- Analytics

- News and Tools

- Market News

- NZD/USD bulls in the market and eye a firm correction

NZD/USD bulls in the market and eye a firm correction

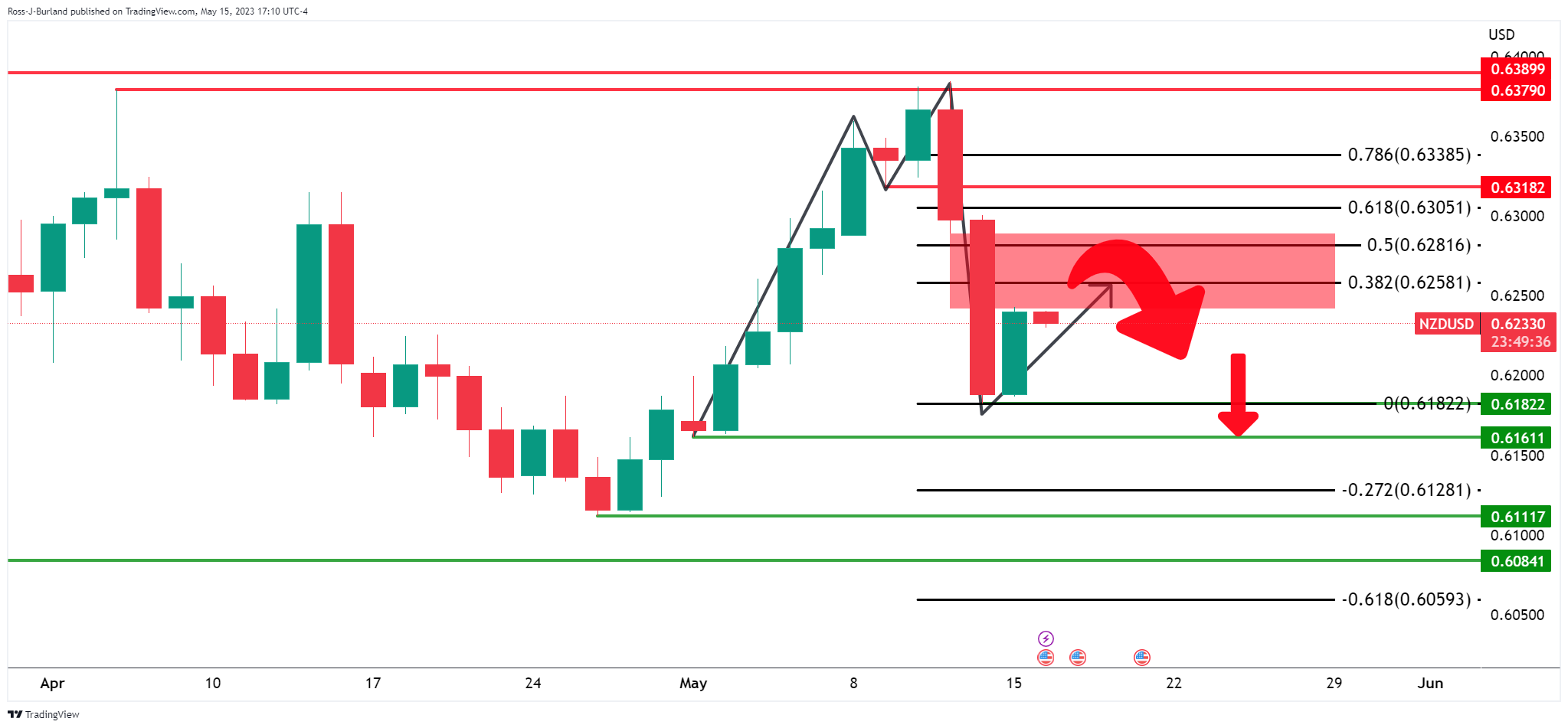

- NZD/USD bulls are moving on a soft US Dollar.

- Bears are lurking in the Fibonacci scale below 0.6320.

NZD/USD is down on the day, losing some 0.12%, and has fallen from a high of 0.6240 and reached a low of 0.6232.

The Kiwi has picked up a touch off yesterday’s lows, reflecting a combination of a weaker USD, and market chatter about the possibility of the OCR perhaps needing to climb to 6% given the migration boom.,´´ analysts at ANZ Bank explained.

´´It is certainly a risk and as we have said for a while, we do think local rates markets are overplaying cuts when the battle against inflation isn’t even won yet, but New Zealand faces fiscal and current account challenges as well, so other than higher carry, it’s not clear whether these challenges and presumably the prospect of moderating growth is good for the Kiwi,´´ the analysts added.

´´In the US, debt ceiling negotiations are dragging on, and Fed speakers are pushing back against market calls for cuts; that’s helping the USD,´´ the analysts concluded.

NZD/USD technical analysis

From a daily perspective, the M-formation is pulling the price into the Fibonacci scale with a focus on the 0.6320s as a key resistance area if bulls were to commit.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.