- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears eye a downside continuation

Gold Price Forecast: XAU/USD bears eye a downside continuation

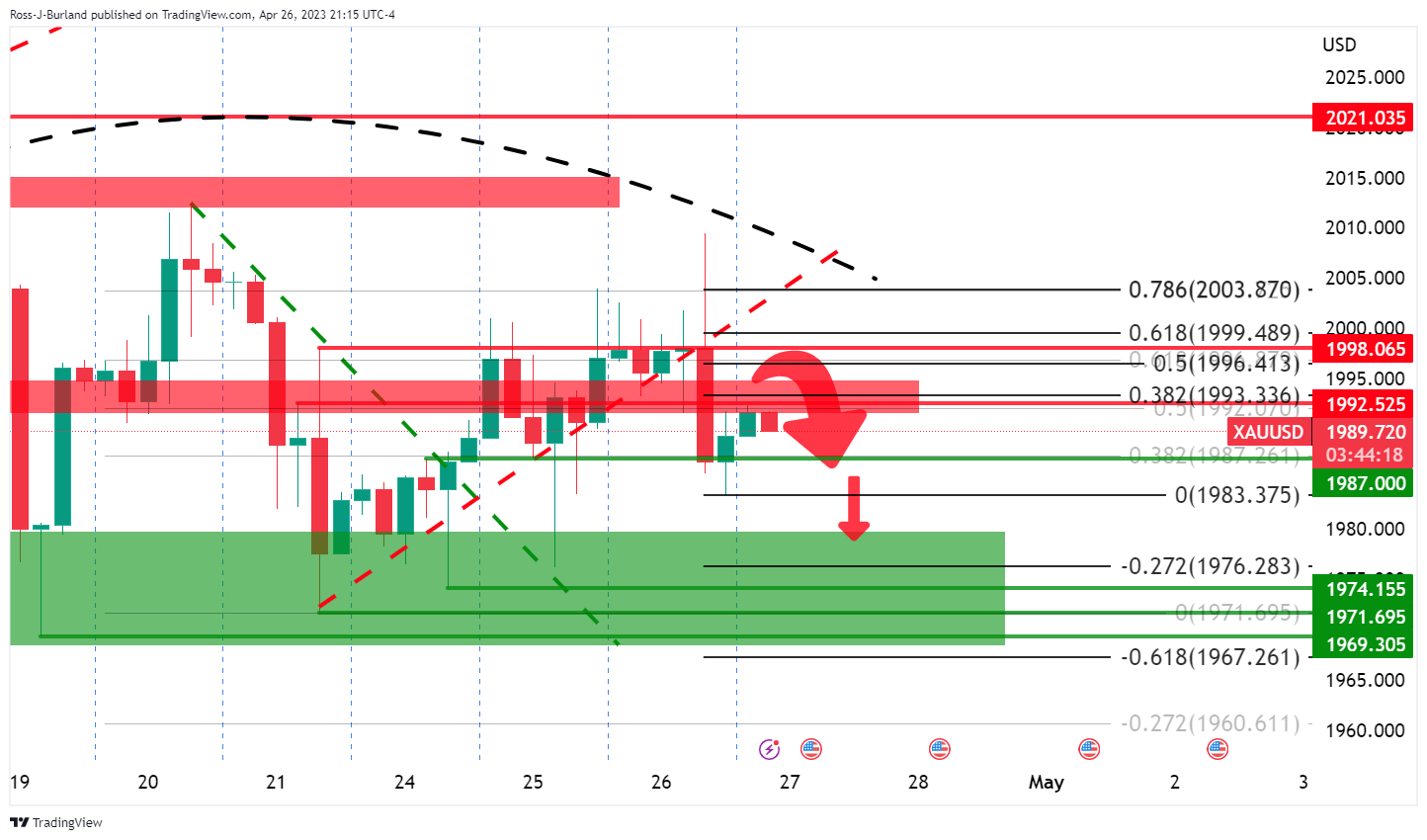

- Gold price is pressured in a broken-down market.

- Gold price is on the backside of the micro trendline and the Gold price is being resisted near a 38.2% Fibonacci.

- The Fed sentiment is weighing on the precious metal.

Gold price is trading a tough higher by some 0.1% in Tokyo after rallying from a low of $1,989.15 to a high of $1,992.29 the high so far but remains on thin ice while below the psychological $2,000 mark on Wednesday.

The US Dollar and bond yields have been rising ahead of next week's expected hike from the Federal Reserve which is leaving an air of bearishness around the yellow metal. The Fed's policy committee is expected to end with a 25-basis point increase in interest rates.

´´We expect the FOMC will raise rates by 25bp when it meets next week. That would leave the target ceiling for fed funds at 5.25% and effective fed funds in line with the median (and end 2023) dot plot of 5.10%,´´ analysts at ANZ Bank said.

´´Our baseline forecast is for one more 25bp rate rise to 5.50%. With respect to the bigger picture, however, the tightening cycle may be nearing its conclusion. We expect future rate decisions to be determined meeting-by-meeting,´´ the analysts added.

´´Our Gross Domestic Product estimates expect the lagged effects of last year’s rate rises to bite more deeply in Q2. We expect consumption and labour market growth to moderate. However, core services inflation ex-shelter may take time to ease.´´

´´Bank solvency is an issue that the FOMC will factor into its deliberations. It is imperative that inflation is brought under control to protect the value of bank assets. We expect fed funds to hold steady in H2 2023 to squeeze inflation,´´ the analyst's note concluded.

Meanwhile, Fed tightening expectations have eased up bit and the WIRP suggests over 80% odds of 25 bp hike at the May 2-3 meeting, down from 90% at the start of this week and back to the 80% seen at the start of last week and 70% at the start of the week before that.

Analysts at Brown Brothers Harriman said that there are no longer any odds of another 25 bp hike in June, down from about 15% at the start of this week.

´´Between the May 2-3 and June 13-14 meetings, the Fed will have digested two more job reports, two CPI/PPI reports, and one retail sales report. At this point, a pause in June might just be the most likely outcome but it really will depend on how all that data come in.,´´ the analysts said. ´´After all that, two cuts are now priced in by year-end vs. one at the start of this week and back to two seen at the start of last week. In that regard, Powell has said that Fed officials “just don’t see” any rate cuts this year. We concur.´´

Meanwhile, in Gold price, analysts at TD Securities have stated that discretionary traders are still sitting on the sidelines, which suggests cuts pricing is still not feeding through to interest.

´´In the near term, weaker longs still remain vulnerable, but we don't expect the first selling meaningful program to kick in until prices break $1964/oz in gold or $24.00/oz in silver.´´

Gold technical analysis

Gold price is weighed technically by the fact that it is on the backside of the trend and pressured within the right-hand shoulder of the head and shoulders in a broken-down market.

Zooming in, we can see that the bears are moving in on the backside of the micro trendline and the Gold price is being resisted near a 38.2% Fibonacci.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.