- Analytics

- News and Tools

- Market News

- EUR/USD Price Analysis: Bears are moving in and eye a run on length

EUR/USD Price Analysis: Bears are moving in and eye a run on length

- EUR/USD bulls ready to throw in the towel?

- EUR/USD bearish technical analysis points to a test and break of key structures.

The Euro hovered near a one-year high vs. the US Dollar on Thursday. At the time of writing, EUR/USD is trading at 1.1020 as the market rallies in a short squeeze in the New York session. The following illustrates a bearish bias in a multi-timeframe analysis.

EUR/USD weekly chart

The rising wedge is a compelling feature on the longer-term charts. This is a bearish geometrical pattern and we can see the market has been driven back into shorts taken out in late March in a short squeeze. Perhaps we will see a long squeeze in the coming days?

EUR/USD daily charts

We have the first layer of structure in the 1.0960s and this would be breaking the micro trendline to tip the bias further to the downside.

EUR/USD H4 charts

Zooming into the 4-hour charts, we have the M-formation which could mean that we will see a test of the neckline resistance near the 1.1030s before a strong test of the trendline support. An engulfment would be an encouraging feature for the bears in that regard.

EUR/USD H1 chart

On the hourly chart, we can see the thesis playing out in faster motion with the current bid in play. A 61.8% Fibonacci retracement meets the neckline resistance. Everything above is trapped volume, so the long squeeze thesis is a reasonable one into 1.0950s stops and the week´s lows.

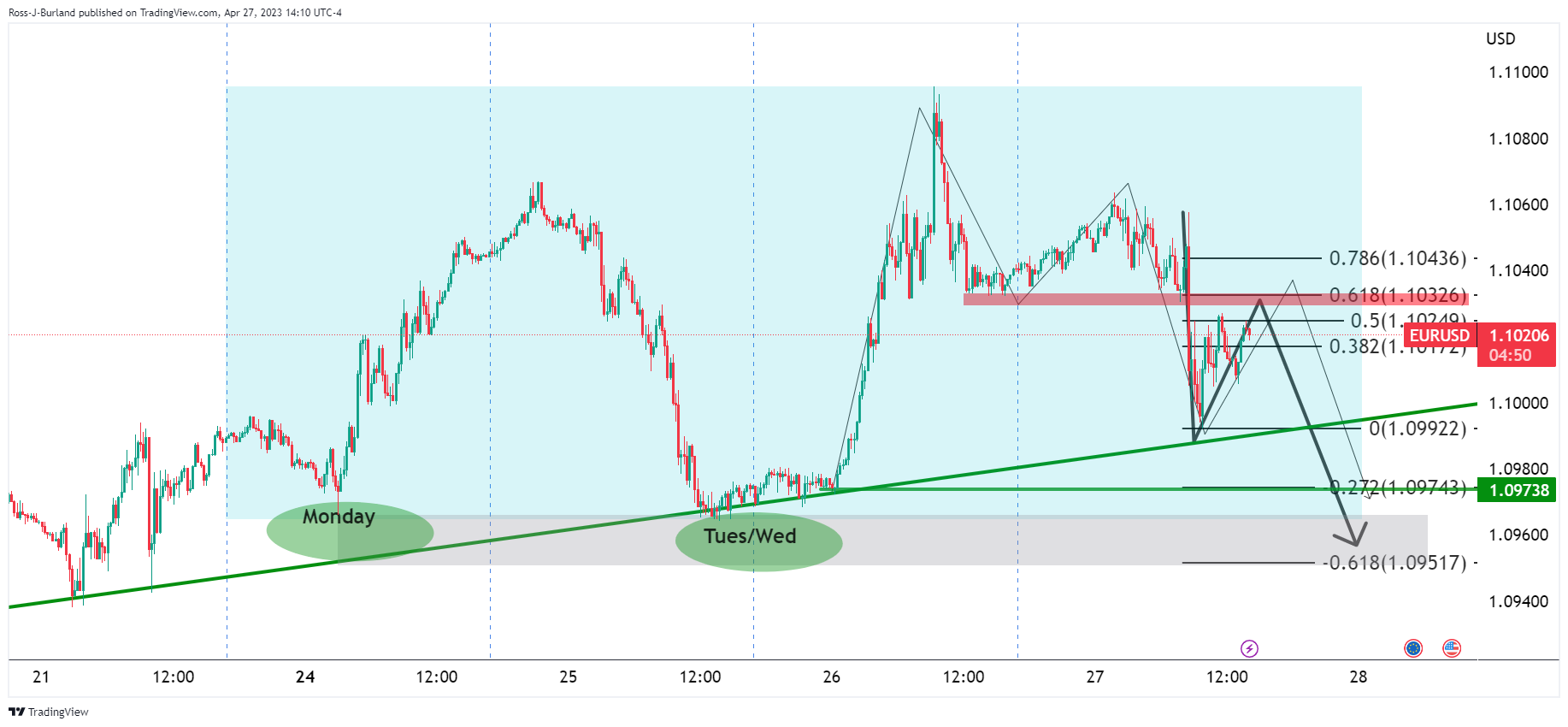

EUR/USD week template, M15 chart

Monday and mid week longs are still in the money with stop losses below eyed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.