- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls can stay hopeful above $1,968, US NFP, Fed clues eyed – Confluence Detector

Gold Price Forecast: XAU/USD bulls can stay hopeful above $1,968, US NFP, Fed clues eyed – Confluence Detector

- Gold Price remains around weekly top, grinds higher past key support confluence.

- Cautious optimism ahead of the US NFP, absence of major data/events prod XAU/USD bulls of late.

- Reconfiguration of Fed bets, optimism about US debt-ceiling deal keeps Gold buyers hopeful.

- Downbeat US employment figures, no US default can keep XAU/USD bulls in the driver’s seat.

Gold Price (XAU/USD) remains on the bull’s radar as it prints the first weekly gain in four heading into the key US employment report for May amid cautious optimism in the market. That said, the bullion’s latest run-up could be linked to the broad reduction in the market’s hawkish expectations from the Federal Reserve (Fed), as well as hopes of avoiding the ‘catastrophic’ US default. Adding strength to the Gold Price upside could be the latest run-up in the equities, backed by the technology shares and downbeat yields. It’s worth noting that the fresh optimism about China’s economic recovery adds strength to the XAU/USD upside as Beijing is one of the world’s biggest Gold consumers.

Moving on, today’s US employment report becomes more important and hence any surprise in the headline figures won’t be taken lightly. That said, Nonfarm Payrolls (NFP) to ease to 190K from 253K prior while the Unemployment Rate is also expected to increase to 3.5% from 3.4%. Apart from that, the US Senate’s passage of the debt-ceiling bill and the avoidance of the default woes, as well as the last round of the Fed talks ahead of the pre-Federal Open Market Committee (FOMC) blackout period for policymakers, should also be eyed closely for clear directions.

Also read: US May Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises

Gold Price: Key levels to watch

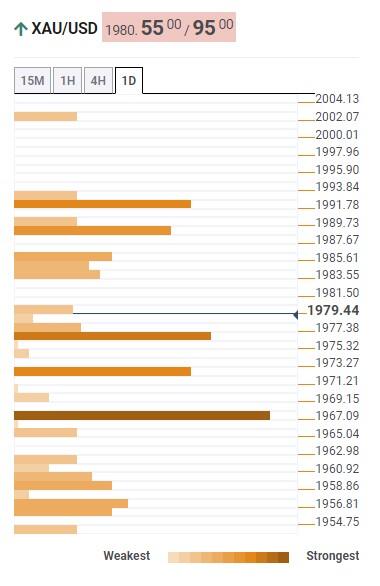

As per our Technical Confluence Indicator, the Gold Price grinds higher past $1,968 key confluence level comprising the 50-HMA, Fibonacci 61.8% in one-week and 23.6% on one-month.

Not only that, but the XAU/USD also trades beyond the Fibonacci 38.2% in one-day and the middle band of the Bollinger on the hourly chart, around $1,972 hurdle, to keep the buyers hopeful.

Also acting as an immediate support, previous resistance, is the convergence of the Pivot Point one-week R1 and Fibonacci 23.6% on one-day.

With this, the Gold Price appears capable of approaching the $1,992 upside hurdle including the 50-DMA and 200-HMA on four-hour chart.

Ahead of that, the $1,989-90 area may prod the XAU/USD bulls as it comprises the Pivot Point one-day R1 and Fibonacci 23.6% on one-month.

In a case where the Gold buyers manage to keep the reins beyond $1,992, the $2,000 round figure may act as the last defense of the Gold bears.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.