- Analytics

- News and Tools

- Market News

- NZD/USD bulls hold the baton, for now

NZD/USD bulls hold the baton, for now

- NZD/USD bulls remain in control riding the trendline support.

- A break of the trendline support opens risk of a move lower.

NZD/USD was moving higher midweek and reached 0.6273 after climbing from a low of 0.6224. At the time of writing, the pair is trading flat at around 0.6243.

´´The Kiwi is at the upper end of the week’s ranges early this morning following a whippy night that also saw a rebound in the USD, which has of course meant that the Kiwi has done well on most crosses,´´ the analysts at ANZ Bank said in a note on Wednesday.

The analysts note that today is Budget day and say that it has been flagged as a no-frills one.

´´Rating agencies are hoping for restraint, and FX markets are in turn hoping that rating agencies give it a tick. But with the tax take slowing, demands on the public purse growing, and deficits expected to persist for longer, FX markets are worried rating agencies might caution us, especially given our record current account deficit.´´

Meanwhile, the US Dollar index, a measure of the greenback's value against six major currencies, climbed as high as 103.11 and to its strongest level since late March. There was the possibility of agreement on the US debt ceiling while US President Joe Biden expressed confidence an agreement will be reached. House Representative Speaker Kevin McCarthy argued that a debt-ceiling agreement by Sunday is doable. Meanwhile, US Vice President Kamala Harris is to brief on preventing a default on Thursday.

NZD/USD technical analysis

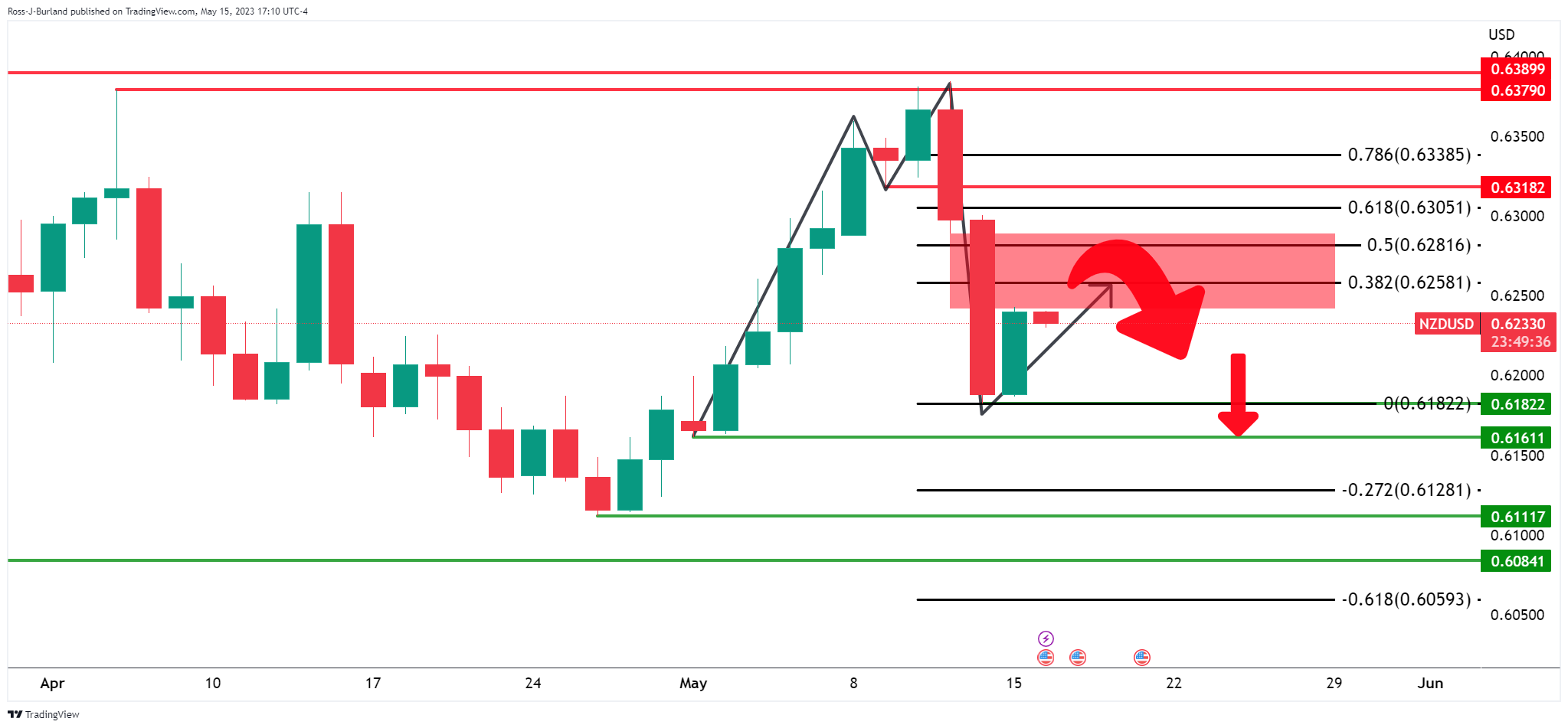

As per the prior day´s analysis, NZD/USD bulls in the market and eye a firm correction, the pair moved up into the 38.2% Fibonacci resistance and came close to a 50% mean reversion:

Prior analysis:

Update 1:

Update 2, live market:

There are still prospects of a move lower although the 4-hour and 1-hour charts can be used to gauge as to whether there is going to be a deceleration in the bullish correction and so far, it is early days still. After all, the price is still on the front side of the bullñish dynamic trendline support.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.