- Analytics

- News and Tools

- Market News

- AUD/USD bulls are taking on the 0.6580s, eyes on 0.6600

AUD/USD bulls are taking on the 0.6580s, eyes on 0.6600

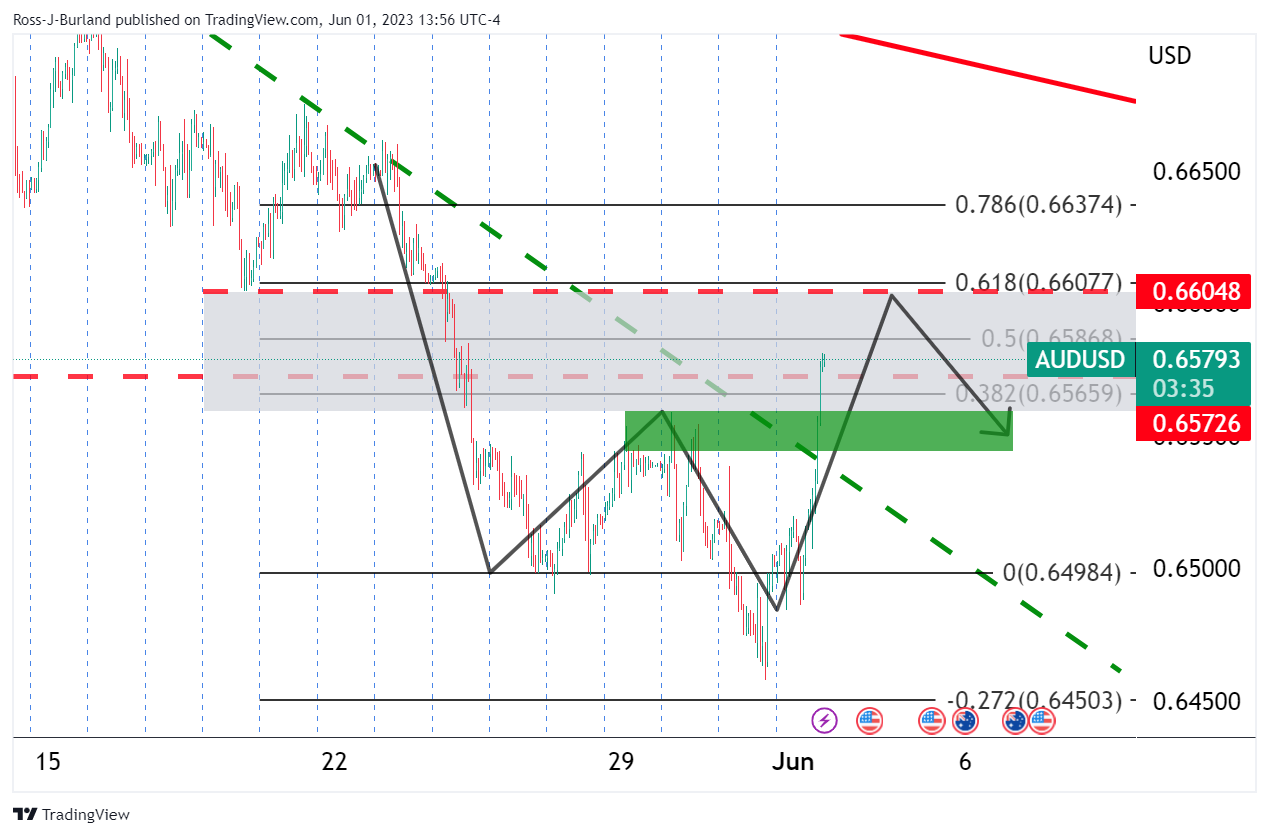

- AUD/USD bulls are moving towards a key resistance area.

- Bears eye a correction into the W-formation´s neckline.

AUD/USD is better bid as we approach lunchtime in the New York session on Thursday. The pair has traveled from a low of 0.6484 and is testing 0.6581 so far.

The US Dollar index fell to 103.52, the lowest for some time as fresh data and comments from some Fed officials raised bets the central bank will pause in June. Firstly, a slump in productivity was revised lower, while the ISM PMI showed the manufacturing sector contracted for a 7th month. Initial jobless claims and the ADP report beat forecasts but the data indicates a less tight labour market.

Additionally, the Federal Reserve´s Governor Philip Jefferson and Philadelphia Fed President Patrick Harker suggested the central bank would skip a rate hike in the next meeting. This all comes ahead of the US Nonfarm Payrolls showdown on Friday. A strong outcome will likely reignite a US Dollar rally while a disappointment will likely boost AUD/USD.

´´US payrolls likely slowed modestly in May, advancing at a still strong 200k+ pace for a second consecutive month. We also look for the UE rate to stay unchanged at a historical low of 3.4%, and for wage growth to print 0.3% MoM (4.4% YoY),´´ analysts at TD Securities said.

AUD/USD technical analysis

Technically, AUD/USD has been pressing up against trendline resistance that it is now breaking at the time of writing. This puts the pair on the way to a test of a 50% mean reversion area. The break of this trendline resistance has opened risk to prior lows near 0.6605 and a 61.8% Fibonacci level. This, in turn, will leave behind a W-formation, a reversion pattern. The neckline will be eyed in the 0.6660s for a restest as support as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.