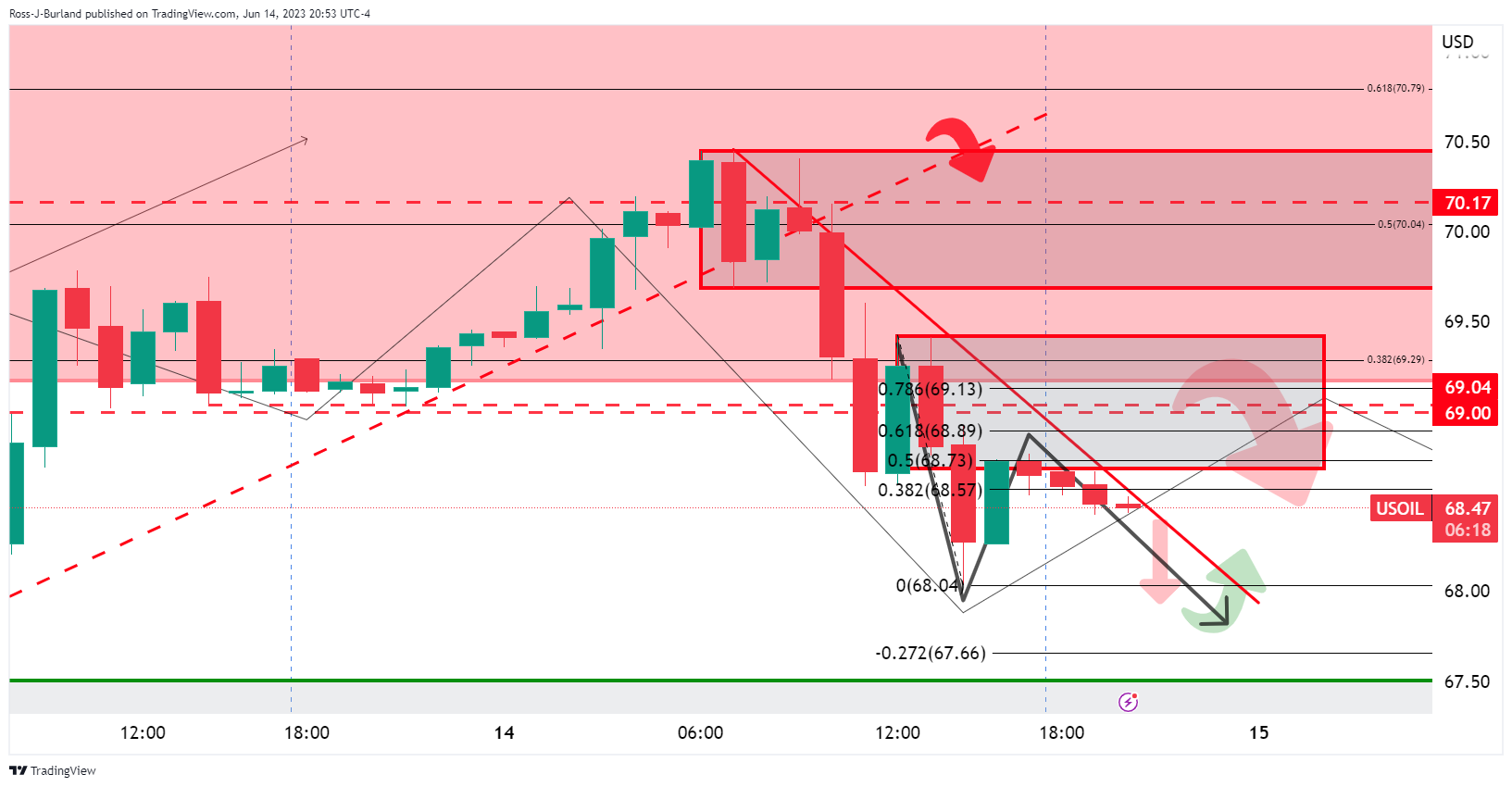

WTI bears taking control and eye 4-hour support targets

- WTI is on the offer following a series of impactful factors.

- WTI bears have eyes on $67.50/00 but there are prospects of a bullish correction.

West Texas Intermediate, WTI, is down some 0.2% in the Asian session and it has travelled between a low of $68.51 and $68.67 so far. Crude oil dropped on Wednesday, breaking key support structure on the downside as a pause in US interest rate hikes and along with an unexpected build in weekly EIA crude inventories.

Initially, Crude prices found support on the back of Chinese crude oil quotas. Bloomberg reported that the Chinese government gave refiners an allocation of 62.28 million tons, which took the total quota this year to around 194 million tons, +18% more than the same time last year.

However, in the early part of the US day, Wednesday's US May PPI report showed prices eased to +1.1% y/y from +2.3% YoY in Apr, better than expectations of +1.5% YoY and the smallest increase in over two years.

All in all, crude oil fell amid signs of weaker demand. Analysts at ANZ Bank explained that US crude oil stockpiles rose by 7.92kbbl last week, according to EIA data. ''This was exacerbated by inventories at the key storage hub of Cushing hitting its highest level since 2021. Gasoline and distillate stockpiles were also higher, rising 2,108kbbl and 2123kbbl respectively,'' the analysts explained.

''Earlier in the session sentiment was boosted by comments from the IEA that the oil market will tighten significantly in the near term as China’s consumption rebounds from the pandemic. This came after Beijing issued a large batch of crude import quotas, signalling stronger demand,'' the analysts explained further.

WTI technical analysis

- WTI Price Analysis: Bears make their moves during the Fed, break support structure

On the hourly chart, bears have eyes on $67.50/00 overall, but as the analysis above shows, there are prospects of a move to the upside also.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.