- Analytics

- News and Tools

- Market News

- Aussie Gross Domestic Product (Q1): Miss by 0.1% QoQ and YoY, AUD/USD in 15 pip rangesteady

Aussie Gross Domestic Product (Q1): Miss by 0.1% QoQ and YoY, AUD/USD in 15 pip rangesteady

The Australian Bureau of Statistics (ABS) has released the Gross Domestic Product (GDP):

- Australia Gross Domestic Product (YoY) came in at 2.3%, below expectations (2.4%) in 1Q.

- Australia Gross Domestic Product (QoQ) came in at 0.2% below forecasts (0.3%) in 1Q.

AUD/USD update

AUD/USD is in a 15-pip range on the data.

-

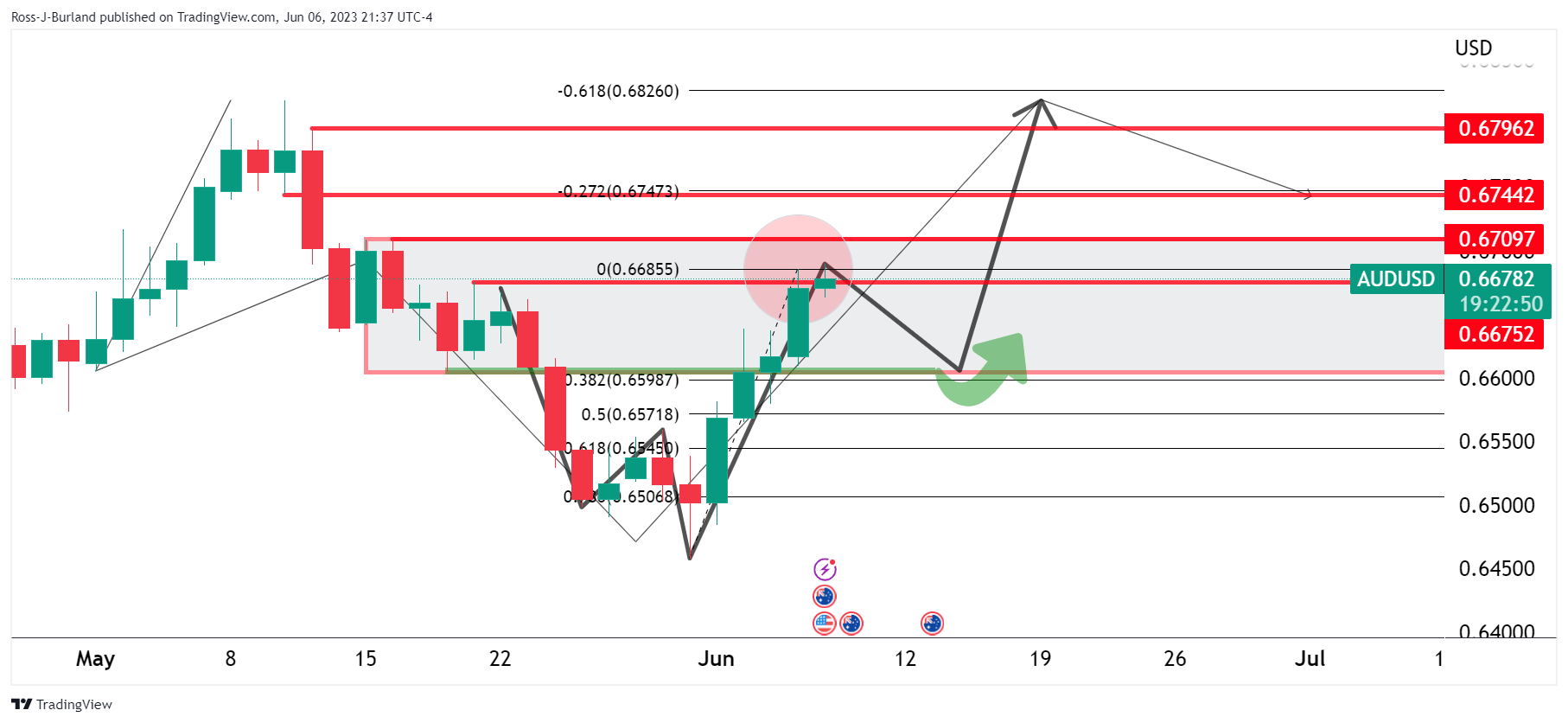

AUD/USD Price Analysis: Bulls eye 0.6700 but bears are lurking ahead of the Fed

As illustrated in the article above, the daily chart shows the price in a W-formation also, but this could be about to complete with a pullback to restest the commitment of the bulls.

A declaration of the momentum with a creeping correction into the Federal Reserve meeting, June 14, could be on the cards.

On the other hand, there is a series of days that have been running in the green which could come under pressure mid-week as follows:

A break of the trendline, 20 EMA and 0.6665 would open risk to test 0.6640 and 0.6612 structures and possible support areas.

About the Gross Domestic Product (GDP)

The Australian Bureau of Statistics (ABS) releases the Gross Domestic Product (GDP) on a quarterly basis. It is published about 65 days after the quarter ends. The indicator is closely watched, as it paints an important picture for the economy. A strong labor market, rising wages and rising private capital expenditure data are critical for the country’s improved economic performance, which in turn impacts the Reserve Bank of Australia’s (RBA) monetary policy decision and the Australian dollar. Actual figures beating estimates is considered AUD bullish, as it could prompt the RBA to tighten its monetary policy.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.