- Analytics

- News and Tools

- Market News

- EUR/USD climbs past 1.0800 in the wake of US CPI

EUR/USD climbs past 1.0800 in the wake of US CPI

- EUR/USD rises to new multi-week highs in the 1.0820/25 band.

- Germany, EMU Economic Sentiment came in mixed in June.

- US headline CPI surprises to the downside in May.

EUR/USD sees its upside reinvigorated and advances to new highs past 1.0820 on turnaround Tuesday.

EUR/USD now looks at Fed, ECB

The upside momentum in EUR/USD gathers extra impulse and appears to surpass the 1.0800 hurdle in a more convincing fashion following the release of US inflation figures measured by the CPI.

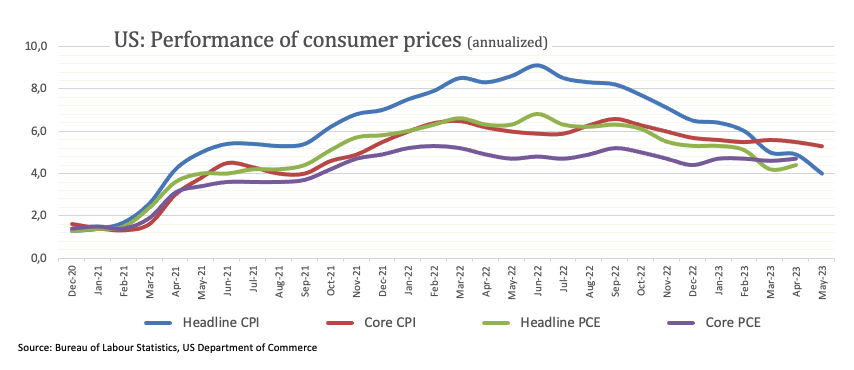

On the latter, further disinflationary pressures saw the headline CPI rise less than expected 4.0% in the year to May and 5.3% when it comes to prices excluding food and energy costs (the core CPI).

In the meantime, the greenback weakens further and flirts with the 103.00 neighbourhood when tracked by the USD Index (DXY) in tandem with further decline in US yields across the curve.

Closer to home, the Economic Sentiment in both Germany and the broader Euroland improved to -8.5 and deteriorated to -10.0, respectively, for the current month.

What to look for around EUR

EUR/USD manages to surpass the key 1.0800 barrier on the back of the persistent selling bias in the US dollar.

In the meantime, the pair’s price action is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB speak continues to favour further rate hikes, although this view appears to be in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany Final Inflation Rate, Economic Sentiment, EMU Economic Sentiment (Tuesday) – EMU Industrial Production (Wednesday) – Eurogroup Meeting, EMU Balance of Trade, ECB Interest Rate Decision, ECB Lagarde (Thursday) – ECOFIN Meeting, Final EMU Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle in June and July (and September?). Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.52% at 1.0809 and the surpass of 1.0823 (monthly high June 13) would target 1.0878 (55-day SMA) en route to 1.0904 (weekly high May 16). On the other hand, the next support at 1.0635 (monthly low May 31) seconded by 1.0516 (low March 15) and finally 1.0481 (2023 low January 6).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.