- Analytics

- News and Tools

- Market News

- Fed Survey: Banks reported tighter standards and weaker demand for loans

Fed Survey: Banks reported tighter standards and weaker demand for loans

The Federal Reserve (Fed) released the April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices, which has become more relevant in the context of concerns about regional US banks. The survey results reflect the first quarter of 2023.

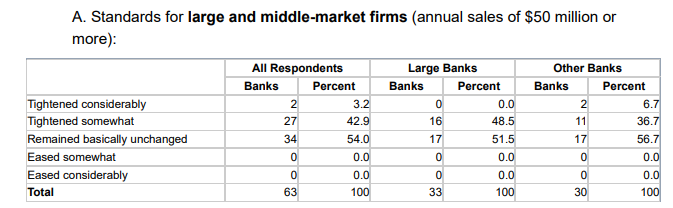

According to the report, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms, as well as small firms, over the first quarter. Banks also mentioned tighter standards and weaker demand for all commercial real estate loan categories.

Key Takeaway from the report:

“Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms as well as small firms over the first quarter.2 Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.”

“For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government-sponsored enterprise (GSE)-eligible and government residential mortgages, which remained basically unchanged.”

“Banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit cards.”

“Regarding the second set of special questions about reasons for changing standards on all loan categories in the first quarter, banks cited a less favorable or more uncertain economic outlook, reduced tolerance for risk, deterioration in collateral values, and concerns about banks' funding costs and liquidity positions.”

“Banks reported expecting to tighten standards across all loan categories. Banks most frequently cited an expected deterioration in the credit quality of their loan portfolios and in customers' collateral values, a reduction in risk tolerance, and concerns about bank funding costs, bank liquidity position, and deposit outflows as reasons for expecting to tighten lending standards over the rest of 2023.”

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.