- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD spikes to fresh bull cycle highs on Fed dovish hike

Gold Price Forecast: XAU/USD spikes to fresh bull cycle highs on Fed dovish hike

- Gold Price rallies and drops back on the Federal Reserve rate hike and statement.

- Markets now await Fed´s Jerome Powell for clarity and direction.

The Gold price jumped to a high of $2,036.15 and counting on the back of the initial reaction to the Federal Reserve rate hike of 25 basis points and accompanying announcements within its statement.

The US Dollar has dumped and is down some 0.8% at the time of writing as the central bank removes the prior language that signaled more hikes were coming. Instead, the statements say the extent to which more firming is needed hinges on the economy. Consequently, Fed futures are pricing in a pause in June and July and rate cuts in September.

Feds statement, key takeaways

- Fed drops language that it anticipates more policy firming may be appropriate to attain a sufficiently restrictive stance.

- Will continue reducing the balance sheet as planned.

- Job gains have been robust and inflation remains elevated.

- Tighter credit conditions are likely to weigh on the economy, hiring, and inflation.

- Fed says the vote in favor of the policy was unanimous.

- Fed repeats us banking system is sound and resilient.

- In determining the extent to which additional policy firming may be appropriate, it will take into account tightening.

All in all, the Fed has opened the door to a rate-hike pause, and Gold price is reacting in kind.

Markets will now await the Chairman, Jerome Powell who will be speaking in the press conference.

Watch live: Fed chair Jerome Powell

Gold technical analysis

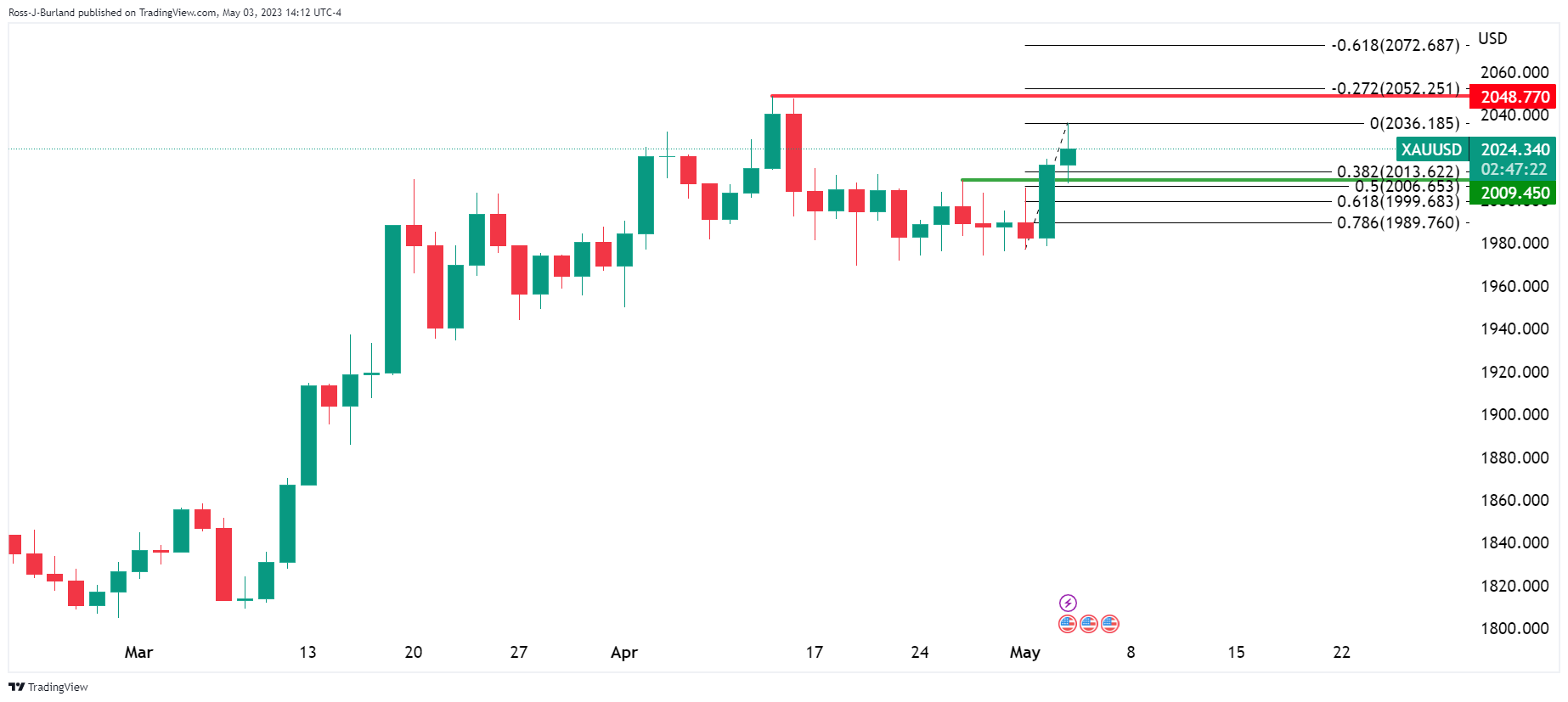

The bulls are in the market but the volatility is rife and there are prospects of a move lower into the in-the-money longs from the start of the US session if the bears can get below $2,021 on hawkish rhetoric from Jerome Powell:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.