- Analytics

- News and Tools

- Market News

- AUD/USD bulls eye 0.6670s, RBA around the corner

AUD/USD bulls eye 0.6670s, RBA around the corner

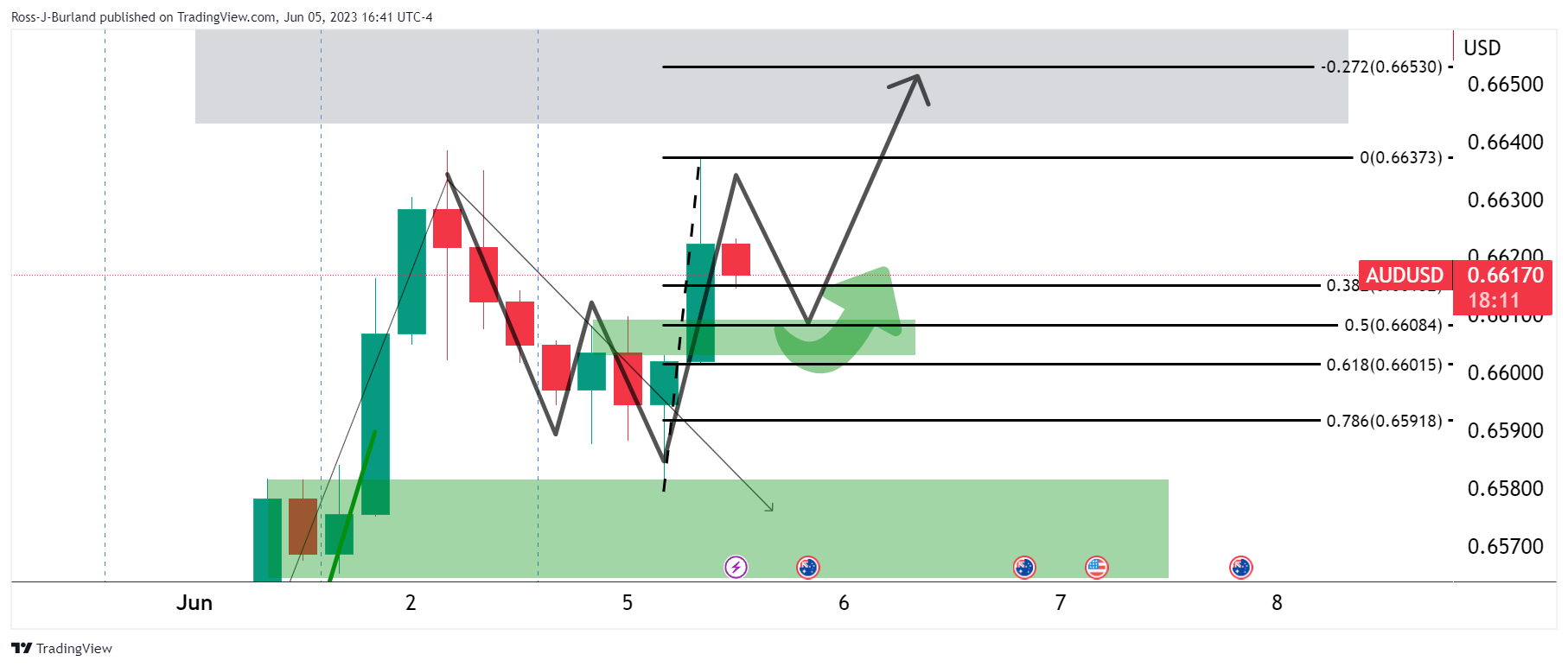

- AUD/USD is moving into the necklines of the W-formations.

- AUD/USD traders await the RBA key event.

AUD/USD is higher by some 0.18% on the day and met support on Monday that attracted buyers to test the prior day´s high of 0.6638. This has occurred as the market gets set for the Reserve Bank of Australia meeting today.

´´Following this week's data we now expect the RBA's target cash rate to peak at 4.35% with a 25bps hike with another in August,´´ analysts at TD Securities explained.

´´Given the monthly April inflation print showed the Bank departing further from its Q2'23 trimmed mean f/c and the higher than expected Fair Wage Commission decision, there is now a strong case for the Bank to move sooner rather than later.´´

Meanwhile, analysts at Rabobank argued that while the market has already assessed that the risks of a RBA rate hike have risen, a policy move would likely result in upside pressure on AUD/USD.

´´Although the AUD may edge a little lower on a steady policy announcement, we would expect that the downside would be limited given our house view that the RBA will be leaving the door open to another rate hike later in the year,´´ the analysts explained.

That said, their expectation that the USD is likely to remain well supported in the coming months suggests that AUD/USD may struggle to break above the 0.66-0.67 area.

As for the US Dollar, the index cut early gains to trade little changed around 104 on Monday on the back of Factory Orders that rose 0.4% in April, well below what had been expected. Additionally, ISM Services PMI fell sharply to the lowest in five months in May.

The data dented the US Dollar that had otherwise enjoyed the Nonfarm Payrolls and a remarkable 339K jobs in May. However, the Unemployment Rate rose by 0.3 percentage points to 3.7% and hourly wage growth slowed. Around 80% of market participants expect the Fed to leave rates steady when it meets next week.

AUD/USD technical analysis

The W-formations are pulling the price into the necklines. There are targets set higher with the 0.6670s eyed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.