- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls eye $2,050 and more US inflation clues – Confluence Detector

Gold Price Forecast: XAU/USD bulls eye $2,050 and more US inflation clues – Confluence Detector

- Gold price struggles to defend weekly gains as $2,050 hurdle keeps pushing back XAU/USD buyers.

- Mixed details of US inflation, cautious optimism and softer China data prod Gold price upside.

- US PPI, consumer inflation expectations eyed for clear directions.

Gold price (XAU/USD) stays on the way to posting a three-week uptrend despite the previous day’s retreat from the key $2,050 resistance. In doing so, the precious metal buyers benefit from the softer US inflation numbers and the downbeat US Dollar. However, mixed details of the US price pressure data join the US-China headlines and looming fears of the US default to prod the XAU/USD bulls.

It should be noted that the mixed concerns about the US inflation details and the market’s consolidation ahead of the US Producer Price Index (PPI), as well as the University of Michigan’s (UoM) 5-year Consumer Inflation Expectations, prod the Gold price upside. Furthermore, China’s lack of interest in placating the Sino-American tension and softer Consumer Price Index (CPI) from the dragon nation also seems to exert downside pressure on the Gold price.

Also read: Gold Price Forecast: XAU/USD defines a range but upside remains favored

Gold Price: Key levels to watch

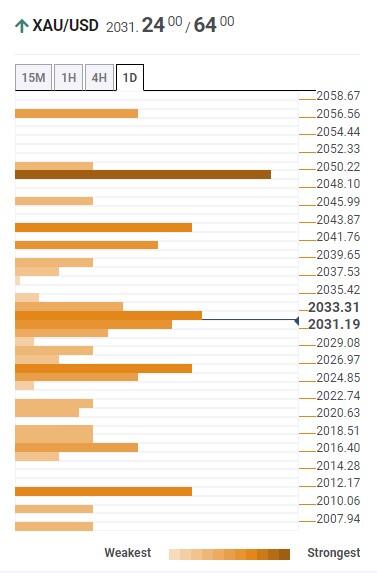

Our Technical Confluence Indicator portrays the Gold price struggle below the $2,050 key resistance comprising the upper band of the Bollinger on the daily chart and the highs marked on previous day, as well as in the previous month.

Ahead of the key $2,050 hurdle, the Pivot Point one-month R1 highlights the $2,043 as an intermediate challenge for the XAU/USD bulls to cross to validate the upside momentum.

Adding to the upside filters is the $2,057-58 region comprising the Fibonacci 23.6% on weekly basis.

It’s worth noting, however, that if the Gold price remains firmer past $2,058, the recently reported all-time high of around $2,080 will be in the spotlight.

Meanwhile, the middle band of the Bollinger on the four-hour play joins Fibonacci 23.6% on one-month to highlight $2,025 as an immediate support for the Gold price.

Following that, a slump towards the $2,015 level comprising the Fibonacci 61.8% on one-week can’t be ruled out.

In a case where the Gold price remains weak past $2,015, the $2,010 level may act as an additional downside filter before allowing the XAU/USD bears to occupy the driver’s seat. That said, Fibonacci 38.2% on one-month constitutes the stated support levels.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.