- Analytics

- News and Tools

- Market News

- EUR/USD losses traction despite hawkish remarks from ECB officials

EUR/USD losses traction despite hawkish remarks from ECB officials

- EUR/USD trading at 1.1027, holding to gains of 0.13% despite the Eurozone Industrial Production plunge.

- Dutch Central Bank President comments on the need for rate hikes to curb inflation.

- US Treasury Secretary Yellen states no favorable alternatives to resolve the debt limit issue without Congress’s assistance.

The EUR/USD retreated from daily highs, hitting 1.1053 as the European session ended. The latest week, we have witnessed the US Federal Reserve (Fed) and the European Central Bank (ECB) increasing rates by 25 bps, though divergence would likely favor the latter. Hence, the EUR/USD is trading at 1.1017, with losses of 0.05%.

ECB officials make hawkish remarks as US debt ceiling takes center stage

US equities continued to trade mixed. The EUR/USD pair is clinging to its earlier gains, despite data from the Eurozone (EU), namely Germany, showing that Industrial Production plunged in March to -3.4%, below the -1.3% contraction expected by the consensus. That, alongside the last week, Germany’s Industrial Orders plummeting 10.7% MoM, has raised recessionary fears amongst the EU.

In the meantime, some ECB officials embarked on hawkish remarks, with Dutch Central Bank President Klaas Knot saying that rate hikes are starting to have an effect, but more are needed to curb inflation. Of late, the ECB’s Chief Economist, Philip Lane, commented that inflation will come down, but momentum is still high.

On the US front, the debt ceiling narrative has taken center stage. According to Janet Yellen, the US Treasury Secretary, there are no favorable alternatives to resolve the debt limit issue in Washington without assistance from the US Congress. In the meantime, US President Joe Biden is expected to meet lawmakers on May 9 to advance in negotiations regarding raising the ceiling.

The US economic docket revealed that Wholesale Inventories were unchanged in March, below estimates of 0.1% MoM, the US Department of Commerce said. Annually based, inventories jumped 9.1% in March, despite the first quarter decline, as more robust US consumer spending contributed to the inventory rundown.

EUR/USD Technical Analysis

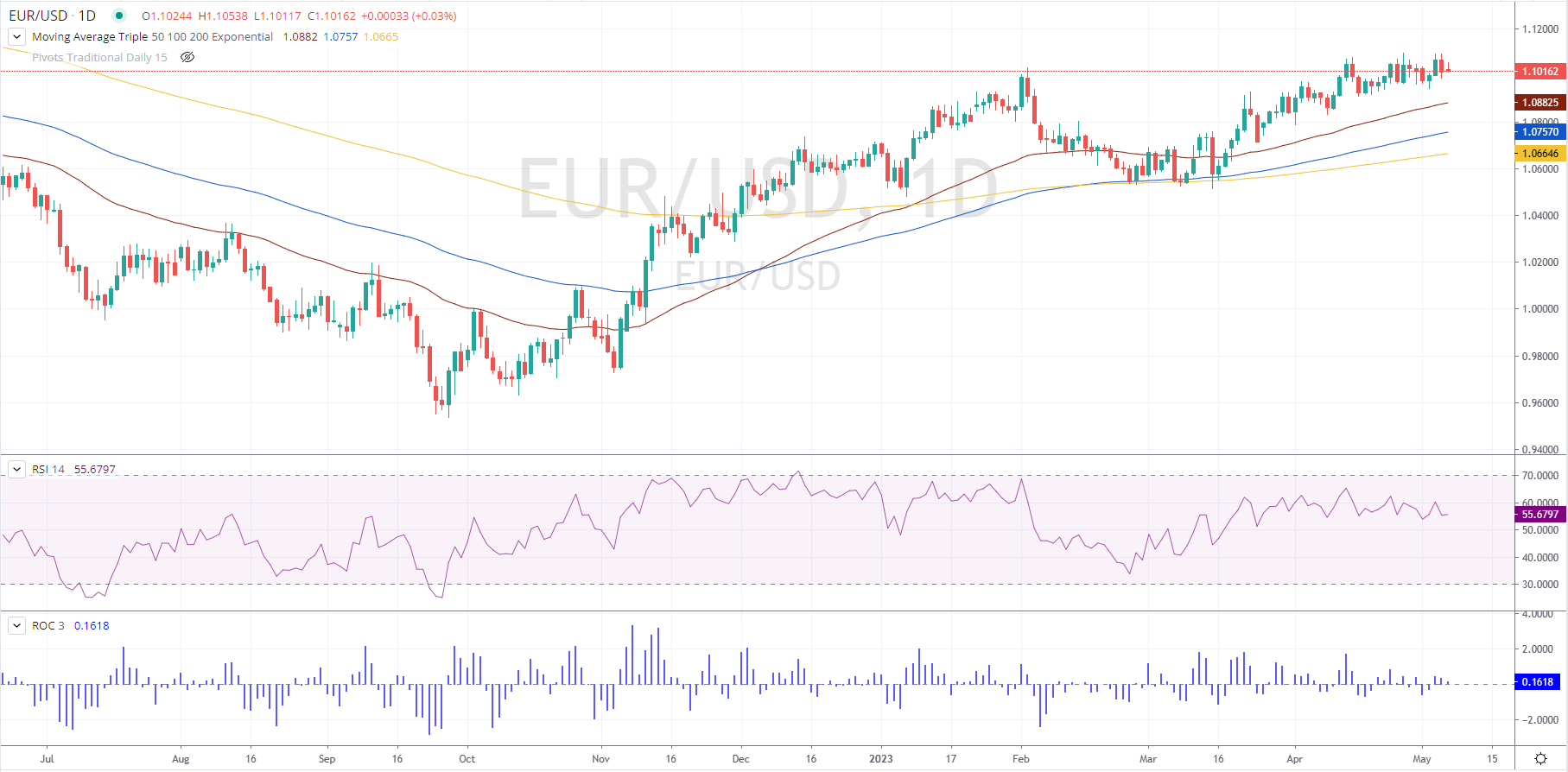

The daily chart’s EUR/USD price action suggests buyers remain in the driver’s seat. Of note is that while the EUR/USD pair is reaching higher highs, the Relative Strength Index (RSI) indicator is not, as it has recorded a successive series of lower peaks. Therefore, a negative divergence between price action and the oscillator is emerging, which could pave the way for further losses. However, the EUR/USD must fall below 1.1000 first, so it can challenge the May 2 daily low of 1.0942. before dropping toward the 1.0900 figure. A breach of the latter will expose the 50-day EMA At 1.0883. Conversely, if EUR/USD buyers reclaim 1.1100, that would keep the EUR/USD uptrend intact.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.