- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD 50% mean reversion resistance eyed

Gold Price Forecast: XAU/USD 50% mean reversion resistance eyed

- Gold price bulls are in the market and there is a scope for a move higher to $2,000.

- If Gold price bears commit, then we could see a 50% mean reversion area hold the fort around $1,992 and a subsequent sell-off from there.

Gold price is robust on Monday as the US Dollar and US Treasury bonds yields fell. Precious metals on Monday recovered from early losses and posted moderate gains. A drop in the US Dollar index printed a 1-week low due to a larger-than-expected increase in the German Apr IFO business climate index and hawkish comments Monday from European Central Bank Governing Council member Pierre Wunsch set off a rally in EUR/USD.

The German Apr IFO business climate index rose +0.4 to a 14-month high of 93.6, stronger than expectations of 93.4. Wunsch said we are "not seeing" inflation going in the right direction yet, and the ECB will only agree to halt interest rate increases once wage growth starts to fall. "We are waiting for wage growth and core inflation to go down, along with headline inflation, before we can arrive at the point where we can pause," the official said.

Meanwhile, the weaker dollar, making the precious metal more affordable for international buyers, offered support. DXY, an index that measures the currency vs. a basket of others was down 0.37/ and fell from a high of 101.9090 to a low of 101.330. Bond yields, bullish for gold since it offers no interest were lower with the US two-year note was paying as low as 4.097% on the day.

Gold technical analysis

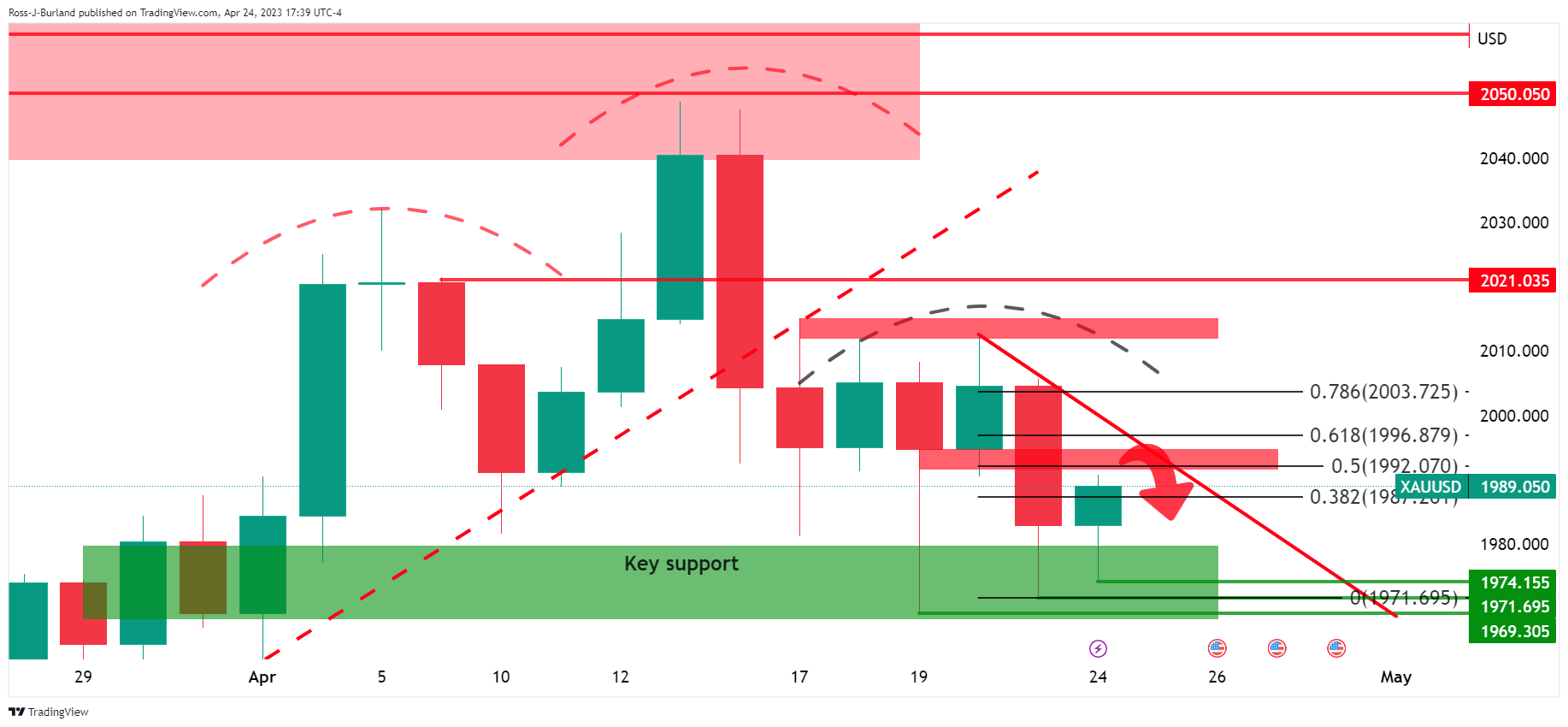

That is a daily head and shoulders, a topping pattern forming at the end of the bullish cycle.

