- Analytics

- News and Tools

- Market News

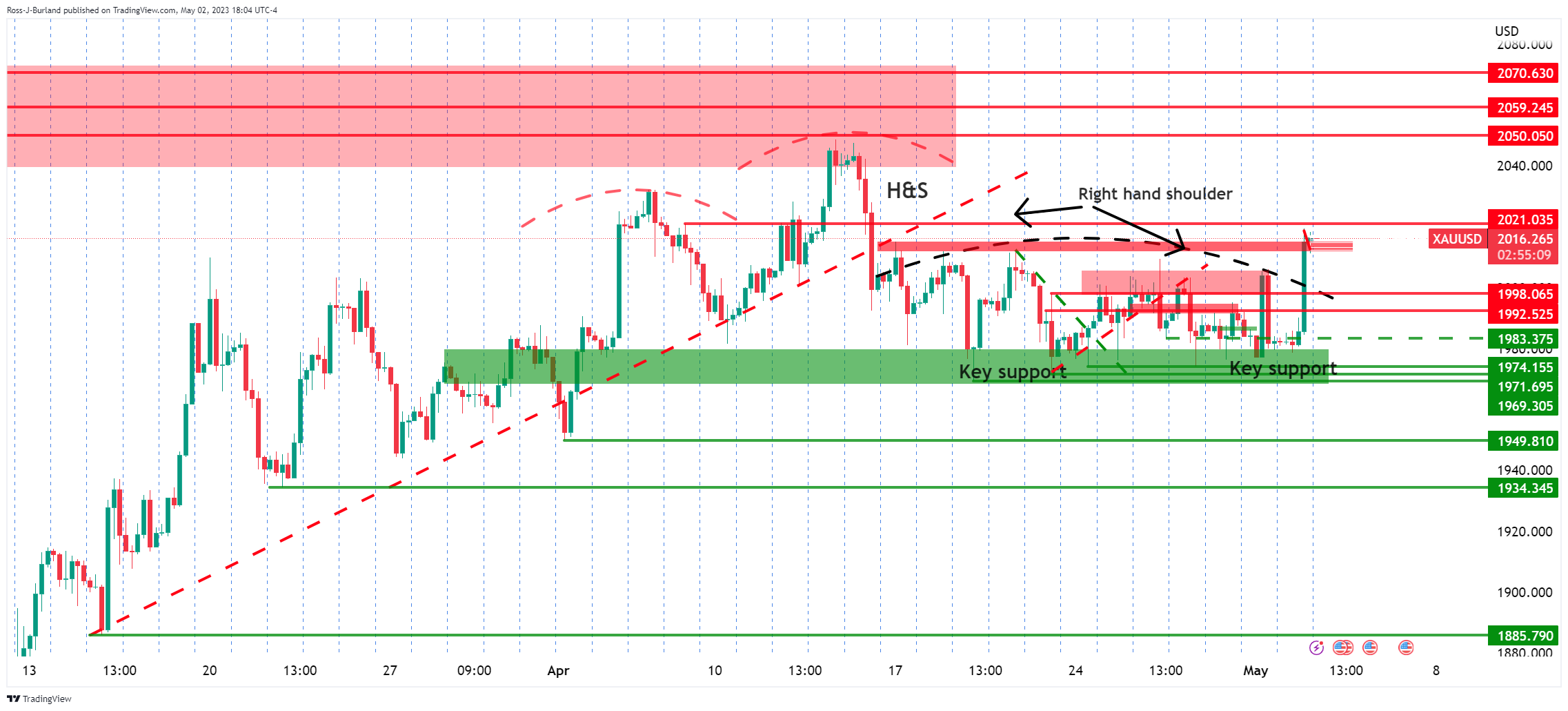

- Gold Price Forecast: XAU/USD bears lurking in the right hand shoulder

Gold Price Forecast: XAU/USD bears lurking in the right hand shoulder

- Gold price rallies into a key resistance area.

- Gold price bears on the look-out for a break lower around the Fed.

Gold price has rallied on the day in a parabolic move ahead of the Federal Reserve using the JOLTS disappointment as the trigger. The yellow metal jumped through the prior channel resistance and rallied from a low of $1,978 to a high of $2,019.

´´Job openings in the US eased to 9.590m in March, down from 9.974m in February. Job openings are now at their lowest level in two years. Demand for labour is continuing to soften, indicating the aggressive tightening is rates is starting to curb demand for workers,´´ analysts at ANZ Bank explained.

In other date, the analysts explained that ´´factory orders in the US increased by 0.9% m/m in March, following a downward revision of the February data to -1.1% MoM. However, orders excluding transportation were down 0.7% m/m indicating there is still some weakness in the manufacturing sector.´´

The weaker US Dollar on Tuesday was positive for the yellow metal while the decline in global bond yields Tuesday was also bullish. Gold has come one of the go-to places in the banking system worries and concerns over the U.S. government heading towards default without an extension of the debt ceiling.

Meanwhile, the focus will be on the Federal Reserve. Analysts at TD Securities are expecting a 25 bp hike ´´and anticipate that post-meeting communication will: (i) emphasize that disinflation has been evolving slower than expected, leaving open the possibility of additional tightening, and (ii) acknowledge the more uncertain economic environment, especially with regard to credit conditions post SVB collapse,´´ the analysts said.

Gold technical analysis

While the move into resistance was sharp, there are still prospects of a downside move below key support and this may only be part of the schematic of the right-hand shoulder still. It all comes down to the Fed and Nonfarm Payrolls.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.