- Analytics

- News and Tools

- Market News

- USD/TRY surpasses 21.00 to print fresh all-time highs

USD/TRY surpasses 21.00 to print fresh all-time highs

- USD/TRY advances to the 21.30 region on Monday.

- Investors appears skeptics after the appointment of M. Simsek.

- Türkiye headline CPI rose below 40% YoY in May.

There seems to be no respite for the weakness of the Turkish lira. That said, USD/TRY clocked a new record high well north of the 21.0000 mark on Monday.

USD/TRY: Further upside looks likely

USD/TRY maintains its firm bullish bias for yet another session and this time breaks above the 21.0000 mark with marked conviction, as investors remain highly apathetic following the announcement of new members of Erdogan’s cabinet.

Recently appointed Treasury and Finance Minister M. Simsek said over the weekend that returning to "rational ground" is necessary to ensure predictability in the economy and emphasized that the new government's primary objective will be to enhance social welfare.

It is worth noting that the lira has already lost more than 14% since January.

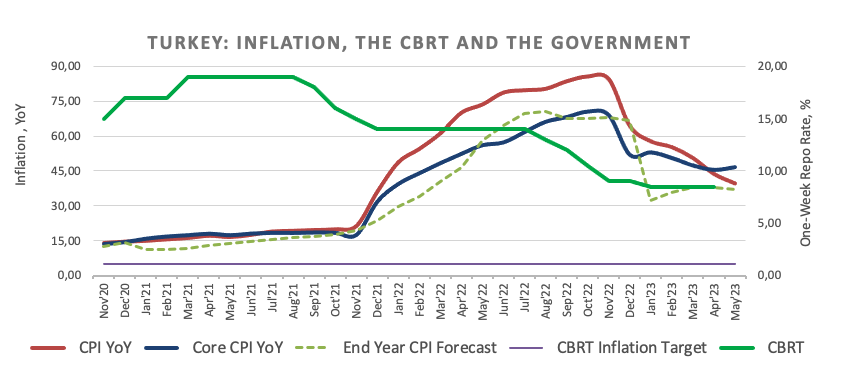

In the docket, inflation figures in Turkey tracked by the headline CPI rose at an annualized 39.59% in May and 0.04% vs. the previous month. It was the first reading below 40% since December 2021. In addition, the Core CPI (CPI excluding energy, food, non-alcoholic beverages, alcoholic beverages, tobacco, and gold) rose 46.62% YoY.

What to look for around TRY

USD/TRY maintains its upside bias well in place, always underpinned by the relentless meltdown of the Turkish currency.

In the meantime, investors are expected to closely monitor upcoming decisions on monetary policy, particularly after President R. T. Erdogan named former economy chief M. Simsek as the new finance minister following the cabinet reshuffle in the wake of the May 28 second round of general elections.

The appointment of Simsek has been welcomed with optimism by market members in spite of the fact that it is not yet clear whether his orthodox stance on monetary policy can survive within Erdogan’s inclination to battle inflation via lower interest rates.

In a more macro scenario, price action around the Turkish lira is supposed to continue to spin around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine, broad risk appetite trends, and dollar dynamics.

Key events in Türkiye this week: CPI, Producer Prices (Monday) – Industrial Production (Friday).

Eminent issues on the back boiler: Persistent skepticism over the CBRT credibility/independence. Absence of structural reforms. Bouts of geopolitical concerns.

USD/TRY key levels

So far, the pair is gaining 1.70% at 21.2381 and faces the next hurdle at 21.3119 (all-time high June 5) followed by 22.00 (round level). On the downside, a break below 19.5366 (55-day SMA) would expose 19.2216 (100-day SMA) and finally 18.8743 (200-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.