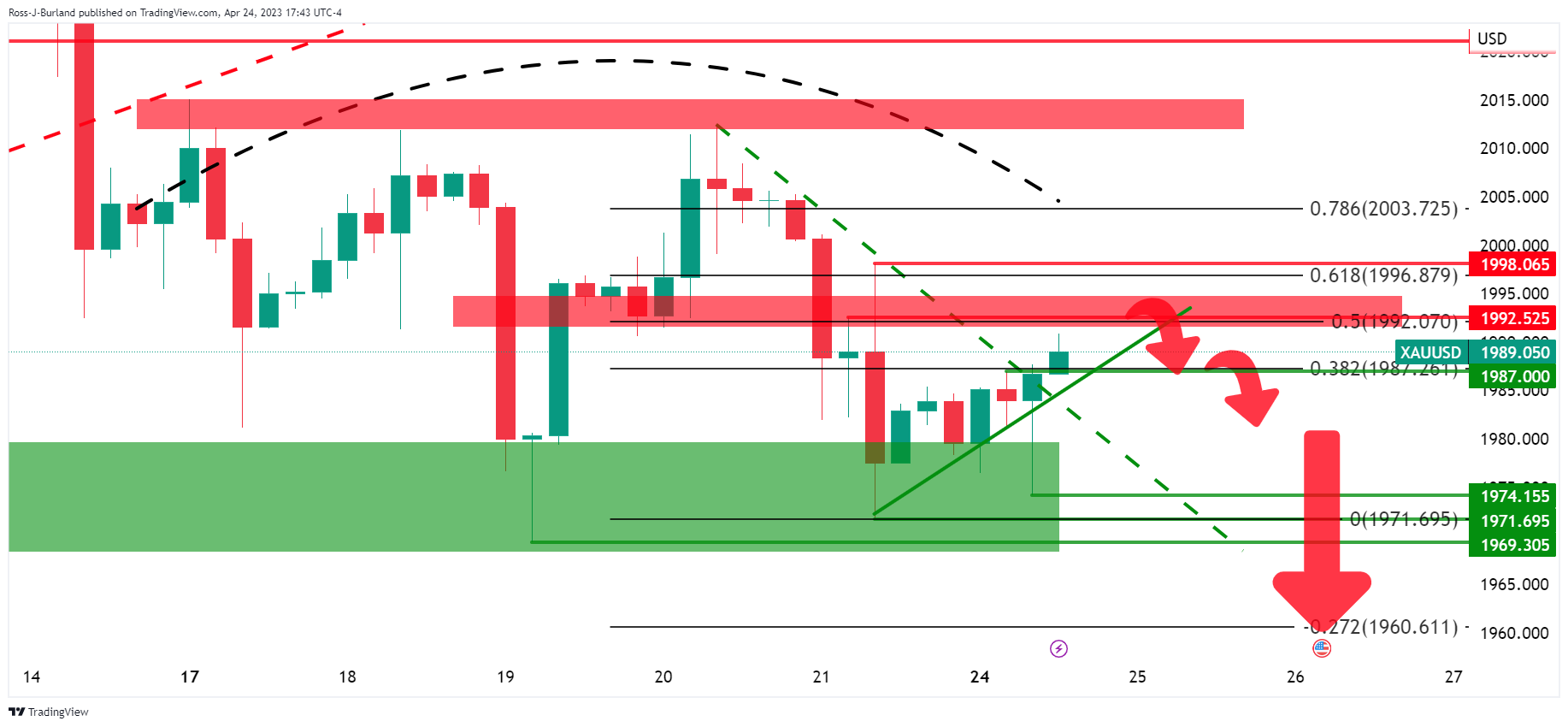

Zoomed in, we can see how things could play out.

While below the Fibonacci scale´s 78.6%, the bias is bearish, especially while being on the front side of the trendline resistance.

A deeper look into the right-hand shoulder, on the 4-hour time frame, we can see that the price has broken the micro trendline resistance that would now be expected to act as a counter-trendline. This leaves scope for as move higher into the bearish impulse to target towards $2,000. However, if bears commit, then we could see a 50% mean reversion area hold the fort around $1,992 and a subsequent sell-off from there.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.