- Analytics

- News and Tools

- Market News

- EUR/USD Price analysis: Bulls eye an upside continuation towards 1.1070

EUR/USD Price analysis: Bulls eye an upside continuation towards 1.1070

- EUR/USD is holding up at a 38.2% Fibonacci retracement level

- Bulls could be in play for the opening sessions.

A subsequent upside continuation is a bias for the open.

As per the prior analysis, EUR/USD Price Analysis: Bears are moving in and eye a run on length, EUR/USD ran into the 1.0960s and support structure as the following will illustrate.

EUR/USD H4 charts

Zooming into the 4-hour charts, we had the M-formation with a test of the neckline resistance near the 1.1030s eyed before a strong test of the trendline support. An engulfment was eyed.

EUR/USD H1 chart

On the hourly chart, the thesis was playing out. A 61.8% Fibonacci retracement met the neckline resistance. Everything above was trapped volume, so the long squeeze thesis was a reasonable one into 1.0950s stops and the week´s lows.

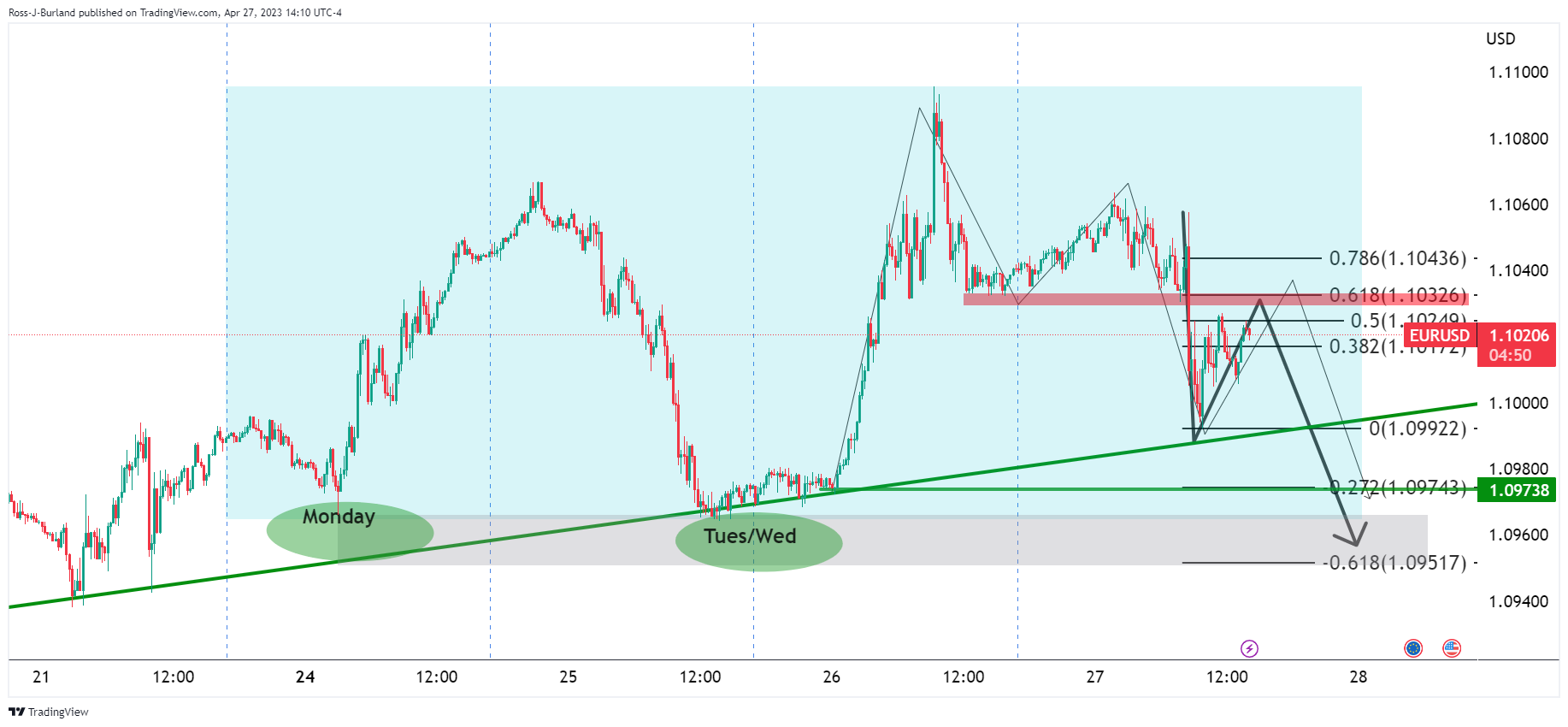

EUR/USD week template, M15 chart

Monday and mid-week longs were still in the money with stop losses below eyed.

EUR/USD update

The price has moved back into the peak formation following the move to test the structure. This leaves the outlook neutral for the days ahead while the price is trapped between horizontal resistance and support. However ...

EUR/USD H1 chart

On the hourly chart, we have seen a break of the prior highs and the 38.2% Fibonacci retracement level is acting as support. A subsequent upside continuation is a bias for the open.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.